A mortgage calculator is a valuable tool that helps potential homeowners establish their monthly mortgage obligations centered on various factors. By inputting details including the loan amount, curiosity rate, loan expression, and often home fees or insurance premiums, the calculator can easily calculate just what a borrower can expect to pay each month. That tool is especially useful for first-time homebuyers who might not need a definite knowledge of Mortgage Calculator mortgage obligations are organized or what they can afford. By using a mortgage calculator, people may obtain a clearer picture of their financial obligations and better plan their budget accordingly.

The primary function of a mortgage calculator would be to determine the monthly payment. This includes not only the principal and curiosity but also can incorporate extra prices like home taxes, homeowners insurance, and also private mortgage insurance (PMI) if the borrower places down less than 20% of the home's value. These extra prices can somewhat affect the total regular cost, so it's vital that you element them in when assessing affordability. Some sophisticated mortgage calculators also allow consumers to account fully for homeowners association (HOA) costs, that may vary with respect to the neighborhood.

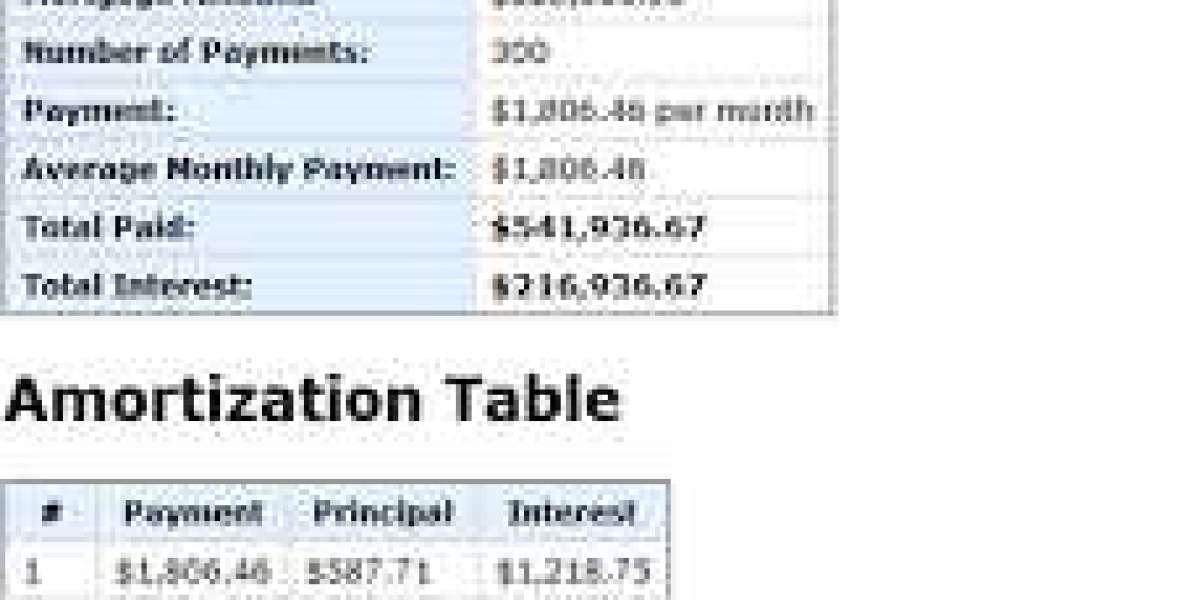

Understanding how a regular cost is broken down is yet another critical advantageous asset of employing a mortgage calculator. In early years of a loan, a bigger portion of the cost goes toward curiosity as opposed to principal. Over time, nevertheless, the key portion raises since the loan stability decreases. A mortgage calculator usually provides an amortization schedule, which reveals this dysfunction around the life of the loan. This assists borrowers know how significantly of the monthly cost is certainly going toward lowering the loan stability, and simply how much is actually just paying the lender for the usage of their money.

One of the most important factors in deciding mortgage obligations is the fascination rate. The rate at which the loan is financed straight influences simply how much a borrower will pay over the life of the loan. Little improvements in curiosity rates can have a big impact on regular payments. For instance, a higher fascination rate increases the cost of credit, indicating larger monthly funds and more paid in curiosity around time. Alternatively, a lesser charge decreases the monthly cost and the general cost of the mortgage. Mortgage calculators let users to try with different curiosity prices to observe improvements will influence their payments.

Mortgage calculators can also be ideal for comparing various loan options. For instance, a borrower might want to compare the regular payment on a 15-year loan versus a 30-year loan. The regular payment for a 15-year mortgage can generally be higher due to the shorter repayment period, but the total curiosity compensated over living of the loan is going to be lower. Using a mortgage calculator, borrowers may simulate various scenarios and determine which loan expression most readily useful meets their budget and long-term financial goals.

In addition to supporting borrowers estimate funds, mortgage calculators also can offer as something for qualifying for a loan. Lenders usually use certain criteria, like debt-to-income proportion (DTI), to assess whether a borrower are able a mortgage. A mortgage calculator can provide an calculate of the borrower's DTI by factoring inside their income and regular debt obligations. By pushing inside their money and other debts, customers can see if they match the conventional DTI demands for certain loan.

Still another function that numerous mortgage calculators contain is the ability to estimate just how much a borrower are able to afford based on their ideal monthly payment. That is helpful for potential buyers who've a set budget in mind but aren't positive just how much home they are able to afford. By inputting a goal monthly cost, the calculator can back-calculate the loan volume they could qualify for, factoring in the estimated fascination rate and loan term. This gives consumers a concept of the price range they must be contemplating when shopping for a home.

Ultimately, mortgage calculators aren't simply for homebuyers—they're also useful for homeowners who are considering refinancing their current mortgage. A refinance mortgage calculator will help determine the affect of refinancing on regular payments, interest costs, and the full total loan term. Additionally it may display whether refinancing helps you to save money in the long run or whether the expenses of refinancing outnumber the benefits. With the capability to change loan terms and fascination charges, homeowners may assess whether refinancing is just a financially noise choice centered on the recent