In today's uncertain economic climate, many investors are looking for ways to secure their financial future. One of the most reliable methods is to buy gold bars. Gold has been a symbol of buy gold bars wealth and a medium of exchange for thousands of years. This precious metal continues to be a safe haven for investors seeking to protect their assets from inflation and market volatility.

Why Buy Gold Bars?

Gold bars offer several advantages over other forms of gold investments, such as coins or jewelry:

- Purity: Gold bars are typically 99.5% to 99.99% pure, providing a higher gold content than most coins or jewelry.

- Lower Premiums: The cost above the spot price of gold is usually lower for bars than for coins, making them a more economical option.

- Storage Efficiency: Gold bars, especially larger ones, are easier to store and manage compared to coins.

Types of Gold Bars

When you decide to buy gold bars, you will encounter two main types:

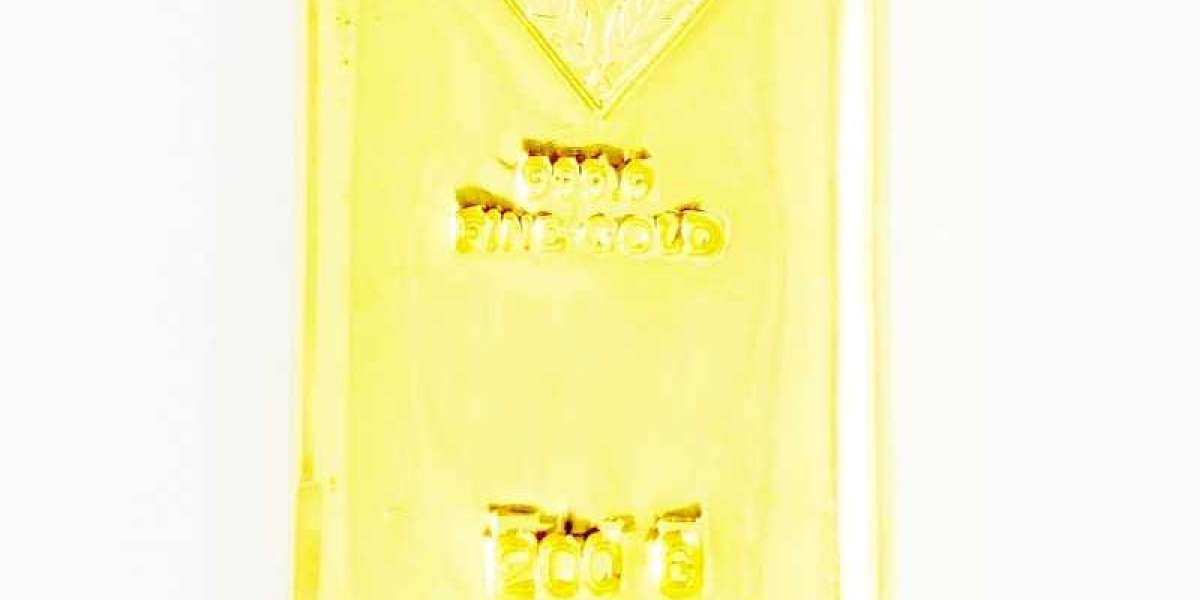

- Minted Bars: These are produced from highly refined gold and have a smooth, polished surface with precise dimensions. They often come in tamper-evident packaging, which guarantees their authenticity and protects them from damage.

- Cast Bars: Also known as ingots, these are made by pouring molten gold into a mold. They have a more rustic appearance and may show slight imperfections, but they are equally valuable.

How to Buy Gold Bars

- Research: Before purchasing gold bars, it is crucial to conduct thorough research. Understand the current market price of gold, commonly referred to as the spot price. This knowledge will help you identify fair prices and avoid overpaying.

- Choose a Reputable Dealer: Select a dealer with a solid reputation for selling genuine gold bars. Look for dealers who are members of reputable trade organizations, such as the London Bullion Market Association (LBMA) or the American Numismatic Association (ANA).

- Check for Certification: Ensure that the gold bars come with certification from recognized refiners, such as PAMP Suisse, Valcambi, or the Royal Canadian Mint. Certification guarantees the purity and weight of the gold bar.

- Payment Methods: Most dealers accept various payment methods, including bank transfers, credit cards, and even cryptocurrencies. Choose a payment method that offers security and convenience.

- Storage: Decide where you will store your gold bars. Options include home safes, bank safety deposit boxes, or professional vault storage services. Each option has its pros and cons, so choose one that best fits your needs for security and accessibility.

Considerations When Buying Gold Bars

- Size and Weight: Gold bars come in various sizes, from as buy gold bars small as 1 gram to as large as 400 ounces. Consider your investment goals and budget when choosing the size of the gold bar.

- Liquidity: Smaller bars are generally easier to sell and trade compared to larger ones. If you anticipate needing to liquidate your investment quickly, smaller bars may be a better option.

- Market Timing: While it's challenging to predict market movements, buying gold during price dips can maximize your investment potential. Monitor market trends and economic indicators to make informed decisions.

Conclusion

To buy gold bars is to invest in a tangible asset that has stood the test of time. Whether you're looking to diversify your portfolio, hedge against inflation, or secure a portion of your wealth, gold bars offer a reliable solution. By conducting thorough research, choosing reputable dealers, and considering your storage options, you can make a wise investment that will provide financial security for years to come.