The India lighting market is experiencing rapid growth, with a value exceeding USD 3.79 billion in 2023. The market is expected to expand at a CAGR of 9.8% from 2025 to 2033, potentially reaching a value of USD 8.79 billion by 2033. This article explores the dynamics driving the growth of the India lighting market, including its size share, market dynamics trends, growth opportunities, and competitor analysis.

Overview of the India Lighting Market

The India lighting market includes a wide range of lighting solutions used across residential, commercial, industrial, and outdoor applications. These lighting products include LED lights, fluorescent lights, halogen bulbs, incandescent lamps, and smart lighting systems. Over the past decade, there has been a significant shift towards energy-efficient lighting, particularly LEDs, which are gaining popularity due to their longer lifespan, energy savings, and environmental benefits.

The increasing urbanisation, rising disposable incomes, and growing focus on sustainability are fuelling the demand for modern and efficient lighting solutions across India. With an expanding middle class and rapid infrastructure development, the lighting industry is poised for significant growth in the coming years.

Get a Free Sample Report with a Table of Contents:

https://www.expertmarketresearch.com/reports/india-lighting-market/requestsample

Size Share of the India Lighting Market

Market Size

In 2023, the India lighting market reached a value of more than USD 3.79 billion. As consumer demand for energy-efficient and innovative lighting solutions increases, the market is set to grow significantly. By 2033, the market is projected to reach a value of USD 8.79 billion, reflecting a compound annual growth rate (CAGR) of 9.8% from 2025 to 2033.

Market Share by Segment

By Type:

- LED Lighting: The LED segment dominates the Indian lighting market due to its energy efficiency, longer lifespan, and lower operational costs. LEDs are expected to continue leading the market in terms of both value and volume.

- Traditional Lighting: Despite the growth of LEDs, traditional lighting solutions such as incandescent bulbs and fluorescent lights continue to hold a significant market share, particularly in rural and semi-urban regions.

By Application:

- Residential: The residential segment is a key contributor to market growth, driven by increasing urbanisation and higher disposable incomes.

- Commercial: The commercial sector, including retail outlets, offices, and hospitality, is expected to witness rapid growth, supported by demand for smart and aesthetic lighting solutions.

- Industrial: With the rise of manufacturing industries, industrial lighting is also on the rise, driven by the need for durable and efficient lighting solutions.

- Outdoor: Outdoor lighting for street lighting, gardens, and commercial spaces is also experiencing growing demand, particularly in urban areas.

Market Dynamics Trends in the India Lighting Market

Key Drivers of Market Growth

Government Initiatives: The Indian government has implemented several initiatives to promote energy-efficient lighting solutions. Programs like UJALA (Unnat Jyoti by Affordable LEDs for All) aim to replace traditional lighting with LEDs, contributing to significant market expansion.

Urbanisation and Infrastructure Development: The rapid urbanisation in India, coupled with infrastructure development in both metropolitan and semi-urban areas, is creating increased demand for efficient lighting systems in residential, commercial, and industrial spaces.

Increased Focus on Sustainability: Consumers and businesses are becoming more conscious of their environmental impact. Energy-efficient lighting options, such as LEDs and solar-powered lighting, are gaining traction due to their low energy consumption and eco-friendly features.

Technological Advancements: The increasing popularity of smart lighting systems is transforming the market. Consumers are adopting IoT-enabled smart lighting solutions, which can be controlled through smartphones and integrated into home automation systems for enhanced convenience and energy savings.

Rising Disposable Incomes: As disposable incomes rise, there is a shift towards premium lighting products that offer better aesthetics, energy efficiency, and advanced features like dimming controls and smart connectivity.

Emerging Trends

Smart Lighting Solutions: The shift toward smart lighting systems, driven by advances in IoT, is one of the key trends in the market. These systems offer enhanced control, energy savings, and flexibility, making them increasingly popular in both residential and commercial applications.

Solar-Powered Lighting: Solar-powered lighting solutions are gaining popularity in off-grid locations, rural areas, and government projects. With the rising adoption of renewable energy, solar lighting systems are becoming an essential part of the India lighting market.

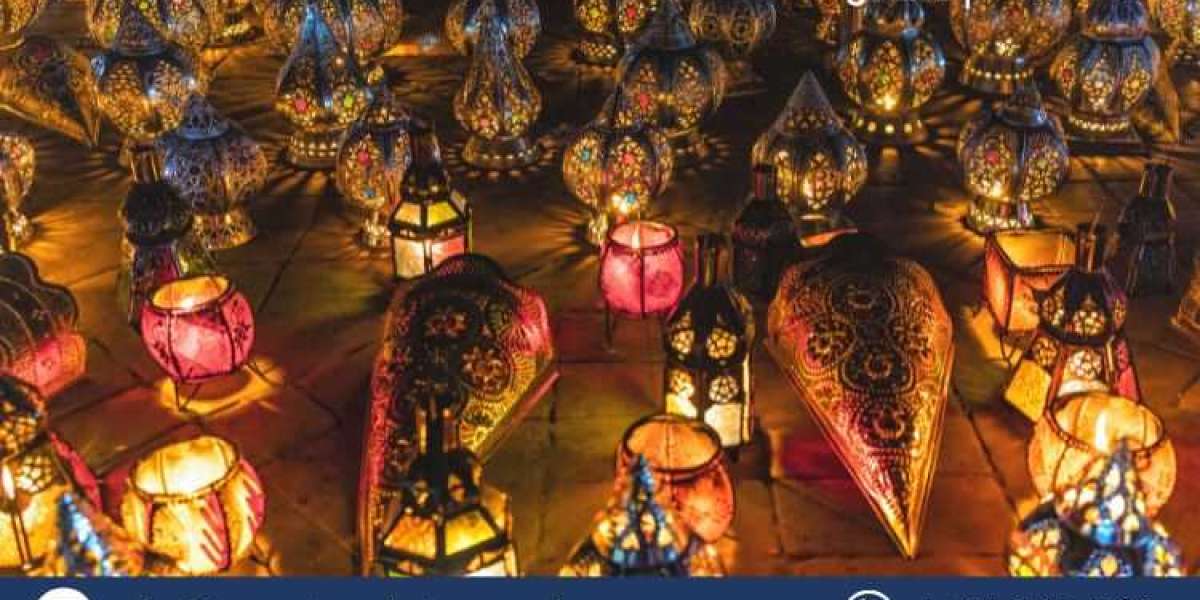

Aesthetic and Decorative Lighting: In both commercial and residential spaces, there is a growing demand for aesthetic lighting solutions that complement the overall design of interiors. This trend is driving the demand for designer lights, chandeliers, and decorative LED lighting.

Growth of the India Lighting Market

The India lighting market is experiencing robust growth, driven by several factors:

Government Initiatives: With the government's push for energy-efficient lighting through programs like UJALA, the market for LED lighting has witnessed a significant increase. The Pradhan Mantri Sahaj Bijli Har Ghar Yojana (Saubhagya) also aims to provide electricity to rural households, further boosting the lighting market.

Rise of Smart Cities: As India progresses toward the development of smart cities, the demand for smart lighting solutions is expected to rise. Smart lighting systems that enhance energy efficiency, monitor environmental conditions, and integrate with other city infrastructure are gaining prominence.

Rural Electrification: With rural electrification programs accelerating, there is an increased demand for affordable and energy-efficient lighting solutions in rural and semi-urban areas, further contributing to market growth.

Energy-Efficient Products: Rising awareness about the need for energy efficiency and lower electricity bills is pushing the demand for energy-efficient lighting products such as LEDs, CFLs, and halogen lights.

Market Opportunities and Challenges in the India Lighting Market

Opportunities

Smart Lighting Solutions: As urban areas grow and consumers embrace smart homes, the adoption of IoT-based lighting systems presents a significant growth opportunity. Manufacturers can innovate to meet the demand for connected and energy-efficient lighting.

Solar Lighting: With India’s abundance of sunlight, solar-powered lighting solutions present a major opportunity in both rural and urban areas. Government support and incentives can further boost market adoption in off-grid regions.

Government Projects: Large-scale government initiatives like street lighting projects, electrification programs, and smart city development create new growth avenues for the lighting industry.

Challenges

High Initial Cost of Smart Lighting: The relatively higher cost of smart lighting systems compared to traditional lighting remains a challenge for widespread adoption, especially in price-sensitive markets.

Competition and Price Sensitivity: The presence of numerous players in the market, along with the price sensitivity of consumers, can limit profit margins. Manufacturers need to strike a balance between quality, innovation, and cost to stay competitive.

Supply Chain and Raw Material Fluctuations: The market is vulnerable to fluctuations in raw material prices, particularly for LED components. Supply chain disruptions can impact product availability and prices.

Competitor Analysis in the India Lighting Market

The India lighting market is competitive, with a mix of established players and emerging companies. Key competitors in the market include:

Philips Lighting India: A subsidiary of Signify, Philips is a market leader in energy-efficient lighting solutions, offering a wide range of products from LED lights to smart lighting systems.

Havells India: Havells is another prominent player offering a broad spectrum of lighting solutions, including LED lighting, indoor and outdoor lighting, and decorative lights.

Osram India: Osram is known for its innovative lighting solutions, focusing on smart lighting, LED technology, and automotive lighting.

Syska LED: Syska is a major player in the LED lighting segment, offering a variety of energy-efficient products across residential, commercial, and industrial applications.

Crompton Greaves Consumer Electricals: Crompton is known for its high-quality LED lights and energy-efficient lighting solutions for residential and commercial applications.

View Our Related Blogs and Post :

HVAC Manufacturers

https://socialnetwork.swazi-host.com/blogs/40690/Beer-Market-Trends-Growth-and-Future-Outlook

Media Contact:

Company Name: Claight Corporation

Contact Person: Faf Warner, Corporate Sales Specialist — U.S.A.

Email: sales@expertmarketresearch.com

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com

Expert Market Research: Insights Analysis for Growth

Discover expert insights, market trends, and strategic analysis to drive growth in your industry with Expert Market Research.