The new Travel Credit Insurance Market report offers a comprehensive study of the current scenario of the market including major market dynamics. Also, it highlights the in-depth marketing research with the newest trends, drivers, and segments with reference to regional and country. Further, this report profiles top key players and analyze their market share, strategic development, and other development across the world.

The research report also covers the comprehensive profiles of the key players in the market and an in-depth view of the competitive landscape worldwide. The major players in the Travel Credit Insurance market include American Express, JPMorgan Chase, Citi, Capital One, Bank Of America, Wells Fargo, U.S. Bank, PNC Bank, Barclays, HSBC, Allianz Partners, Travelex Insurance Services, Nationwide. This section consists of a holistic view of the competitive landscape that includes various strategic developments such as key mergers acquisitions, future capacities, partnerships, financial overviews, collaborations, new product developments, new product launches, and other developments.

Get more information on "Global Travel Credit Insurance Market Research Report" by requesting FREE Sample Copy at https://www.valuemarketresearch.com/contact/travel-credit-insurance-market/download-sample

Market Dynamics

The increasing globalization of travel and tourism, rising travel expenditures, and international business travel drive demand for travel credit insurance as a financial protection mechanism against unexpected trip cancellations, flight disruptions, medical emergencies, and other travel-related risks. Travel credit insurance provides travelers with peace of mind and financial security, covering non-refundable travel expenses and reimbursing costs incurred due to unforeseen events such as illness, injury, natural disasters, or political unrest. Additionally, the growing trend towards experiential travel and adventure tourism drives demand for comprehensive policies that offer coverage for high-risk activities such as extreme sports, wildlife safaris, and remote expeditions, ensuring travelers are adequately protected during their adventures. Moreover, the increasing prevalence of travel disruptions and incidents, including flight delays, cancellations, and airline bankruptcies, is driving awareness about the importance of travel credit insurance as a safety net for travelers, particularly in volatile and unpredictable travel environments. Furthermore, the COVID-19 pandemic and its influence on global travel patterns, border restrictions, and quarantine requirements have underscored the importance of this insurance in providing financial protection and flexibility for travelers facing unexpected disruptions and cancellations. The growing availability of these products and services through online travel agencies, travel insurance providers, credit card companies, and financial institutions is expanding market access and consumer awareness, making it easier for travelers to purchase and manage their travel insurance coverage, further driving market growth and adoption. However, changes in travel patterns and insurance regulations may challenge the market growth in the coming years.

The research report covers Porter’s Five Forces Model, Market Attractiveness Analysis, and Value Chain analysis. These tools help to get a clear picture of the industry’s structure and evaluate the competition attractiveness at a global level. Additionally, these tools also give an inclusive assessment of each segment in the global market of Travel Credit Insurance. The growth and trends of Travel Credit Insurance industry provide a holistic approach to this study.

Browse Global Travel Credit Insurance Market Research Report with detailed TOC at https://www.valuemarketresearch.com/report/travel-credit-insurance-market

Market Segmentation

This section of the Travel Credit Insurance market report provides detailed data on the segments at country and regional level, thereby assisting the strategist in identifying the target demographics for the respective product or services with the upcoming opportunities.

By Insurance

- Trip Cancellation

- Baggage Loss

- Travel Accident Insurance

- Emergency Medical Assistance

- Rental Car Insurance

- Flight Delay

By Distribution Channel

- Direct

- Travel Agencies

- Airlines

- Affinity Partners

By End User

- Individuals Card Holders

- Business Card Holders

Regional Analysis

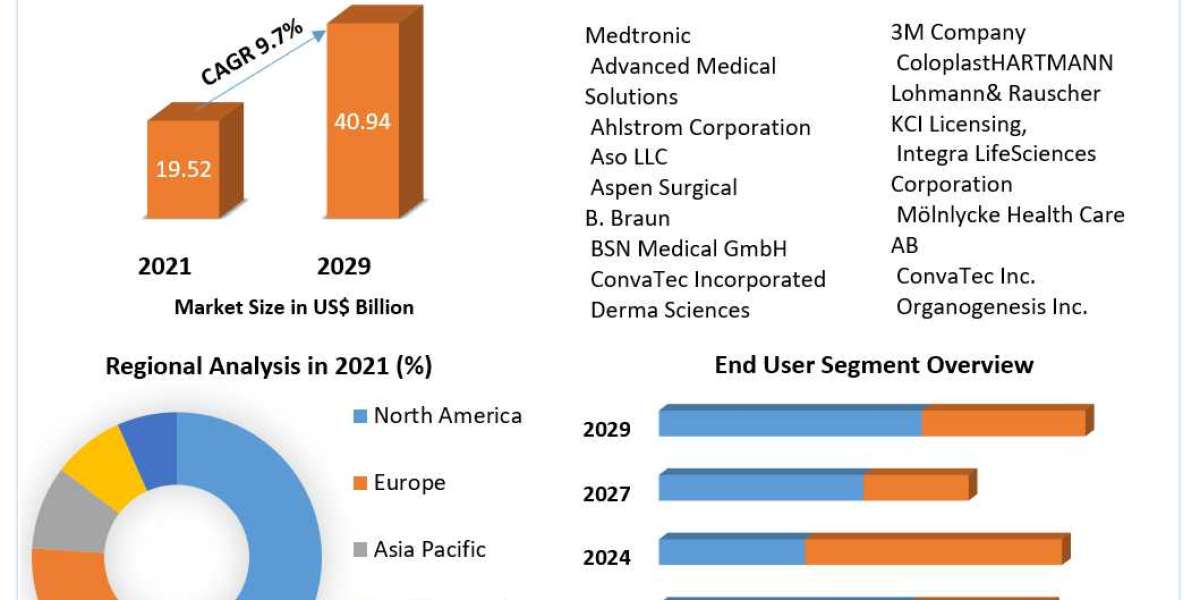

This section covers the regional outlook, which accentuates current and future demand for the Travel Credit Insurance market across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa. Further, the report focuses on demand, estimation, and forecast for individual application segments across all the prominent regions.

Purchase Complete Global Travel Credit Insurance Market Research Report at https://www.valuemarketresearch.com/contact/travel-credit-insurance-market/buy-now

About Us:

Value Market Research was established with the vision to ease decision making and empower the strategists by providing them with holistic market information.

We facilitate clients with syndicate research reports and customized research reports on 25+ industries with global as well as regional coverage.

Contact:

Value Market Research

UG-203, Gera Imperium Rise,

Wipro Circle Metro Station, Hinjawadi, Pune - 411057

Maharashtra, INDIA.

Tel: +1-888-294-1147

Email: sales@valuemarketresearch.com

Website: https://www.valuemarketresearch.com