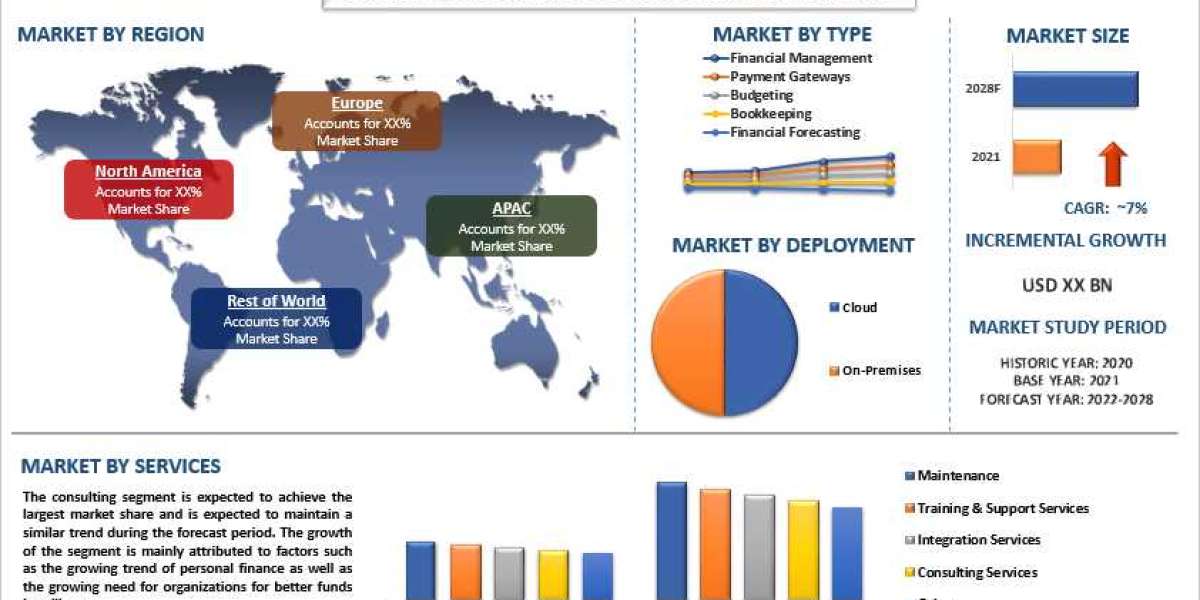

According to a new report published by UnivDatos Markets Insights, the Financial Services Application Market was valued at more than USD 111,657 million in 2020 and is expected to grow at a CAGR of around 7% from 2022-2028. The analysis has been segmented into Type (Financial Management, Payment Gateways, Budgeting, Bookkeeping, and Financial Forecasting); Deployment (Cloud and On-Premises) Services (Maintenance, Training Support Services, Integration Services, Consulting Services, and Others); Region/Country.

Get the inside scoop with Sample report:-https://univdatos.com/report/financial-services-application-market/get-a-free-sample-form.php?product_id=35805

The financial services application market report has been aggregated by collecting informative data on various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the financial services application market. The financial services application market report offers a detailed analysis of the latest industry developments and trending factors in the market that are influencing the market growth. Furthermore, this statistical market research repository examines and estimates the financial services application market at the global and regional levels.

Market Overview

A financial service application is an app or software that provides financial services to users, such as banking, investment management, budgeting, or payments. These applications can be web-based, mobile, or desktop software. Financial service applications typically allow users to perform a variety of financial tasks, including checking their account balances, transferring money, paying bills, applying for loans, and managing investments. Some financial service applications also provide personalized financial advice and recommendations based on the user's financial data and goals.

The growing adoption of financial service applications is mainly attributed to their features such as convenience, financial services applications provide users with the convenience of accessing their financial information and conducting transactions from anywhere at any time. This is especially important for younger generations who value convenience and prefer digital experiences over traditional brick-and-mortar banking. Furthermore, the growing trend of making online payments is expected to drive the market during the forecast period.

Some of the major players operating in the market include FIS; Fiserv, Inc.; NCR Payment Solutions, LLC; SSC Technologies, Inc.; Infosys Limited; Oracle; SAP; TATA Consultancy Services Limited; Microsoft; and IBM.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the global economy and financial services companies. By analyzing COVID-19 data, financial services companies can assess the credit risk of their borrowers, adjust their investment strategies, and assess their risk exposure in the insurance industry. For example, infection rates and hospitalization rates can help companies assess credit risk, mortality rates can help adjust insurance policies, and analysis of the impact on specific industries can inform investment decisions.

The global financial services application market report is studied thoroughly with several aspects that would help stakeholders in making their decisions more curated.

· Based on type the market is segmented into financial management, payment gateways, budgeting, bookkeeping, and financial forecasting. The growth of payment gateways is the increasing use of mobile devices for online transactions. Payment gateways offer mobile-optimized checkout processes that are easy and convenient for customers to use on their smartphones or tablets. Furthermore, Payment gateways offer advanced security features that protect customers' personal and financial information from fraud and theft. They also provide a streamlined payment processing experience for businesses, with features such as automatic payment processing and recurring billing.

· On the basis of deployment, the market is bifurcated into cloud and on-premises. The cloud segment is expected to grow with the highest CAGR during the forecast period. By using cloud computing, fintech companies can reduce their infrastructure and maintenance costs while also benefiting from greater agility and scalability, allowing them to quickly and easily scale their operations as needed. Additionally, cloud technology offers enhanced security features, which are critical in the highly regulated fintech industry, where data privacy and security are paramount. Overall, the use of cloud technology in fintech is enabling greater innovation and growth in the industry, driving its continued evolution and expansion.

Browse Full Report Description + Research Methodology + Table of Content + Infographics@https://univdatos.com/report/financial-services-application-market/

Financial services application Market Geographical Segmentation Includes:

· North America (United States, Canada, and Rest of North America)

· Europe (Germany, United Kingdom, Spain, Italy, France, and the Rest of Europe)

· Asia-Pacific (China, Japan, India, and the Rest of Asia-Pacific)

· Rest of the World

The financial services application market in North America has seen significant growth due to several factors. Firstly, North America is a hub for technological advancement, and the financial service industry has been quick to adopt new technologies. Secondly, the COVID-19 pandemic has accelerated the demand for digital services, and financial service applications have been at the forefront of meeting this demand. Thirdly, the financial service industry is highly competitive, and developing innovative financial service applications has become a key strategy for companies to stand out. Lastly, the regulatory environment in North America has been evolving rapidly, with changes in regulations driving the adoption of financial service applications.

The major players targeting the market include

· FIS

· Fiserv, Inc.

· NCR Payment Solutions, LLC

· SSC Technologies, Inc.

· Infosys Limited

· Oracle

· SAP

· TATA Consultancy Services Limited

· Microsoft

· IBM

Competitive Landscape

The degree of competition among prominent global companies has been elaborated by analyzing several leading key players operating worldwide. The specialist team of research analysts sheds light on various traits such as global market competition, market share, most recent industry advancements, innovative product launches, partnerships, mergers, or acquisitions by leading companies in the financial services application market. The major players have been analyzed by using research methodologies for getting insight views on global competition.

Access sample report (including graphs, charts, and figures):https://univdatos.com/report/financial-services-application-market/get-a-free-sample-form.php?product_id=35805

Key questions resolved through this analytical market research report include:

• What are the latest trends, new patterns, and technological advancements in the financial services application market?

• Which factors are influencing the financial services application market over the forecast period?

• What are the global challenges, threats, and risks in the financial services application market?

• Which factors are propelling and restraining the financial services application market?

• What are the demanding global regions of the financial services application market?

• What will be the global market size in the upcoming years?

• What are the crucial market acquisition strategies and policies applied by global companies?

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature and geography. Please let us know If you have any custom needs.

Related Report

Building-Integrated Photovoltaics Market