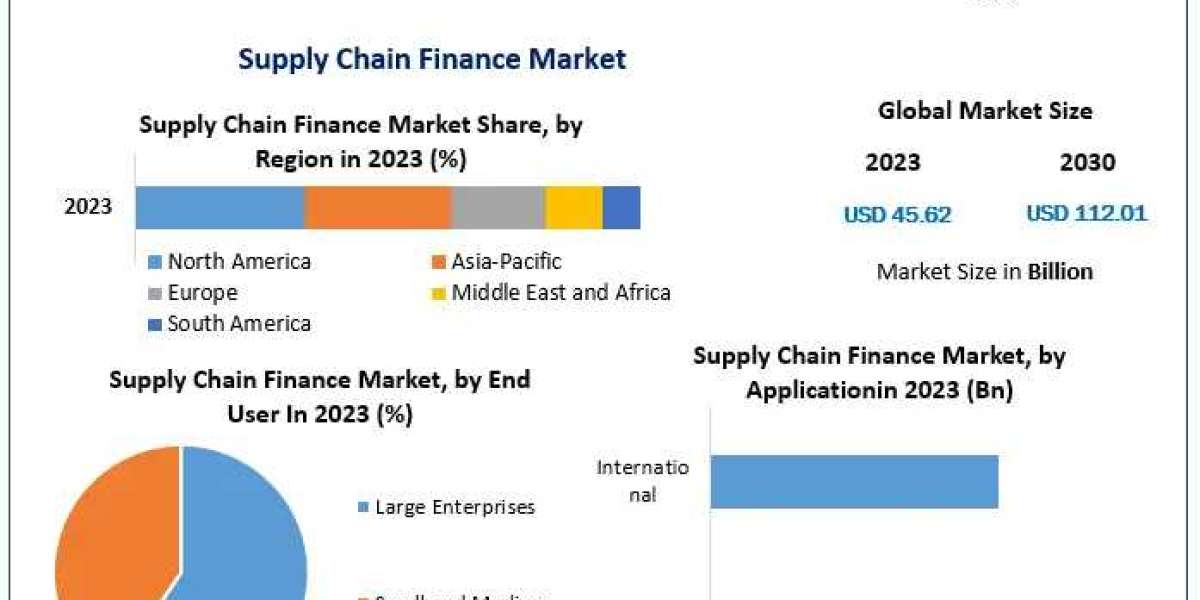

Supply Chain Finance Market was valued at USD 45.62 Billion in 2023 and is expected to reach USD 112.01 Billion by 2030, exhibiting a CAGR of 13.69 % during the forecast period (2024-2030)

Supply Chain Finance Market Overview:

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Supply Chain Finance Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Supply Chain Finance market, with forecasts outspreading to the year 2030.

Explore additional details by clicking the link provided:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Scope and Methodology:

The Supply Chain Finance market research provides comprehensive information on significant aspects, including those that are expected to drive the industry's growth and upcoming challenges. The competitive environment of the industry, the products marketed by well-known companies, and the investment potential in the Supply Chain Finance market will all be thoroughly understood by stakeholders. The study covers both the qualitative and quantitative components of the sector. A comprehensive examination of the competition for the Supply Chain Finance Market is included in the scope of the MMR report.

The report offers a number of new requirements, each with a thorough justification. The Supply Chain Finance Market was created by consulting both primary and secondary sources of information, including government documents, websites, annual reports, and the opinions of other professionals and academics.

To access more comprehensive information, click here:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Regional Insights:

This study includes a comprehensive analysis of all pertinent data, including market size, growth rate, and import and export by region. The research's geographic analysis makes it possible to comprehend the Supply Chain Finance market situations in various nations. The Supply Chain Finance market is made up of the markets in North America, Europe, Asia Pacific, Latin America, Africa, and the Middle East.

Supply Chain Finance Market Segmentation:

by Offering

• Export and Import Bills

• Letter of Credit

• Performance Bonds

• Shipping Guarantees

• Others

by Provider

• Banks

• Trade Finance House

• Others

The banks sector held the largest market share in 2021 with almost 85% of the worldwide supply chain finance market share, and it is expected that it would maintain its leading position over the projected period. Supply chain finance is a group of tech-based finance and business processes that enables all parties involved in a transaction to work together more efficiently and save money. Supply chain finance works best when the buyer can obtain financing at a lower cost and has a better credit rating than the supplier. However, throughout the course of the projected period, the trade finance house market is expected to grow at the highest rate—14%.

by End User

• Large Enterprises

• Small and Medium-sized Enterprises

by Application

• Domestic

• International

With about a quarter of the global market share in 2023, the domestic sector led the supply chain finance market. Over the course of the projection period, it is anticipated that this market segment will continue to hold the bulk of the market share. Over the course of the projected period, the abroad category is expected to see the fastest CAGR of 14.2%.

Request a sample copy of the report to see what's inside:https://www.maximizemarketresearch.com/request-sample/168082/

Supply Chain Finance Market Key Players:

• IBM

• Ripple

• Rubix by Deloitte

• Accenture

• Distributed Ledger Technologies

• Oklink

• Nasdaq Linq

• Oracle

• AWS

• Citi Bank

• ELayaway

• HSBC

• Ant Financial

• JD Financial

• Qihoo 360

• Tencent

• Baidu

• Huawei

• Bitspark

• SAP

• ALIBABA

For an in-depth analysis, click the provided link:https://www.maximizemarketresearch.com/market-report/supply-chain-finance-market/168082/

Key questions answered in the Supply Chain Finance Market are:

- What is Supply Chain Finance?

- What was the Supply Chain Finance market size in 2023?

- What is the growth rate of the Supply Chain Finance Market?

- Which are the factors expected to drive the Supply Chain Finance market growth?

- What is the CAGR at which the Supply Chain Finance market will grow during the forecast period?

- What are the different segments of the Supply Chain Finance Market?

- Which is the fastest growing region in the Supply Chain Financemarket?

- What growth strategies are the players considering to increase their presence in Supply Chain Finance?

- What are the upcoming opportunities and trends for the Supply Chain Finance Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Supply Chain Finance Market?

- Who are the leading companies and what are their portfolios in Supply Chain Finance Market?

- What segments are covered in the Supply Chain Finance Market?

- Who are the key players in the Supply Chain Finance market?

Related Reports:

♦ Portable Power Station Market https://www.maximizemarketresearch.com/market-report/global-portable-power-station-market/111920/

♦ Wood Chips Market https://www.maximizemarketresearch.com/market-report/global-wood-chips-market/115358/

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2023)

- Past Pricing and price curve by region (2018 to 2023)

- Market Size, Share, Size Forecast by different segment | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

Contact Maximize Market Research: sales@maximizemarketresearch.com