Summary:

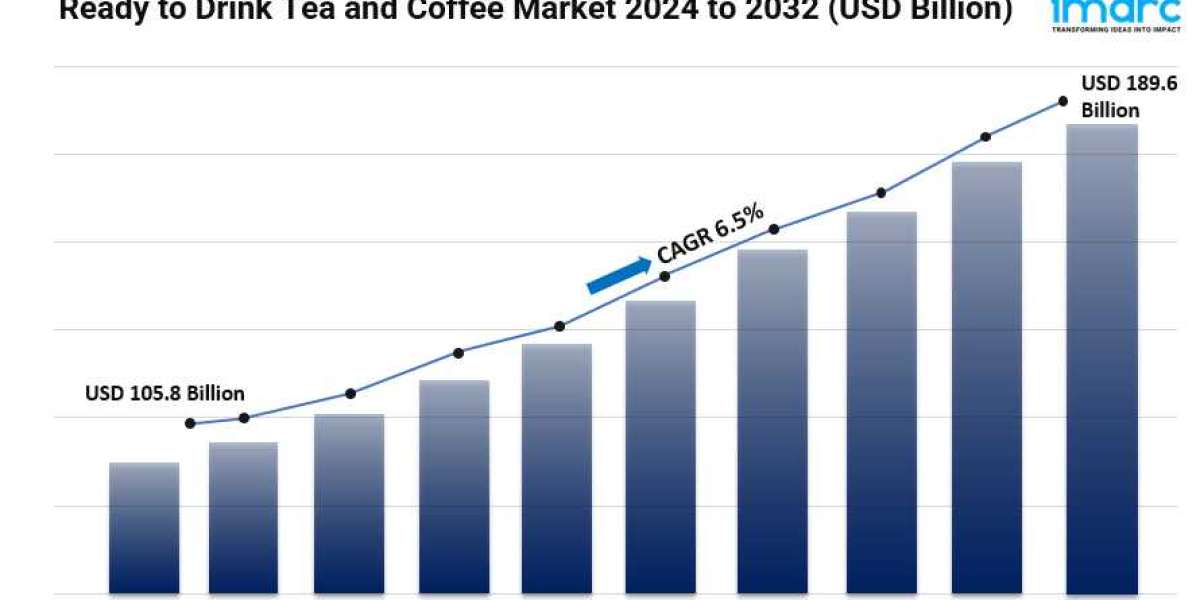

- The global ready to drink tea and coffee market size reached USD 105.8 Billion in 2023.

- The market is expected to reach USD 189.6 Billion by 2032, exhibiting a growth rate (CAGR) of 6.5% during 2024-2032.

- RTD tea leads the market, accounting for the majority of the ready to drink tea and coffee market share owing to its cultural popularity and perceived health benefits.

- On the basis of additives, the market has been categorized into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

- PET bottle represents the largest segment due to their durability, resealability, and compatibility with various beverage sizes.

- On the basis of additives, the market has been categorized into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

- Off-trade represents the leading application segment spurred by bulk purchasing behavior and widespread retail availability.

- Asia Pacific leads the market with its strong demand for convenient, ready-to-drink traditional beverages.

- The rising influence of social media and digital marketing is strengthening the market growth, as consumers are more exposed to trends around RTD beverages through influencer promotions and brand collaborations.

- The expanding café culture, even beyond traditional café settings, has created a wider acceptance of sophisticated, ready-made drinks.

Industry Trends and Drivers:

- Rising Health Consciousness:

Consumers are increasingly prioritizing their health and wellness, driving the demand for healthier beverage options. RTD teas, particularly green tea, herbal tea, and other variants, are perceived as healthy alternatives to sugary soft drinks. They are rich in antioxidants, natural ingredients, and often low in sugar or calories, which align with the growing trend toward clean-label and functional beverages. Similarly, coffee, especially black or cold brew varieties, is known for its antioxidant properties and potential health benefits, such as boosting metabolism and improving focus. This shift in consumer preference for healthier drinks over carbonated and sugary beverages is fueling the growth of the RTD tea and coffee market.

- Convenience and on-the-go consumption:

In today’s fast-paced lifestyle, consumers are seeking convenient, ready-to-consume products that fit seamlessly into their daily routines. RTD tea and coffee products offer a quick and easy solution for those who want their caffeine fix or a refreshing beverage without the time-consuming preparation of brewing or steeping. As more people spend time commuting, traveling, or managing hectic schedules, the demand for portable, pre-packaged drinks has surged. RTD formats offer the perfect balance of taste and convenience, catering to consumers' busy lifestyles. This has made RTD beverages a popular choice in urban centers, among young professionals, students, and even fitness enthusiasts.

- Product innovation and flavor variety:

The RTD tea and coffee market has witnessed a wave of innovation, with manufacturers introducing a wide range of new flavors, ingredients, and formulations. From nitrogen-infused cold brews to matcha-infused teas, the diversity of product offerings is attracting a broader consumer base. Companies are focusing on premiumization by incorporating organic ingredients, non-dairy milk alternatives, and plant-based sweeteners, tapping into trends like veganism and lactose intolerance. Additionally, flavor experimentation with regional blends, exotic fruits, and spices has kept consumers engaged, driving repeat purchases and expanding the market reach.

Request for a sample copy of this report: https://www.imarcgroup.com/ready-to-drink-tea-coffee-market/requestsample

Ready to Drink Tea and Coffee Market Report Segmentation:

Breakup By Product:

- RTD Tea

- Black Tea

- Fruit Herbal Based Tea

- Oolong Tea

- Green Tea

- RTD Coffee

- Ginseng

- Vitamin B

- Taurine

- Guarana

- Yerba Mate

- Acai Berry

RTD tea offers a wider variety of health-oriented options, flavors, and formulations, making it highly appealing to health-conscious consumers.

Breakup By Additives:

- Flavors

- Artificial Sweeteners

- Acidulants

- Nutraceuticals

- Condoms

- Others

On the basis of additives, the market has been categorized into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others.

Breakup By Packaging:

- Glass Bottle

- Canned

- PET Bottle

- Aseptic

- Others

PET bottles are lightweight, cost-effective, and convenient, making them the preferred choice for on-the-go consumption and mass distribution of RTD beverages.

Breakup By Price Segment:

- Premium

- Regular

- Popular Priced

- Fountain

- Super Premium

On the basis of price segment, the market has been divided into premium, regular, popular priced, fountain, and super premium.

Breakup By Distribution Channel:

- Off Trade

- Independent Retailers

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

- On-Trade

- Foodservice

- Vending

Supermarkets, convenience stores, and hypermarkets provide easy access and visibility, driving bulk purchases of RTD tea and coffee for home consumption.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the market with its high consumption of tea and coffee, combined with increasing urbanization and disposable incomes.

Top Ready-to-Drink Tea and Coffee Market Leaders:

The ready-to-drink tea and coffee market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- Pepsico

- The Coca-Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin' Brands

- Ferolito Vultaggio Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Chilsung Fights

- Monster Beverage

- San Benedetto Mineral Water

- Kirin Holdings Co.

- Unilever

- Arizona Beverage Co.

- Suntory

Browse full report with TOC List of Figures: https://www.imarcgroup.com/ready-to-drink-tea-coffee-market

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most changemakers to create a lasting ambitious impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145