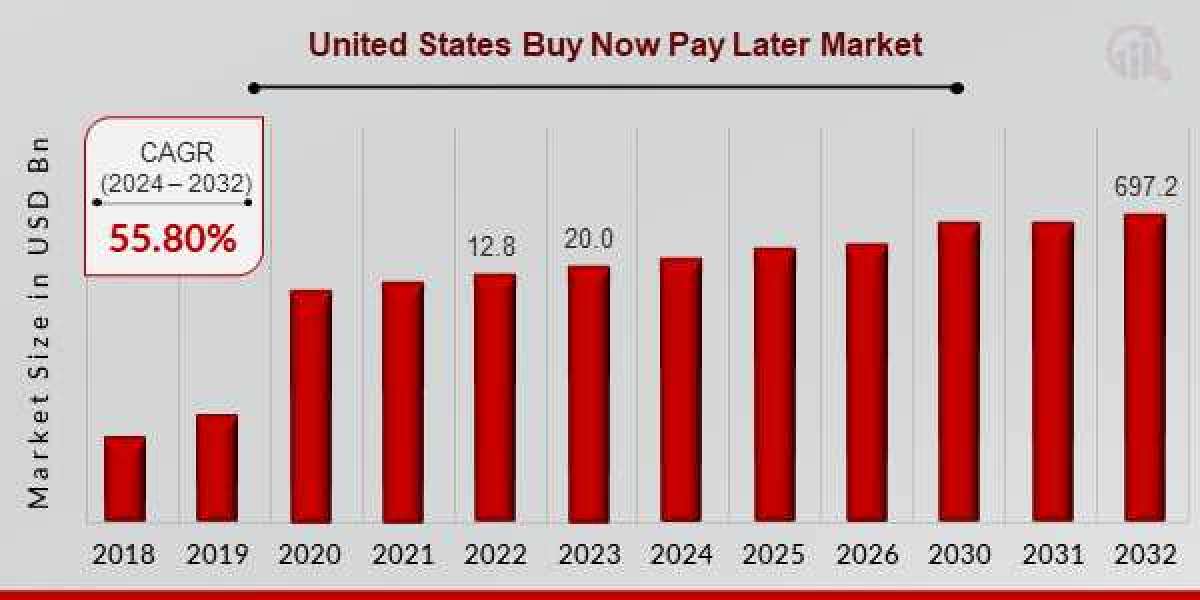

United States Buy Now Pay Later (BNPL) Market Overview

The Buy Now Pay Later (BNPL) market in the United States has experienced significant growth in recent years, reshaping the retail and e-commerce landscape. BNPL services allow consumers to make purchases and defer payments over time, typically in interest-free installments. This financing option has become particularly popular among younger generations, such as Millennials and Gen Z, who favor the convenience and flexibility it offers over traditional credit cards.

Buy Now Pay Later Market industry is projected to grow from USD 20.0 Billion in 2023 to USD 697.2 Billion by 2032. The market's rapid growth is driven by the increasing demand for alternative payment solutions, the rise of e-commerce, and the financial preferences of younger consumers. In addition, merchants are adopting BNPL solutions as they see improved conversion rates, higher average order values, and enhanced customer satisfaction.

With technology advancing and new players entering the market, BNPL services are expanding into different industries beyond retail, including healthcare, travel, and education. This rapid expansion is changing how Americans view financing, making it a core component of the modern shopping experience.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/21414

Key Market Segments

1. By Business Model

B2C (Business-to-Consumer):

The B2C segment dominates the U.S. BNPL market. It encompasses consumers using BNPL services for online and in-store shopping. Popular sectors in this segment include fashion, electronics, and beauty products, where installment plans attract budget-conscious shoppers. B2C BNPL providers offer direct-to-consumer solutions, typically via apps and integrated checkout options with online retailers.B2B (Business-to-Business):

Although smaller, the B2B BNPL market is gaining momentum, with businesses offering delayed payment solutions to other enterprises. B2B BNPL is especially appealing for small and medium-sized enterprises (SMEs), which may need flexible financing to manage cash flow or invest in new products.

2. By Payment Type

Interest-Free Installments:

This is the most common payment model in BNPL, where consumers can split their purchases into a set number of interest-free installments, usually paid every two weeks. Companies such as Affirm, Klarna, and Afterpay use this model, making it the most attractive option for shoppers who want to avoid interest fees.Interest-Based Installments:

Some BNPL providers offer longer repayment periods, ranging from 6 to 36 months, often with an added interest rate. This option is more common for larger purchases, such as electronics or home appliances, where buyers may need more time to pay off their purchases.

3. By Sales Channel

Online Sales:

The majority of BNPL transactions occur online, particularly in the e-commerce space. Retailers are integrating BNPL options at checkout to encourage customers to complete purchases and reduce cart abandonment rates. The growth of online shopping, fueled by the COVID-19 pandemic, has played a crucial role in the widespread adoption of BNPL services.In-Store Sales:

While BNPL originated as an online service, it has since expanded to brick-and-mortar stores. Retailers now offer BNPL options in-store, allowing customers to apply for payment plans at the point of sale. This trend is growing as physical retailers strive to compete with the convenience of e-commerce.

4. By End-Use

Retail and E-Commerce:

The retail sector, including fashion, electronics, beauty, and home goods, is the largest consumer of BNPL services. Retailers partner with BNPL providers to offer customers flexible payment plans, leading to higher conversions and larger basket sizes.Travel and Leisure:

Travel is emerging as a growing sector for BNPL adoption. Companies like Uplift and Affirm have partnered with airlines, hotels, and travel agencies to offer installment plans for booking vacations and travel-related expenses.Healthcare:

BNPL is also gaining traction in healthcare, where services like Sunbit offer financing options for dental, vision, and medical treatments. This model provides a solution for patients who need to manage out-of-pocket healthcare expenses without taking on credit card debt.

Industry Latest News

Expansion into New Sectors:

BNPL services, traditionally popular in retail and e-commerce, are expanding into sectors like education, automotive, and home improvement. For instance, companies are now offering installment plans for tuition fees, car repairs, and large home projects, opening up new revenue streams for BNPL providers.Regulatory Scrutiny and Compliance:

As the BNPL market grows, so does regulatory scrutiny. The Consumer Financial Protection Bureau (CFPB) in the U.S. has started investigating BNPL providers to ensure transparency and consumer protection. The CFPB is concerned about potential risks like hidden fees, overborrowing, and the impact on consumers' credit scores.Partnerships and Acquisitions:

BNPL providers are forming partnerships with major brands and retailers to expand their market presence. For example, Amazon partnered with Affirm to offer BNPL options on its platform, while Square (now Block) acquired Afterpay for $29 billion in 2021 to integrate BNPL services into its ecosystem.Credit Card Competition:

As BNPL grows, traditional credit card companies are responding with their own installment payment options. For example, American Express and Chase now offer similar financing features that allow cardholders to pay off purchases over time. This competition is driving innovation in the BNPL space, with both fintech and credit card companies seeking to attract younger consumers.

Key Companies

1. Affirm

Affirm is one of the leading BNPL providers in the U.S., known for offering transparent and flexible financing options without hidden fees. Affirm's business model includes both interest-free and interest-based payment plans. It has partnered with major retailers, including Amazon, Walmart, and Peloton.

2. Afterpay

Acquired by Square (Block) in 2021, Afterpay is a prominent BNPL platform that allows consumers to split purchases into four interest-free installments. With a strong presence in fashion and beauty retail, Afterpay has expanded into in-store payments and continues to grow its market share in the U.S.

3. Klarna

Klarna, based in Sweden, has become a significant player in the U.S. BNPL market. Offering a variety of payment plans, including interest-free and extended installment options, Klarna has partnered with brands like Sephora, HM, and Nike. Klarna’s user-friendly app and loyalty features have made it a favorite among younger consumers.

4. PayPal (Pay in 4)

PayPal launched its BNPL service, Pay in 4, to compete with leading BNPL providers. PayPal’s large user base and integration with millions of merchants make it a formidable player in the BNPL market. The service offers interest-free payment plans, seamlessly integrated into PayPal's checkout process.

5. Sezzle

Sezzle is another prominent BNPL provider in the U.S. that focuses on ethical finance. It offers interest-free installment plans and is particularly popular among younger consumers and merchants in the fashion and lifestyle sectors. Sezzle has also gained attention for its commitment to financial education and responsible spending.

6. Uplift

Uplift specializes in offering BNPL solutions for travel-related expenses. It has partnered with airlines, travel agencies, and cruise lines to provide customers with flexible payment options for vacations and travel bookings. Uplift’s business model is centered on making travel more affordable for consumers.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/us-buy-now-pay-later-market-21414

Market Drivers

1. Consumer Preference for Flexible Payment Solutions

Younger generations, especially Millennials and Gen Z, prefer BNPL services over traditional credit cards due to the simplicity and transparency of installment plans. The ability to manage finances without incurring interest or hidden fees appeals to consumers looking for more control over their spending.

2. Growth of E-Commerce

The surge in e-commerce has played a vital role in the rise of BNPL services. With online shopping becoming more prevalent, particularly during the COVID-19 pandemic, retailers are adopting BNPL solutions to reduce cart abandonment rates and increase sales. BNPL services provide a seamless checkout experience, boosting customer satisfaction and engagement.

3. Lower Interest Rates Compared to Credit Cards

One of the main drivers behind BNPL’s popularity is its lower cost compared to credit cards. Many BNPL services offer interest-free payment plans, making them a more affordable option for consumers. This is especially attractive for individuals with limited or poor credit who may face high interest rates on traditional credit products.

4. Merchant Benefits

Retailers have embraced BNPL services because they help increase conversion rates, reduce cart abandonment, and boost average order values. By offering flexible payment options, merchants can attract more customers and improve overall sales. This benefit, coupled with the ability to reach a broader customer base, is a key driver for BNPL adoption among businesses.

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com