Summary:

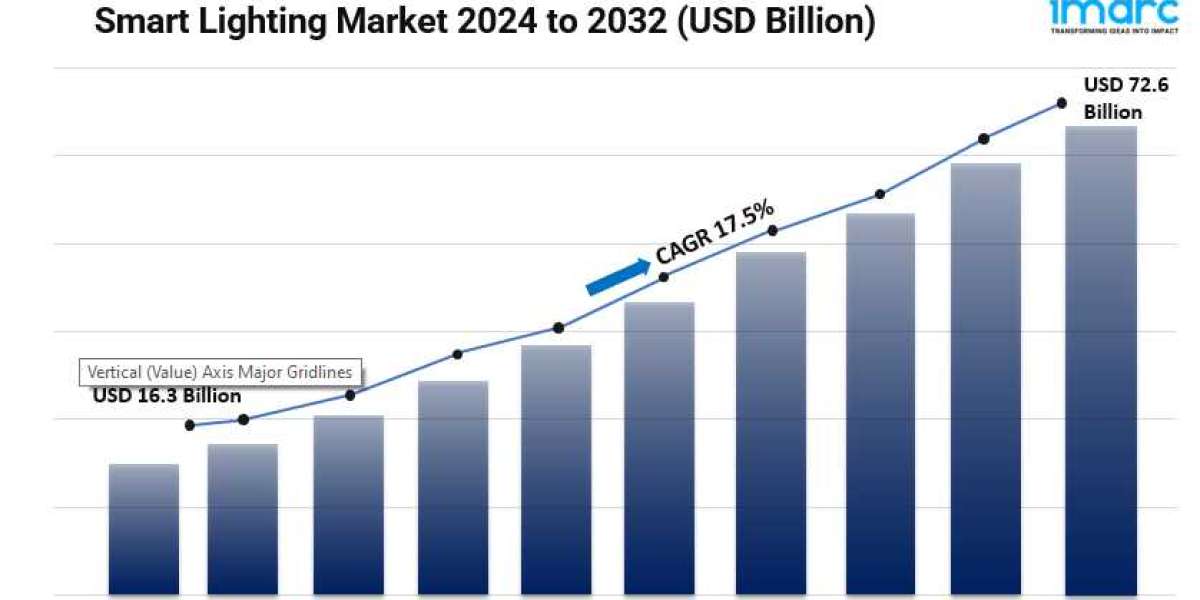

- The global smart lighting market size reached USD 16.3 Billion in 2023.

- The market is expected to reach USD 72.6 Billion by 2032, exhibiting a growth rate (CAGR) of 17.5% during 2024-2032.

- Europe leads the market, accounting for the largest smart lighting market share due to strong government regulations promoting energy efficiency.

- Hardware accounts for the majority of the market share in the offering segment because smart lighting systems heavily rely on physical components.

- Wired technology holds the largest share in the smart lighting industry due to its reliability and widespread adoption.

- New installation remains a dominant segment in the market as the installation of smart lighting is part of broader infrastructure projects.

- LED lamps represent the leading light source segment owing to their excellent energy efficiency.

- Commercial holds the majority of the market share as businesses seek energy efficient solutions.

- The rising emphasis on energy efficiency and cost savings is a primary driver of the smart lighting market.

- The widespread product integration with smart homes and Internet of Things (IoT) are further reshaping the smart lighting market.

Request for a sample copy of this report: https://www.imarcgroup.com/smart-lighting-market/requestsample

Industry Trends and Drivers:

- Energy Efficiency and Cost Savings:

Energy efficiency is one of the most significant factors driving the growth of the smart lighting market. Traditional lighting solutions, such as incandescent and fluorescent bulbs, consume more energy and generate higher electricity costs over time. Smart lighting, particularly with the use of light-emitting diode (LED) bulbs, offers an energy-efficient alternative. These systems can be automated to adjust brightness levels based on the time of day or occupancy, leading to less energy waste. The long lifespan of LED bulbs compared to traditional ones also means fewer replacements, contributing to overall cost savings. With rising electricity prices and increased awareness of environmental sustainability, both consumers and businesses are focusing on reducing their carbon footprints. Smart lighting allows for precise control, including features like dimming, color adjustments, and even adaptive lighting that adjusts according to ambient light.

- Integration with Smart Homes and IoT:

The integration of smart lighting systems into smart homes and Internet of Things (IoT) ecosystems is another major driver of market growth. Smart lighting products can be easily controlled via mobile apps, smart speakers, and other connected devices, offering a seamless experience for users. These lighting systems can sync with other smart home devices like thermostats, security cameras, and entertainment systems, creating an interconnected home environment that can be managed remotely. This level of control and automation has captured consumer interest, making smart lighting an essential component of the modern smart home. IoT platforms allow users to set customized lighting schedules, adjust brightness based on real-time data, and even change the color of lights depending on mood or activity.

- Government Initiatives and Regulations:

Government policies and regulations aimed at promoting energy efficiency and sustainability are playing a key role in driving the smart lighting market. Across the globe, various governments are implementing stringent energy-efficiency regulations, which are encouraging the adoption of smart lighting systems. In line with this, many countries have set regulations to phase out inefficient lighting, such as incandescent bulbs, in favor of more energy-efficient options like LED lights. Additionally, governments are offering financial incentives, including tax breaks and subsidies, for businesses and households that adopt smart technologies aimed at reducing energy consumption. These policies align with broader goals of reducing carbon emissions and combating climate change.

Smart Lighting Market Report Segmentation:

We explore the factors propelling the smart lighting market growth, including technological advancements, consumer behaviors, and regulatory changes.

Breakup By Offering:

- Hardware

- Lights and Luminaires

- Lighting Controls

- Software

- Services

- Design and Engineering

- Installation

- Post-Installation

Hardware account for the majority of shares as it includes essential components like smart bulbs, switches, and sensors, which are required for any smart lighting setup.

Breakup By Communication Technology:

- Wired Technology

- Wireless Technology

Wired technology dominates the market owing to its stability and reliability, especially in large-scale applications like commercial buildings and street lighting.

Breakup By Installation Type:

- New Installation

- Retrofit Installation

New installation represents the majority of shares as emerging smart city projects and new construction ventures prioritize smart lighting systems from the outset.

Breakup By Light Source:

- LED Lamps

- Fluorescent Lamps

- Compact Fluorescent Lamps

- High Intensity Discharge Lamps

- Others

LED lamps hold the majority of shares due to their high energy efficiency, longer lifespan, and lower maintenance costs compared to traditional lighting.

Breakup By Application:

- Commercial

- Residential

- Public Infrastructure

- Others

The commercial sector exhibits a clear dominance as this sector demands advanced lighting solutions to reduce operational costs and enhance energy efficiency across large office spaces, malls, and industries.

Breakup By Region:

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others)

- Middle East and Africa ( Turkey, Saudi Arabia, Iran, United Arab Emirates, Others)

Europe holds the leading position owing to a large market for smart lighting driven by stringent energy efficiency regulations, government incentives, and widespread adoption of smart city initiatives.

Top Smart Lighting Market Leaders:

The smart lighting market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Philips Lighting

- Acuity Brands

- Osram

- Cree

- General Electric Company

- Eaton

- Honeywell

- Legrand

- Hubbell Lighting

- Zumtobel Group

- Hafele Group

- Lutron Electronics

- Wipro Consumer Care and Lighting

- Streetlight.Vision

- Virtual Extension

- Syska LED

Browse full report with TOC List of Figures: https://www.imarcgroup.com/smart-lighting-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145