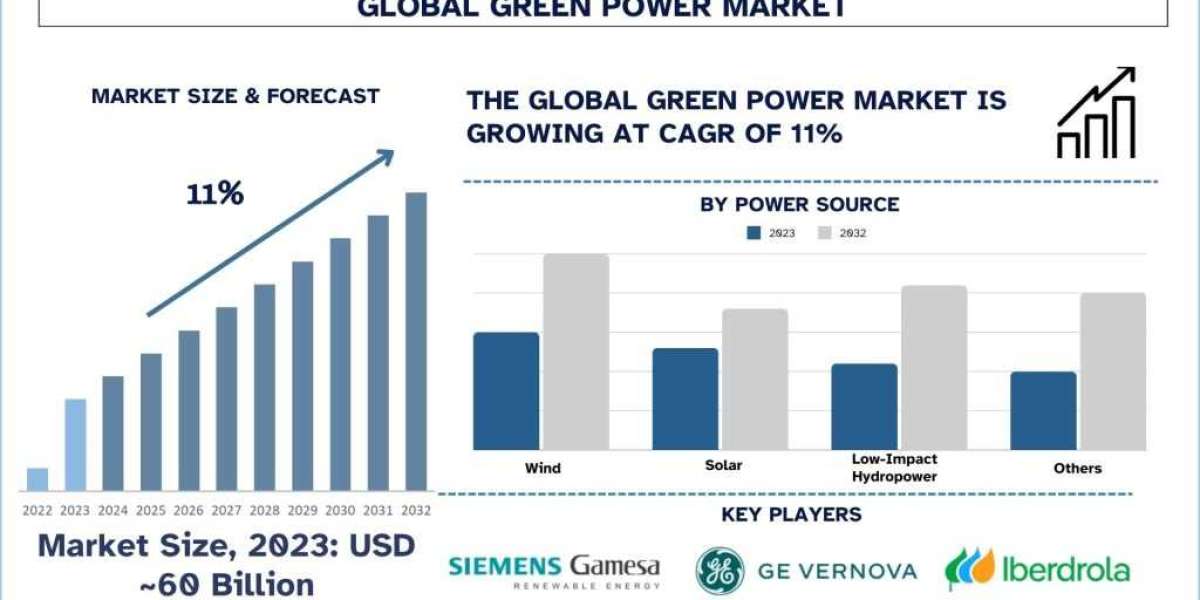

According to the UnivDatos Market Insights analysis, the increasing environmental awareness, rising innovations in solar panels, wind turbines, and energy storage systems, and increased energy consumption drive the Green Power market. As per their “Green Power Market” report, the global market was valued at USD 60 Billion in 2023, growing at a CAGR of about 11% during the forecast period from 2024 – 2032.

Drone technology is already essential in the renewable energy sector and is disseminating a new way on how solar and wind energy systems are operated and managed. Here is more information about clean energy drones specifically focusing on important trends, facts, and technologies.

Expanding Offshore Wind Farms

- Offshore Wind Energy Investments: The global investment in the offshore wind energy sector new a record high in 2023 such as:

As per WindEurope.org, on 18 January 2024, 2023 saw a record 4.2 GW of new offshore wind farms come online, up 40% in 2022. And €30bn of new investments were confirmed – covering 9 GW that’ll be built over the coming years. The supply chain is also seeing a turnaround, with new factories announced in Poland, Denmark, Germany, the Netherlands, and Spain.

As per PIB.gov, on 19 June 2024, The successful commissioning of 1 GW offshore wind projects will produce renewable electricity of about 3.72 billion units annually, which will result in an annual reduction of 2.98 million tons of CO2 equivalent emission for a period of 25 years. Further, this scheme will not only kick start the offshore wind energy development in India but also lead to the creation of the required ecosystem in the country to supplement its ocean-based economic activities. This ecosystem will support the development of an initial 37 GW of offshore wind energy at an investment of about Rs.4,50,000 crore.

- Project Milestones: The United States has in the recent past offered lease areas for offshore wind deployment along the Atlantic Coast where several large-scale projects are planned to achieve commercial operation by 2026. According to the DOE, in 2022, the proposed wind projects on the Atlantic Coast alone are estimated to support up to 86,000 jobs, USD 57 billion in investments, and provide up to USD 25 billion in economic output by 2030.

- Environmental Impact: Offshore wind farms have been observed to deliver on the manufacturing of power in addition to promoting conservation of the marine life, hence increasing its diversity.

Rising Demand for Energy Storage Solutions

- As per the IEA, Global investment in battery energy storage exceeded USD 20 billion in 2022, predominantly in grid-scale deployment, which represented more than 65% of total spending in 2022. After solid growth in 2022, battery energy storage investment is expected to hit another record high and exceed USD 35 billion in 2023, based on the existing pipeline of projects and new capacity targets set by governments.

- Policy Support: The market is being encouraged by grant funding, tax credits, and probably more importantly supportive regulation and a push by the government towards the installation of energy storage.

Corporate Sustainability Commitments

- Power Purchase Agreements (PPAs): Lately, companies have opted for long-term PPAs as they guarantee access to renewable energy. Purchasers in the United States signed 31.1 GW of renewable energy from renewable Power Purchasing Agreements in the year 2022.

- Net-Zero Goals: Microsoft Google and Apple are some of the biggest companies which have committed to getting to net zero by 2030. These commitments underpin investments in renewable power generation assets and new technologies.

- Supply Chain Transparency: Companies also reduce their sustainability risks by sources with renewable power buying influences upon their suppliers that cause shifts toward green power across numerous industries.

Innovative Financing Models

- Green Bonds: The green bond market has grown much bigger as issuance soared past one trillion dollars in 2023. Their target finance initiatives intend to cut down carbon and support renewable energy.

- Crowdfunding Platforms: Projects like SolarShare, and EnergyFund it provide people with opportunities to purchase renewable energy and bring the public into power investment.

- Public-Private Partnerships: Subnational structures, using partnerships with private corporations, are experimenting more with modalities of large-scale financing of renewable energy.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=21098

Advancements in Solar Energy

- Bifacial Solar Panels: The innovation of bifacial solar panels where solar panels work on both facets enhancing efficacy and energy yield. They can produce up to 30 percent more electricity than standard panels.

- Floating Solar Farms: The use of floating solar systems is gradually being adopted due to the lack of space in many areas for land-bound structures. Such systems can bring down evaporation levels and at the same time bring improvement in energy generation.

- Recycling Initiatives: While the uptake of solar panels grows, the issue of how to deal with solar panels at the end of their useful life is of growing concern. Organizations are putting their resources into matters that will enable them to recycle some of the parts from old panels in a bid to ensure that there is the right balance in the solar energy business.

Related Energy and Power Market Research Industy Report:-

Syngas Market: Current Analysis and Forecast (2024-2032)

Bifacial Solar Market: Current Analysis and Forecast (2024-2032)

Conclusion

The green power sector is experiencing rapid evolution and innovation as a result of technology and as organizations and governments endorse ambitious goals. Today, this article captures some of the trends and developments as the world transitions toward sustainability with renewable energy as the solution to climate change and part of building a sustainable global economy. Sustaining the enhancements, integrating new ideas, and harnessing partnerships with other players will be critical in shaping the future of the green power revolution, and making the world greener for future generations.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com