Global Inulin Market Size, Share, Trends Growth Research Analysis 2024-2032

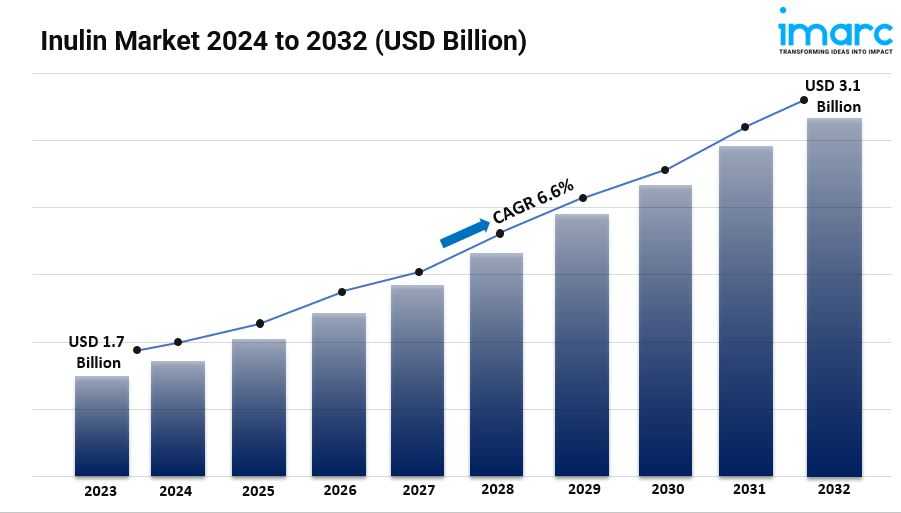

- The global inulin market size reached USD 1.7 billion in 2023.

- The market is expected to reach USD 3.1 Billion by 2032, exhibiting a growth rate (CAGR) of 6.6% during 2024-2032.

- Europe leads the market, accounting for the largest inulin market share.

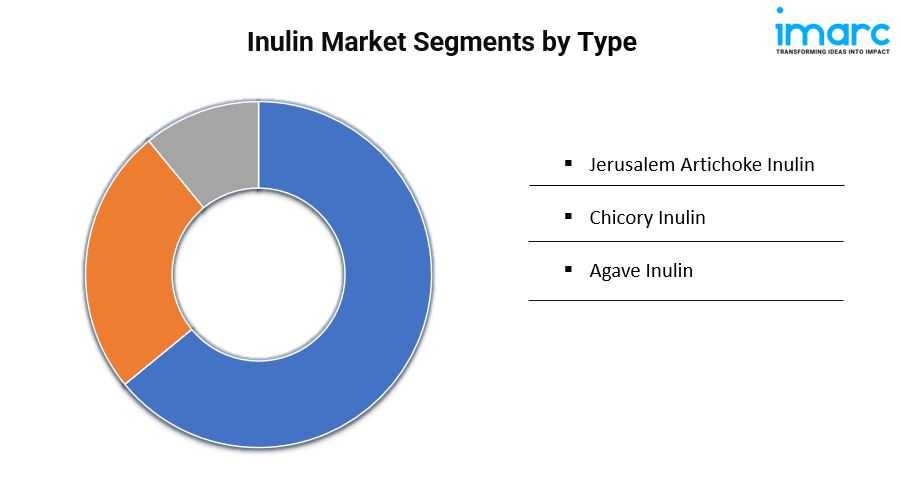

- Chicory inulin accounts for the majority of the market share in the type segment due to its widespread availability, practical advantages, and well-established uses in food and drink products.

- Powder holds the largest share of the inulin industry.

- Organic remains a dominant segment in the market because natural and sustainably sourced ingredients are becoming more and more popular in health and wellness products.

- Food and Beverages represent the leading application segment.

- The growing use of inulin in the pharmaceutical industry, where it is utilized as a carrier for drug delivery systems due to its biocompatibility and prebiotic effects, is impelling the market size.

- Furthermore, the expansion of the functional foods and beverages (FB) sector, where inulin is incorporated to enhance the fiber content and offer health benefits, is meeting the rising consumer demand for functional ingredients.

Request to Get the Sample Report: https://www.imarcgroup.com/inulin-market/requestsample

Industry Trends and Drivers:

The Rising Demand for Dietary Fibers in FB Products:

The increasing demand for dietary fibers plays a crucial role in driving the inulin market. Inulin, a soluble fiber found in various plants, is gaining popularity as a functional ingredient in food products due to its prebiotic properties, which promote gut health by stimulating the growth of beneficial bacteria in the intestines.

With consumers becoming more health-conscious and seeking products that support digestive health, manufacturers are incorporating inulin into a wide range of FB items, including yogurts, cereals, baked goods, and dairy alternatives. This trend is further supported by regulatory bodies recognizing dietary fiber’s health benefits, leading to a surge in products labeled as high-fiber thereby providing an impetus to the market growth.

- The Growing Health Consciousness Among Consumers:

The growing health consciousness among consumers is a significant driver of the inulin market. As awareness of the link between diet and health increases, individuals are becoming more proactive about their nutritional choices. Inulin is perceived as a natural, plant-based ingredient that provides multiple health benefits, such as improved digestion, enhanced satiety, and better blood sugar management.

This trend is particularly prominent among health-focused consumers, such as those following low-calorie, low-fat, or diabetic diets, who seek products with functional ingredients that can help manage their health concerns. Consequently, food manufacturers are reformulating their products to include inulin as a way to cater to this health-conscious demographic, further bolstering the market demand.

- Expanding Applications of Inulin in the Pharmaceutical and Nutraceutical Industries:

The expanding applications of inulin in the pharmaceutical and nutraceutical industries are contributing to the market’s growth. Inulin is increasingly recognized for its potential health benefits beyond its role as a dietary fiber. It is being studied for its ability to support weight management, improve mineral absorption (especially calcium), and enhance overall gut health.

As the demand for natural ingredients in nutraceutical formulations grows, inulin is finding its way into dietary supplements, functional foods, and beverages designed to address various health issues. Additionally, pharmaceutical companies are exploring the use of inulin as an excipient in drug formulations due to its biocompatibility and ability to modify drug release profiles, thus supporting the market growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=reportid=4577flag=C

Inulin Market Report Segmentation:

Breakup By Type:

- Jerusalem Artichoke Inulin

- Chicory Inulin

- Agave Inulin

Chicory inulin accounts for the majority of shares as they are widely used type due to its high availability, functional benefits, and established applications in food and beverage products.

Breakup By Form:

- Powder

- Liquid

Powder dominates the market owing to its versatility in formulation, ease of use, and stability in various food and beverage products.

Breakup By Nature:

- Organic

- Conventional

Organic holds the majority of shares due to increasing consumer demand for natural and sustainably sourced ingredients in health and wellness products.

Breakup By Application:

- Pharmaceuticals

- Dietary Supplements

- Food and Beverage

- Bakery and Confectionery Products

- Cereals

- Meat Products

- Sports Drinks

- Dairy Products

- Others

The food and beverage industry represents the majority of shares due to its use as a fiber source, texture enhancer, and sugar replacer in a wide range of products.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe holds the leading position due to its advanced food and beverage sector, high consumer awareness of health benefits, and strong regulatory support for functional ingredients like inulin.

Top Inulin Market Leaders: The inulin market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- BENEO GmbH (Südzucker AG)

- Cargill Incorporated

- Ciranda Inc.

- Cosucra Groupe Warcoing SA

- Jarrow Formulas Inc.

- NOW Foods

- Nutriagaves Group

- PMV Nutrient Products Pvt Ltd.

- Sensus B.V. (Coöperatie Koninklijke Cosun U.A.)

- Steviva Brands Inc.

- The Tierra Group

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145