Fraud Detection and Prevention Market Overview

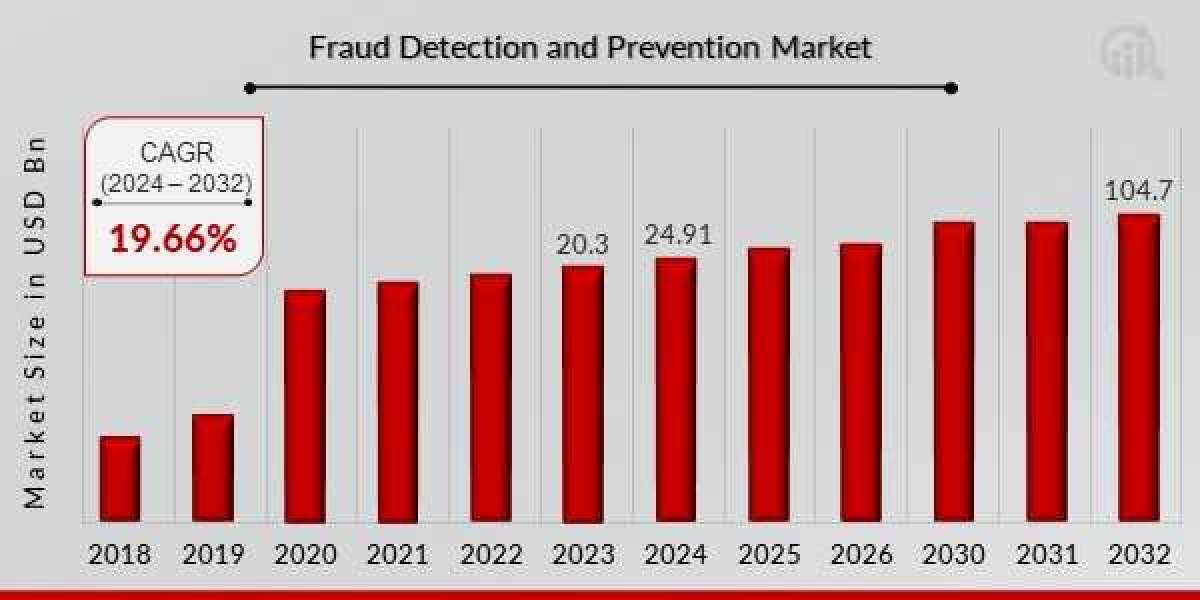

The Fraud Detection and Prevention (FDP) Market is experiencing robust growth, driven by the increasing sophistication of fraudulent activities across industries and the rising importance of securing digital transactions. As more businesses adopt digital platforms for financial transactions, e-commerce, and data management, the risks associated with fraud have grown significantly. FDP solutions help organizations identify suspicious behavior, mitigate risks, and ensure compliance with regulations, making them essential in today's digital economy. Fraud Detection and Prevention Market size is projected to grow from USD 24.91 billion in 2024 to USD 104.7 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 19.66% during the forecast period (2024 - 2032).

With advancements in machine learning (ML), artificial intelligence (AI), and big data analytics, modern fraud detection systems have become highly accurate and efficient. These technologies enable real-time monitoring, anomaly detection, and predictive analysis, helping businesses detect fraud early and minimize financial losses. The market's expansion is further fueled by regulatory requirements such as GDPR, CCPA, and other data protection laws that mandate robust data security measures.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/2985

Key Market Segments

By Solution Type:

- Fraud Analytics: This includes solutions that use statistical, ML, and AI-based models to analyze patterns and detect anomalies in real-time. Fraud analytics has become a critical component of financial institutions, helping them prevent identity theft, account takeovers, and transactional fraud.

- Authentication: Authentication solutions include multi-factor authentication (MFA), biometric verification, and identity verification technologies. These solutions ensure that only authorized users can access sensitive systems and perform transactions.

- Governance, Risk, and Compliance (GRC): GRC solutions help organizations ensure compliance with regulatory standards while managing risks associated with fraud. These tools are particularly crucial for industries like banking, insurance, and healthcare.

- Reporting and Visualization: Visualization tools provide insights into fraud patterns through dashboards and graphical representations. These tools enable companies to understand complex data quickly and take preventive measures accordingly.

By Service Type:

- Professional Services: These include consulting, integration, and deployment services that help companies implement fraud detection solutions effectively. Professional services are essential for customizing solutions to meet industry-specific needs.

- Managed Services: Managed service providers (MSPs) offer end-to-end management of fraud detection solutions, allowing companies to outsource their security needs. This is particularly beneficial for small and medium-sized enterprises (SMEs) that lack in-house expertise.

- Training and Support: As fraud detection solutions evolve, companies need training and support services to stay updated with the latest technologies and best practices. Training ensures that staff can effectively use these tools to detect and prevent fraud.

By Deployment Mode:

- On-Premises: On-premises solutions are deployed locally on a company’s servers and infrastructure. These solutions offer greater control over data but come with higher upfront costs and maintenance responsibilities.

- Cloud-Based: Cloud-based fraud detection solutions are hosted on external servers and accessed via the internet. They offer scalability, flexibility, and lower initial investment, making them popular among SMEs. Cloud deployment also facilitates real-time monitoring and analysis, essential for detecting fraud.

By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI): The BFSI sector is the largest user of fraud detection solutions due to the high volume of transactions and sensitive customer data they manage. Fraud detection tools help banks detect credit card fraud, transaction anomalies, and identity theft.

- Retail and E-commerce: As online shopping becomes more prevalent, retailers face increased risks of payment fraud, account takeovers, and refund fraud. FDP solutions help detect suspicious transactions and secure customer data.

- Healthcare: The healthcare industry uses fraud detection tools to prevent billing fraud, insurance fraud, and unauthorized access to patient records. These solutions ensure compliance with regulations like HIPAA.

- Government and Public Sector: Government agencies use FDP tools to combat identity theft, benefit fraud, and tax evasion. These solutions are crucial for safeguarding public resources and ensuring transparency.

Industry Latest News

AI-Powered Fraud Detection: Many companies are investing in AI-based fraud detection solutions that can analyze large datasets in real-time and identify complex fraud patterns. AI models are capable of learning from new types of fraudulent activities, making them more adaptive and efficient than traditional rule-based systems.

Biometric Authentication Gains Traction: Biometric solutions such as facial recognition, fingerprint scanning, and voice recognition are becoming mainstream in fraud prevention strategies. Financial institutions and online retailers are increasingly adopting these technologies to enhance customer verification and reduce fraud risks.

Rise of Digital Banking Spurs Demand: The growth of digital banking services has led to a surge in demand for advanced fraud detection solutions. Fintech companies and neo-banks are partnering with fraud prevention providers to ensure secure and seamless digital transactions.

Focus on Behavioral Analytics: Behavioral analytics is gaining prominence as a method of detecting fraud by analyzing user behavior patterns, such as typing speed, browsing habits, and mouse movements. This approach allows for a deeper understanding of user actions and helps identify abnormal behavior indicative of fraud.

Emergence of Blockchain for Fraud Prevention: Blockchain technology is being explored as a means to enhance transparency and traceability in financial transactions. The decentralized nature of blockchain makes it difficult for fraudsters to alter data, thus providing an additional layer of security.

Key Companies

IBM Corporation: IBM offers advanced fraud detection solutions through its Watson platform, utilizing AI and machine learning to identify fraudulent activities in real-time. Its solutions are widely adopted in the BFSI and retail sectors.

FICO: Known for its credit scoring, FICO also provides fraud detection tools that leverage predictive analytics and AI. Its solutions are designed to identify anomalies in payment patterns and prevent identity theft and card fraud.

SAS Institute Inc.: SAS offers a comprehensive suite of fraud detection solutions that include fraud analytics, reporting, and visualization. Its tools are particularly popular in the financial services industry, helping banks manage fraud risks effectively.

Experian PLC: Experian specializes in credit risk management and identity verification services. Its fraud detection solutions help organizations prevent identity theft, credit card fraud, and account takeovers.

ACI Worldwide: ACI Worldwide provides payment systems and fraud detection solutions for banks and retailers. Its real-time fraud management tools are designed to secure online and mobile transactions, providing a seamless customer experience.

LexisNexis Risk Solutions: LexisNexis offers fraud detection services focusing on identity verification and risk assessment. Its solutions are used across various industries, including healthcare, insurance, and retail.

Market Drivers

Increasing Digital Transactions: The rise of digital banking, e-commerce, and online services has led to an increase in digital transactions, making organizations more vulnerable to cyberattacks and fraud. This trend drives the demand for advanced fraud detection and prevention solutions.

Evolving Fraud Tactics: Fraudsters are constantly developing new tactics to exploit weaknesses in digital platforms. This creates a need for solutions that can adapt and evolve, using AI and machine learning to stay ahead of emerging threats.

Regulatory Compliance: Strict regulations around data privacy and security, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), require organizations to implement robust fraud detection measures. Compliance with these laws is a major driver of the FDP market.

Rising Awareness of Data Security: With data breaches becoming more common, organizations are increasingly aware of the need to secure their data. This has led to higher investments in fraud detection solutions to protect sensitive information and build customer trust.

Adoption of Cloud-Based Solutions: The shift towards cloud computing has made fraud detection solutions more accessible to small and medium-sized enterprises (SMEs). Cloud-based FDP tools offer scalability, flexibility, and real-time analytics, making them a preferred choice for many businesses.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/fraud-detection-prevention-market-2985

Regional Insights

North America: North America is the leading market for fraud detection solutions, driven by the high adoption of digital services and the presence of major financial institutions. The region also has a strong regulatory framework that mandates robust fraud prevention measures.

Europe: Europe has a significant share of the FDP market due to strict regulations like GDPR and a strong emphasis on data privacy. Financial institutions and e-commerce companies in the region are investing in advanced fraud detection tools to ensure compliance and protect customer data.

Asia-Pacific: The Asia-Pacific region is experiencing rapid growth in the FDP market due to the expansion of digital banking and e-commerce. Countries like India, China, and Japan are investing in fraud prevention solutions to address the rising incidents of online fraud and cyberattacks.

Middle East Africa: The Middle East and Africa are emerging markets for fraud detection, with increasing digital adoption and a growing need for secure online transactions. The rise of fintech startups in the region has also contributed to the demand for fraud detection solutions.

Latin America: Latin America is seeing steady growth in the adoption of FDP solutions, driven by the increasing use of mobile payments and online banking. The region's financial institutions are focusing on improving their fraud prevention strategies to combat rising cyber threats.

Conclusion

The Fraud Detection and Prevention Market is poised for substantial growth as businesses continue to adopt digital platforms and face new security challenges. The demand for advanced, AI-powered fraud detection solutions is increasing as organizations strive to protect their data and comply with stringent regulatory requirements. With the rise of digital banking, e-commerce, and cloud computing, the market is expected to see sustained growth, especially in emerging economies. As the landscape of cyber threats evolves, companies that can offer innovative and adaptable solutions will find ample opportunities in this dynamic market.