The rare earth metals market plays a pivotal role in powering modern technologies, from renewable energy solutions and electric vehicles (EVs) to advanced defense systems. However, the market operates within a complex geopolitical framework, presenting both challenges and opportunities for global stakeholders.

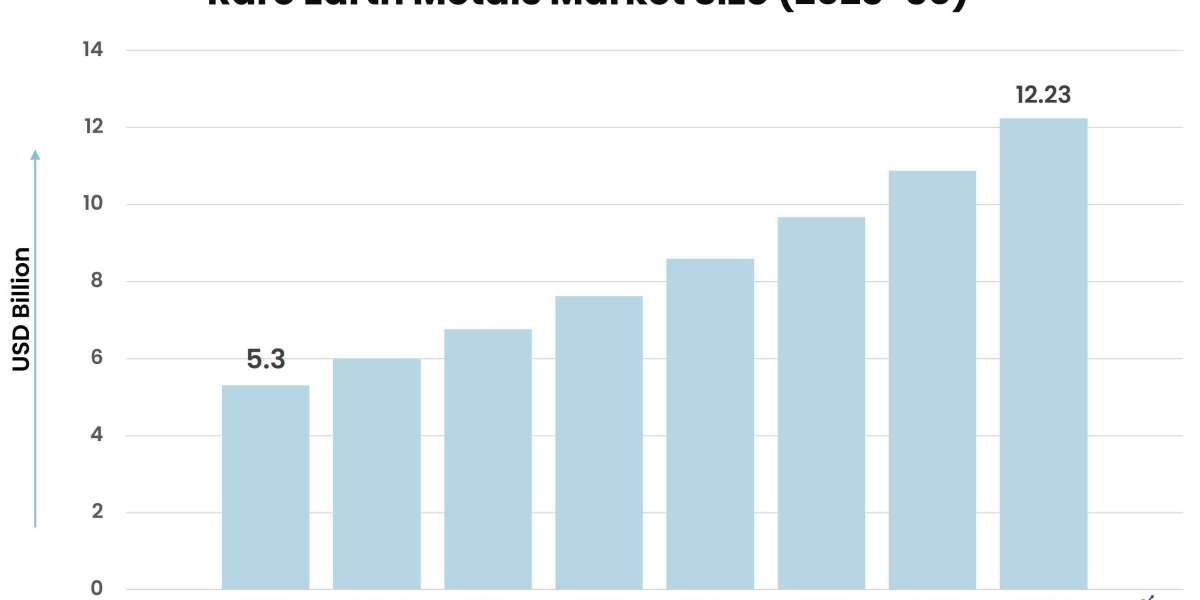

According to Stratview Research, the rare earth metals market was estimated at USD 5.3 billion in 2023 and is likely to grow at a CAGR of 12.67% during 2024-2030 to reach USD 12.23 billion in 2030.

Challenges in the Rare Earth Metals Market

- Supply Chain Dominance: China dominates the rare earth metals market, accounting for over 60% of global production. This concentration of supply creates vulnerabilities for other nations, particularly in times of political tensions or trade disputes.

- Environmental Concerns: The extraction and processing of rare earth metals are resource-intensive and environmentally damaging. Strict environmental regulations in many countries limit mining activities, exacerbating supply constraints.

- Volatility in Pricing: The market experiences significant price fluctuations due to geopolitical tensions, export restrictions, and shifts in demand, creating uncertainty for industries reliant on these metals.

- Dependency on Imports: Many nations, including the U.S., Japan, and European countries, heavily rely on imported rare earth metals, exposing them to potential supply disruptions.

- Rising Demand Outstripping Supply: The rapid growth in technologies like EVs, wind turbines, and electronics is driving demand for rare earth metals. However, supply chains are struggling to keep pace with this growth.

Opportunities Amidst Geopolitical Challenges

- Diversification of Supply: Countries are actively seeking to reduce dependency on Chinese exports by investing in alternative sources. Australia, the U.S., and Canada are ramping up mining projects, while Africa and Southeast Asia are emerging as potential suppliers.

- Recycling and Reuse: Advancements in recycling technologies for rare earth metals offer a sustainable solution to meet growing demand while mitigating environmental impact.

- Strategic Partnerships: Collaborative efforts between governments and private sectors are fostering the development of diversified and secure supply chains. Initiatives like the U.S.-EU Trade and Technology Council aim to strengthen rare earth metals production outside China.

- Innovation in Extraction and Processing: New technologies, such as solvent extraction and bioleaching, are making rare earth metals mining more efficient and environmentally friendly.

- Focus on Sustainability: The global push for green technologies creates significant opportunities for rare earth metals in renewable energy and electric mobility markets.

Conclusion

While the rare earth metals market faces challenges in its geopolitical and environmental landscape, strategic investments, technological advancements, and international collaboration present pathways to growth. Balancing supply chain security with sustainability will be key to unlocking the full potential of this critical industry.