Palladium is a precious metal with diverse applications, ranging from automotive catalytic converters to electronics, hydrogen storage, and more. Its increasing use in the automotive industry, combined with limited supply, has resulted in price fluctuations over the years. In this article, we will explore the Palladium Price Trend, examining recent developments, market forecasts, historical data, and providing insights into factors influencing its price movements.

The demand for palladium has skyrocketed, largely driven by its crucial role in reducing vehicle emissions. This is especially true in gasoline-powered vehicles, where palladium is used in catalytic converters. However, the palladium market has faced challenges, including a constrained supply due to mining limitations and geopolitical factors. As a result, palladium prices have seen significant volatility. Understanding these price dynamics can help stakeholders in the automotive, industrial, and investment sectors make informed decisions.

Latest Palladium Prices and Market News

The palladium market has been marked by sharp price fluctuations over the past few years, often influenced by changes in supply-demand dynamics and investor sentiment. In recent months, prices have continued to show strong momentum, reflecting the tightening supply due to limited mining output and increasing demand from the automotive sector. The recent surge in palladium prices has also been linked to the ongoing shift towards cleaner technologies and stricter emission standards that require more palladium in automotive catalytic converters.

The price trend of palladium is typically quoted per ounce, and various factors contribute to its market valuation. A strong global economic recovery, increasing industrial demand, and supply disruptions from key mining regions, such as Russia and South Africa, all play a role in determining the market price.

For businesses in industries reliant on palladium, from manufacturers of catalytic converters to investors, keeping track of these fluctuations is critical. Accurate and timely data on palladium prices can provide a competitive advantage and inform purchasing and investment decisions.

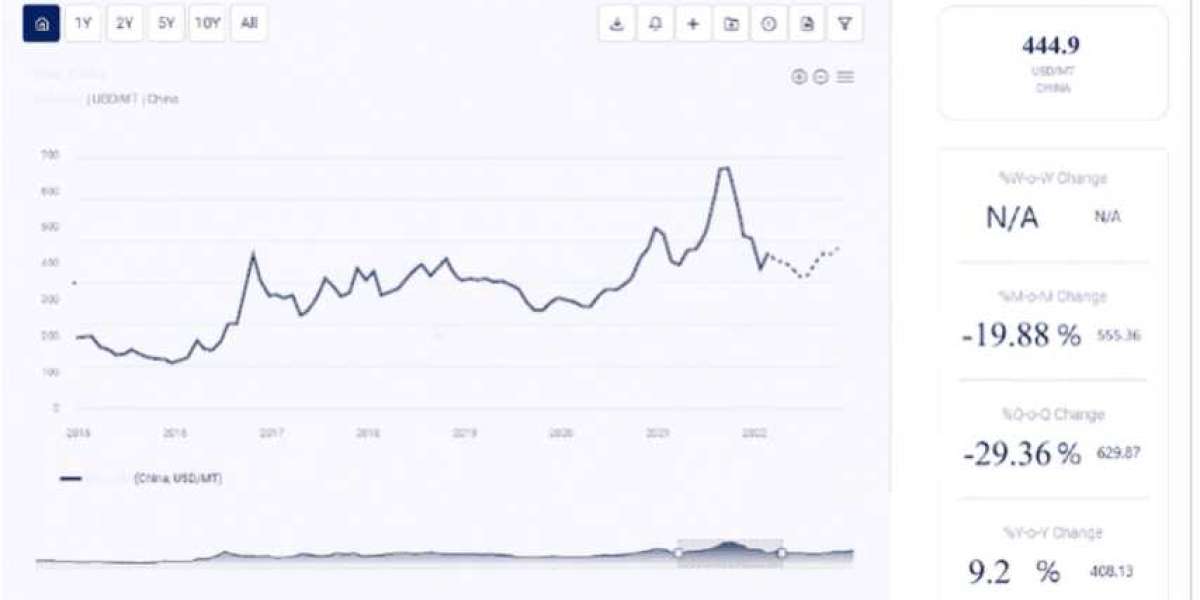

Palladium Price Trend: Historical Data Forecast

Palladium has experienced a remarkable price trajectory over the last decade. After years of trading in the $300–$400 range, palladium prices soared to new heights, peaking near $2,900 per ounce in early 2020. This price surge was driven by growing demand, especially from the automotive sector, and supply challenges in mining. Following this peak, prices experienced a correction, but the overall trend has remained upward, supported by solid demand and constrained supply.

Historically, palladium has been more expensive than its sister metal, platinum, due to the aforementioned supply-demand imbalances. The continued global shift towards electric vehicles (EVs) has also had a significant effect on palladium's price dynamics, as traditional gasoline-powered vehicles require significantly more palladium for catalytic converters.

In terms of market forecasts, analysts predict that the palladium market will continue to experience volatility, with prices potentially moving higher in the long term. Factors such as ongoing emission standards, the automotive industry's dependence on palladium, and mining constraints will likely drive price fluctuations. Furthermore, geopolitical factors, particularly tensions in Russia (a major supplier of palladium), can significantly impact the market.

Palladium Price Database and Chart

For businesses involved in the palladium market, maintaining access to reliable, real-time pricing data and historical charts is crucial. Tracking the Palladium Price Trend over time helps companies and investors identify patterns, predict price movements, and make informed purchasing or investment decisions.

A detailed price database should include:

- Real-time prices for palladium across various markets.

- Historical data showing price fluctuations over the past year, five years, and beyond.

- Price charts that highlight trends, highs, and lows, offering insight into how the metal’s price has evolved over time.

- Forecasts that predict future price movements based on current market conditions, supply-demand forecasts, and other influencing factors.

These tools can be valuable in strategic decision-making processes, especially in markets where palladium's price volatility has direct implications on production costs, investment returns, and profitability.

Market Insights: Factors Affecting Palladium Prices

Several factors influence the price trend of palladium, and understanding these factors is key for anyone involved in the palladium market. Here’s a look at the key drivers:

Automotive Industry Demand: The primary driver of palladium demand is its use in automotive catalytic converters. As stricter emission standards continue to take effect worldwide, automakers are increasingly turning to palladium to meet these regulations. This trend is expected to persist, especially as the automotive sector recovers from the impacts of the COVID-19 pandemic.

Mining Supply: Palladium is primarily mined in a few regions, including Russia, South Africa, and Canada. Any disruptions to mining activities, such as geopolitical tensions or labor strikes, can lead to a supply shortage, pushing prices higher. Additionally, palladium is often extracted as a byproduct of platinum and nickel mining, which can influence its availability.

Shift to Electric Vehicles (EVs): While the rise of electric vehicles (EVs) is expected to reduce the long-term demand for palladium in the automotive sector, it remains a significant factor in the short-term, as gasoline-powered vehicles still dominate the global fleet.

Investment Demand: Palladium is also seen as a store of value and has become increasingly popular among investors as a safe-haven asset, especially during times of economic uncertainty. Investment demand for palladium in exchange-traded products (ETPs) and other investment vehicles can significantly impact its price.

Geopolitical Risks: As mentioned, Russia is one of the world's largest producers of palladium. Political and economic instability in Russia can have a direct impact on palladium supply and, consequently, on its market price.

Regional Insights Analysis

The palladium market’s dynamics vary across different regions. Let’s take a closer look at the major regions influencing palladium prices:

North America: The U.S. is a key player in the automotive industry and, therefore, a significant consumer of palladium. In recent years, U.S. manufacturers have been increasingly reliant on palladium for meeting emissions standards. Additionally, North America has seen increased investor interest in palladium as a commodity.

Europe: Europe is another important market for palladium due to stringent emissions standards. European manufacturers, particularly in countries like Germany and France, depend heavily on palladium for their vehicles' catalytic converters. The European Union’s push toward stricter emission standards has led to an uptick in demand for palladium.

Asia-Pacific: China and India are two of the largest markets for palladium in the automotive sector, though China has a growing EV market that could reduce future demand for palladium. However, in the short-term, demand for palladium is likely to remain strong, particularly in China’s growing automotive sector.

Russia and South Africa: As the largest global producers of palladium, both Russia and South Africa have significant influence on the market. Geopolitical issues, labor unrest, and mining output from these regions play a crucial role in global palladium price movements.

Request for Real-Time Palladium Prices

If you are involved in the palladium market and need up-to-the-minute price data, accurate market analysis, and historical insights to inform your decisions, Procurement Resource can help. We offer comprehensive and real-time palladium price data, charts, and forecasts that provide valuable insights for businesses, investors, and manufacturers.

? Request for Real-Time Palladium Prices: https://www.procurementresource.com/resource-center/palladium-price-trends/pricerequest

Whether you're a manufacturer in need of accurate procurement information, an investor looking for the latest trends, or a researcher analysing market shifts, Procurement Resource provides the tools and data to stay ahead of the market.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA