Triethanolamine (TEA) is a versatile chemical compound primarily used in various industries such as pharmaceuticals, cosmetics, agriculture, and manufacturing. It is an organic compound, a colorless, viscous liquid with a slight ammonia-like odor. Triethanolamine plays a crucial role in formulating surfactants, emulsifiers, corrosion inhibitors, and detergents, making it a staple in multiple sectors. However, like other industrial chemicals, the price of triethanolamine is subject to fluctuations due to various market factors such as raw material costs, demand-supply dynamics, production capacities, and geopolitical events.

This article explores the triethanolamine price forecast for the period 2024-2032, identifying the key factors influencing price trends, potential risks, opportunities, and expected price movements. Additionally, it looks at the market's historical trends, current conditions, and forecasts to provide a comprehensive outlook on triethanolamine pricing for the upcoming years.

Key Factors Affecting Triethanolamine Prices

Several factors impact the price of triethanolamine, ranging from raw material availability to broader economic conditions. Below are the primary drivers:

1. Raw Material Prices

Triethanolamine is produced through the reaction of ammonia with ethylene oxide. As such, its production is heavily dependent on the prices of these raw materials. Ammonia, in particular, is volatile in price due to factors such as seasonal demand, natural gas prices (which are essential for ammonia production), and geopolitical events affecting key ammonia-producing regions.

Ethylene oxide prices are also impacted by fluctuations in crude oil and natural gas prices. Any significant price increase in these raw materials can directly affect the cost of producing triethanolamine.

2. Demand from End-User Industries

Triethanolamine is used in a variety of end-user industries, such as:

Cosmetics and Personal Care: TEA is commonly used in skin care formulations and shampoos as an emulsifier and pH balancer. The growing demand for cosmetic products globally, especially in emerging economies, is a significant driver of triethanolamine consumption.

Agriculture: TEA is utilized in the manufacture of herbicides, pesticides, and fungicides. With the global agricultural market expanding, particularly in regions like Asia-Pacific and Latin America, this has led to increased demand for TEA.

Detergents and Surfactants: As an essential component of detergents and industrial cleaners, the demand from this sector can influence price trends.

The performance of these sectors, especially in terms of growth and expansion, significantly affects the price of triethanolamine.

3. Supply Chain Disruptions

Natural disasters, trade restrictions, transportation issues, and geopolitical tensions can all lead to disruptions in the supply of key ingredients or finished products. In recent years, global supply chains have been severely impacted by COVID-19, leading to shortages and price hikes in various chemicals, including triethanolamine.

In addition, any major disruptions in the transportation or production facilities, particularly in key manufacturing hubs such as China, the US, and Europe, can result in tight supply conditions, further driving up prices.

4. Technological Innovations and Production Capacity

Advancements in production technology, such as more efficient methods for producing triethanolamine or improvements in raw material procurement, could reduce production costs and ease pressure on prices. Conversely, if production facilities struggle to keep up with demand or face technical setbacks, this could lead to higher prices.

The global triethanolamine industry is also seeing expansion, particularly in countries such as China, which may lead to price reductions if new supply chains significantly increase production capacity and meet demand more efficiently.

5. Government Regulations

Changes in environmental regulations or trade policies can significantly impact the price of triethanolamine. For example, stringent regulations on the chemical industry, including emissions and waste disposal, could increase operational costs, resulting in higher product prices.

6. Crude Oil Prices

As an oil derivative, the cost of crude oil has a direct relationship with the prices of ethylene oxide and ammonia, two key ingredients in triethanolamine production. A rise in global crude oil prices typically leads to a corresponding rise in the costs of ethylene oxide and ammonia, which in turn pushes the price of triethanolamine upward.

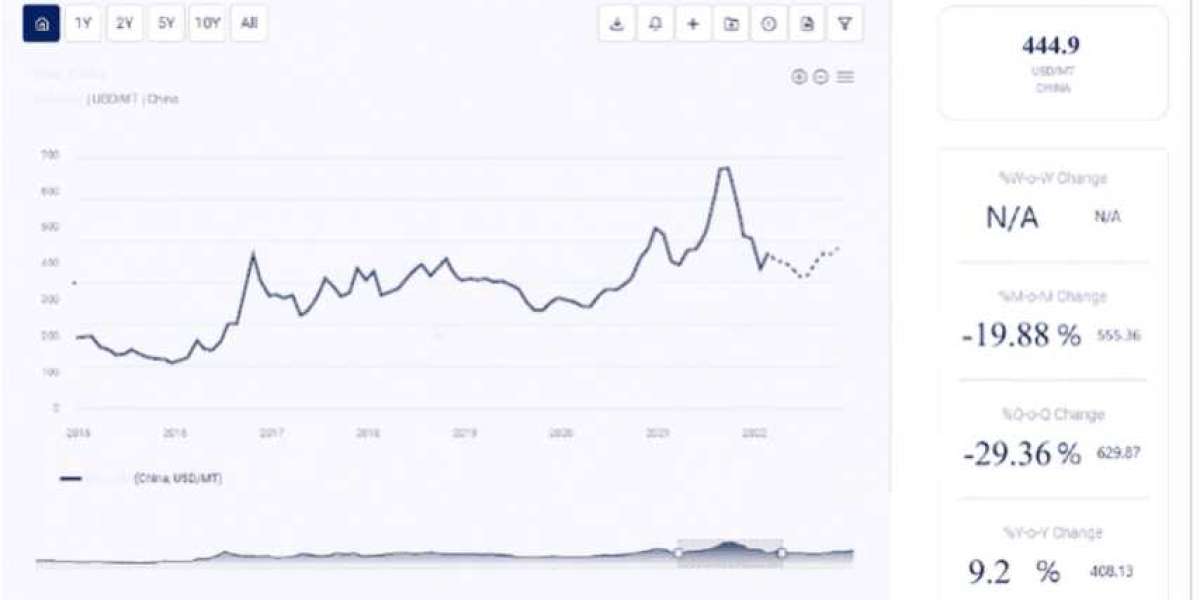

Historical Price Trends of Triethanolamine

The price of triethanolamine has experienced significant fluctuations over the past decade, largely influenced by changes in raw material prices, shifts in demand from end-use industries, and economic conditions. Between 2010 and 2020, the global price of triethanolamine followed a cyclical pattern, with peaks during periods of high crude oil prices and corresponding declines when oil prices decreased.

From 2020 onwards, triethanolamine prices saw notable increases due to several key factors:

- Pandemic-induced supply chain disruptions led to raw material shortages and shipping delays.

- Higher demand from the personal care industry during lockdowns, as consumers increasingly sought hygiene products such as hand sanitizers and personal care goods.

- Volatility in crude oil and ammonia prices, driven by geopolitical events and market uncertainty.

Recent Price Movements

As of 2023, the price of triethanolamine was elevated due to a mix of ongoing logistical challenges, higher input costs, and robust demand from several key industries. These trends are expected to continue into 2024, with prices likely to remain high, albeit at slightly lower levels than the peaks witnessed during the pandemic.

Triethanolamine Price Forecast 2024-2032

Short-Term Price Outlook (2024-2026)

The forecast for triethanolamine prices in the short term (2024-2026) indicates a moderate increase, driven primarily by continued supply chain pressures and raw material price fluctuations.

Ammonia Prices: Ammonia production remains highly dependent on natural gas, and fluctuations in gas prices will continue to impact the price of triethanolamine. With increasing demand for fertilizers, which share ammonia as a key input, ammonia prices are expected to remain volatile.

Ethylene Oxide Prices: As the demand for ethylene oxide continues to be closely tied to the automotive, construction, and healthcare sectors, fluctuations in ethylene oxide pricing will influence triethanolamine price trends. If global demand for petrochemicals rises, it could lead to higher ethylene oxide prices and, subsequently, triethanolamine prices.

Government Policies: The ongoing implementation of stricter environmental regulations may push manufacturers to adopt cleaner but more costly production processes, potentially raising triethanolamine prices.

However, the forecasted moderate increase in prices will be offset by the ongoing expansion of production capacity, particularly in Asia-Pacific and the Middle East. This regional shift in production and new entrants into the market could improve the supply-side dynamics and potentially stabilise prices.

Medium-Term Price Outlook (2027-2030)

In the medium term, the triethanolamine market is expected to stabilise. By 2027, prices may begin to moderate as new production facilities come online, and supply chains recover from the disruptions of the past few years. However, demand from end-user industries such as personal care, agriculture, and industrial cleaning products will likely continue to grow, supporting stable prices.

Technological Innovations: Advancements in manufacturing technologies and process efficiencies could help lower production costs. If manufacturers can scale up production while maintaining lower costs, this could exert downward pressure on prices.

Geopolitical Stability: Increased geopolitical stability in key oil-producing regions may reduce the volatility in raw material prices. A more stable supply of crude oil and ammonia will likely help to stabilise prices for triethanolamine.

Shift Toward Sustainable Alternatives: The rise in demand for sustainable and green chemicals may drive innovation, potentially reducing reliance on triethanolamine or leading to cost-efficient alternatives, which could influence long-term prices.

Long-Term Price Outlook (2031-2032)

The long-term outlook for triethanolamine prices suggests a period of moderate to slow growth. With increasing environmental awareness and efforts to move towards greener alternatives, the price of triethanolamine may stabilise or even decrease if eco-friendly substitutes emerge and take a larger market share.

Demand Saturation: As key industries, including personal care and agriculture, continue to grow at steady rates, the demand for triethanolamine may plateau, causing price hikes to slow down.

Sustainability Trends: The adoption of biobased or green alternatives to conventional chemicals, such as triethanolamine, may impact prices. However, it is unlikely that these substitutes will fully replace triethanolamine in the short to medium term, given its widespread applications.

Economic Growth: Global economic growth, particularly in emerging markets such as India and China, may continue to support demand for triethanolamine, but at a more stable rate as industries mature and production capacities expand.

The price of triethanolamine is set to face various challenges and opportunities in the period between 2024 and 2032. While the short-term outlook remains volatile due to raw material costs, supply chain disruptions, and global demand fluctuations, the medium-term forecast suggests a more stable environment with gradual price moderation.

Long-term price trends will likely be shaped by technological advances in manufacturing, increasing demand from emerging markets, and the gradual shift toward greener chemicals. Companies operating in the triethanolamine market will need to navigate these dynamics carefully to maintain profitability and ensure supply chain efficiency.

Overall, the triethanolamine market is expected to experience steady growth, though prices may stabilise as new production technologies and regulatory developments influence the chemical industry.

Media Contact:

Contact Person: Leo Frank, Business Consultant

Email: sales@expertmarketresearch.com

Toll Free Number: US +1-415-325-5166 | UK +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com