What Are Pre IPO Shares?

Pre IPO shares are equity shares that a company offers before its initial public offering (IPO). An IPO marks the first time a company offers its shares to the public through a stock exchange. Before this event, companies often sell shares privately to institutional investors, venture capitalists, or high-net-worth individuals. These are the pre IPO shares, representing an early stage of investment.

Investors buy these shares with the expectation that the company will go public and the value of the shares will increase significantly. However, investing in Pre ipo shares also involves higher risks, as the company’s future performance and the success of its IPO remain uncertain.

Why Invest in Pre IPO Shares?

- High Growth Potential: Investing in pre IPO shares offers an opportunity to capitalize on the growth of promising companies at an early stage. Companies often experience a surge in valuation post-IPO, translating to significant returns for early investors.

- Exclusive Access: Access to pre IPO shares is generally limited to a select group of investors. Being part of this exclusive club can provide a competitive edge.

- Portfolio Diversification: For seasoned investors, pre IPO shares can add diversification to their investment portfolio, balancing high-risk and high-reward opportunities.

Risks of Investing in Pre IPO Shares

While the potential rewards are enticing, investing in pre IPO shares is not without risks:

- Illiquidity: Unlike publicly traded stocks, pre IPO shares cannot be easily sold. Investors may need to hold these shares for a prolonged period until the company goes public.

- Uncertainty: The company’s performance is uncertain, and there is no guarantee that the IPO will succeed or that the share value will increase.

- Limited Information: Companies offering pre IPO shares are not subject to the same disclosure requirements as publicly traded companies. This lack of transparency can make it difficult to assess the company’s financial health and growth prospects.

How to Invest in Pre IPO Shares

Investing in pre IPO shares requires careful planning and due diligence. Here are some steps to consider:

- Identify Opportunities: Look for companies with strong fundamentals, a compelling business model, and significant growth potential. Staying informed about industry trends can help identify promising candidates.

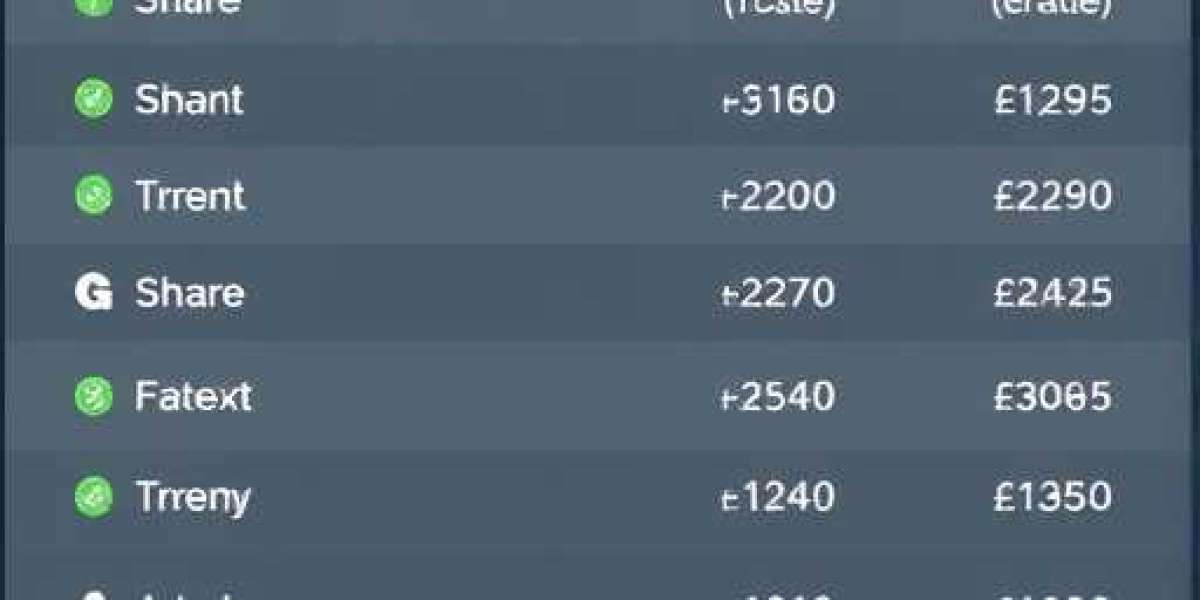

- Engage with Brokers or Platforms: Several platforms and brokerage firms specialize in pre IPO shares. These entities connect investors with companies offering pre-IPO opportunities.

- Assess the Valuation: Evaluate the company’s valuation and compare it with industry benchmarks. Overpaying for pre IPO shares can diminish potential returns.

- Understand the Terms: Review the terms of the investment, including lock-in periods, rights, and obligations associated with the shares.

- Seek Professional Advice: Consulting with financial advisors or experts can provide valuable insights and help mitigate risks.

Real-Life Success Stories

Investing in pre IPO shares has proven lucrative for many investors. Companies like Facebook, Google, and Uber offered early investors extraordinary returns post-IPO. For instance, those who acquired Facebook’s pre IPO shares witnessed their investment multiply manifold after the company’s public debut.

Who Can Invest in Pre IPO Shares?

Historically, investing in pre IPO shares was restricted to institutional investors, venture capital firms, and accredited individuals. However, with the advent of new investment platforms, retail investors are increasingly gaining access to these opportunities. Some platforms allow fractional investments, lowering the entry barrier for individual investors.

Key Considerations Before Investing

- Risk Tolerance: Assess your ability to withstand potential losses. Pre IPO shares are high-risk investments and may not be suitable for risk-averse individuals.

- Investment Horizon: Be prepared for a long-term commitment. The time between purchasing pre IPO shares and realizing returns can span several years.

- Research: Conduct thorough research into the company’s market position, management team, and growth prospects.

- Diversify: Avoid putting all your capital into a single investment. Diversifying across different companies and industries can reduce risk.

The Future of Pre IPO Shares

The growing interest in pre IPO shares is reshaping the investment landscape. With more platforms democratizing access, the market is becoming increasingly inclusive. This trend is likely to continue as technology facilitates transparency and connectivity in the pre-IPO ecosystem.

Conclusion

Investing in pre IPO shares can be a game-changer for those seeking to capitalize on the growth of innovative companies. While the risks are significant, the potential rewards make this investment avenue worth exploring. By understanding the intricacies of pre IPO shares and adopting a strategic approach, investors can navigate this high-stakes arena with confidence.

Whether you are a seasoned investor or a curious beginner, delving into pre IPO shares could open the door to lucrative opportunities. Stay informed, stay cautious, and remember that thorough research is your best ally in this exciting investment journey.