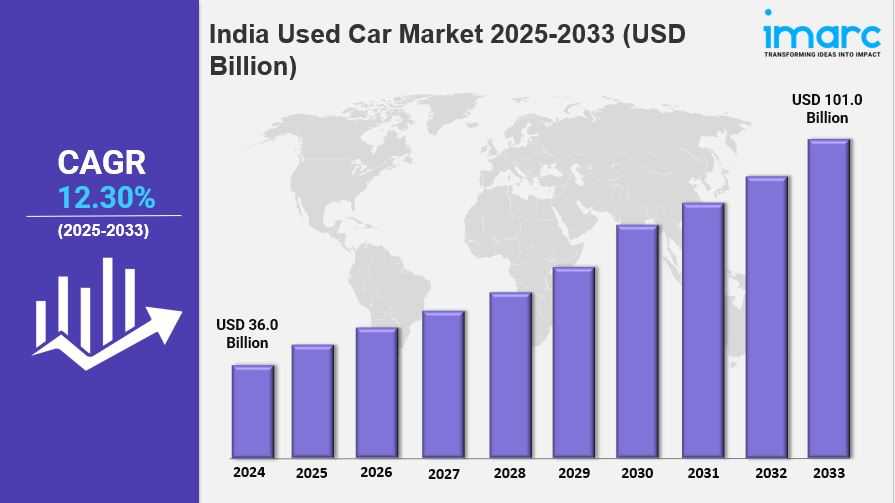

Market Overview 2025-2033

The India used car market size reached USD 36.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 101.0 Billion by 2033, exhibiting a growth rate (CAGR) of 12.30% during 2025-2033. The India used car market is witnessing significant expansion, fueled by growing consumer confidence, increased urban mobility, and rising disposable incomes. Notable trends include a surge in demand for certified pre-owned vehicles, with leading companies emphasizing digital platforms and transparent transactions to enhance customer experience.

Key Market Highlights:

✔️ Strong growth driven by rising consumer confidence and urban mobility.

✔️ Increasing demand for certified pre-owned vehicles and value-for-money options.

✔️ Growing emphasis on digital platforms for seamless buying and selling experiences.

Request for a sample copy of the report: https://www.imarcgroup.com/india-used-car-market/requestsample

India Used Car Market Trends and Driver:

The India used car market is poised for remarkable transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues to accelerate, more individuals are seeking affordable mobility solutions, leading to a surge in demand for pre-owned vehicles. In 2025, the market size is expected to reach approximately USD 32 billion, reflecting a robust growth trajectory fueled by rising disposable incomes and a growing middle class.

A significant trend shaping the used car landscape is the increasing popularity of certified pre-owned (CPO) vehicles. Consumers are becoming more discerning, prioritizing quality and reliability in their purchases. This shift has prompted dealerships and online platforms to enhance their offerings, providing comprehensive inspections and warranties. As a result, the market share of CPO vehicles is projected to expand significantly by 2025, capturing a larger segment of the overall used car market.

Digitalization is another key driver of change in the India used car market. Online platforms are revolutionizing the way consumers buy and sell vehicles, offering convenience and transparency. In 2025, the integration of advanced technologies such as AI and big data analytics will further streamline the purchasing process, enabling buyers to make informed decisions. This digital shift is expected to increase the market share of online sales channels, making them a vital component of the overall ecosystem.

Sustainability is also becoming a focal point for consumers and businesses alike. As awareness of environmental issues grows, buyers are increasingly considering fuel-efficient and electric vehicles in the used car segment. This trend is likely to reshape the market landscape by 2025, with a noticeable rise in the availability and demand for eco-friendly options. Overall, the India used car market is on the cusp of significant evolution, driven by consumer preferences, technological advancements, and a commitment to sustainability.

India Used Car Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Breakup by Vendor Type:

- Organized

- Unorganized

Breakup by Fuel Type:

- Gasoline

- Diesel

- Others

Breakup by Sales Channel:

- Online

- Offline

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145