Market Overview 2024-2032

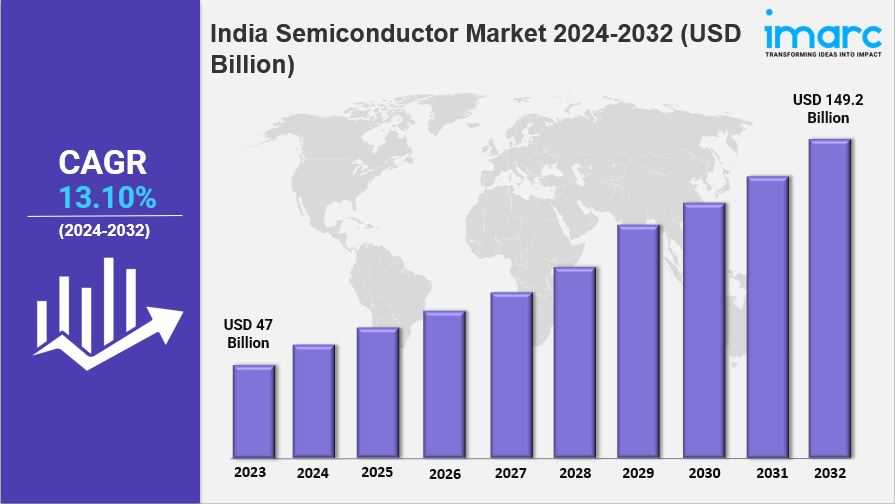

The India semiconductor market size reached USD 47 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 149.2 Billion by 2032, exhibiting a growth rate (CAGR) of 13.10% during 2024-2032. The India semiconductor market is anticipated to showcase a robust growth rate (CAGR) of 15.5% from 2025 to 2033.

This expansion is fueled by the surging demand for electronics, advancements in technology, and the government's push for self-reliance in semiconductor manufacturing. Key trends include the rise of electric vehicles and IoT devices, with leading companies concentrating on research and development to enhance production capabilities and sustainability initiatives.

Key Market Highlights:

✔️ Strong growth driven by escalating demand for advanced electronics and smart devices across various sectors.

✔️ Government initiatives and investments aimed at boosting domestic semiconductor manufacturing capabilities and reducing import dependency.

✔️ Focus on innovation and RD, with companies exploring cutting-edge technologies like AI, IoT, and 5G to enhance product offerings and market competitiveness.

Request for a sample copy of the report: https://www.imarcgroup.com/india-semiconductor-market/requestsample

India Semiconductor Market Trends and Driver:

The India semiconductor market is poised for significant transformation, driven by a combination of technological advancements and increasing demand across various sectors. As industries such as automotive, consumer electronics, and telecommunications continue to evolve, the need for semiconductors is expected to surge. By 2025, the market size is projected to reach substantial figures, reflecting the growing importance of these components in enabling innovations like electric vehicles and smart devices.

One of the key trends shaping the landscape is the push for self-reliance in semiconductor manufacturing. The Indian government has introduced various initiatives to bolster domestic production capabilities, aiming to reduce dependence on imports. This strategic focus is likely to enhance India's semiconductor market share on the global stage. Investments in infrastructure and incentives for local manufacturers are expected to attract both domestic and foreign players, fostering a competitive environment that encourages innovation.

Sustainability is another critical trend influencing the semiconductor sector. Companies are increasingly adopting eco-friendly practices, from sourcing materials to manufacturing processes. This shift aligns with global efforts to reduce carbon footprints and cater to environmentally conscious consumers. By 2025, the emphasis on sustainable practices is anticipated to become a significant differentiator for companies within the India semiconductor market, as stakeholders prioritize environmentally responsible solutions.

Furthermore, the rapid adoption of emerging technologies, such as artificial intelligence (AI) and the Internet of Things (IoT), will drive demand for advanced semiconductor solutions. These technologies require sophisticated chips that can handle complex computations and connectivity demands. As a result, the India semiconductor market will likely witness a surge in innovation, with companies investing heavily in research and development to stay ahead of the curve. The convergence of these trends will not only shape the future of the semiconductor industry in India but also position the country as a key player in the global semiconductor ecosystem.

India Semiconductor Market Segmentation: The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Breakup by Components:

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

Breakup by Material Used:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

Breakup by End User:

- Automotive

- Industrial

- Data Center

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

Breakup by Region:

- South India

- North India

- West and Central India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145