Managing payroll is one of the most critical tasks for any business, whether it's a small startup, a nonprofit organization, or a large corporation. Timely and accurate payroll processing ensures employees are paid fairly and on time, and it helps you stay compliant with tax regulations. In today’s fast-paced world, many businesses are turning to free payroll check-maker tools to simplify this process. These tools are a great option for small businesses and startups that need an efficient way to create professional paychecks without spending a lot of money on expensive software.

But not all free payroll check maker tools are created equal. To make sure you're choosing the right one for your business, it’s important to understand what features are essential. In this blog, we’ll dive into the key features you should look for in a free payroll check maker to ensure your payroll process is smooth, accurate, and reliable.

Why Use a Free Payroll Check Maker?

Before we get into the features, let’s briefly talk about why using a free payroll check maker is a great choice for your business. Many small businesses and entrepreneurs are on a budget and want to avoid the high costs associated with professional payroll software. A free payroll check maker tool helps solve this issue by providing basic features like paycheck creation, tax calculations, and deduction tracking at no cost.

In addition, these tools are easy to use, often require no prior payroll experience, and help you stay organized. You can produce professional-looking paychecks in a matter of minutes, which reduces the chances of errors and saves time that would otherwise be spent manually calculating wages and deductions.

Now that we know the benefits of using a free payroll check maker, let’s explore the essential features you should look for when choosing the best tool for your business.

1. Customization Options

When choosing a free payroll check maker, one of the first things to consider is the level of customization the tool offers. Every business has different needs, and being able to customize your paychecks can make a big difference in how professional and organized they look.

Here’s what to look for:

- Company Branding: Choose a tool that allows you to include your company’s logo, name, and contact information. This adds a personal touch to the paychecks and reinforces your brand identity.

- Paycheck Layout: The layout should be customizable to some extent so that you can organize the paycheck information in a way that works best for your business. You should be able to adjust where employee information, payment details, and deductions are displayed.

- Fonts and Colors: A good free payroll check maker should allow you to choose fonts and colors that match your business’s style guide. This makes your paychecks look more cohesive with your overall branding.

By customizing your paychecks, you ensure that they not only reflect the correct information but also align with your brand, making a positive impression on your employees.

2. Accurate Tax Calculation

Tax calculations can be tricky, especially when you're dealing with different states, local taxes, and various deductions. One of the most important features to look for in a free payroll check maker is automatic tax calculation.

Here’s why:

- Federal and State Taxes: A good tool should calculate federal income tax, state taxes, and any local taxes, based on the employee's pay rate and location. This feature reduces the risk of errors and ensures compliance with tax regulations.

- FICA Contributions: The tool should automatically calculate FICA (Federal Insurance Contributions Act) taxes, which include Social Security and Medicare contributions.

- Withholdings for Benefits: The tool should be able to handle deductions for benefits like healthcare, retirement contributions, and other employee benefits.

With automatic tax calculations, you won’t have to worry about manually calculating the taxes for each paycheck, reducing the chance of making costly mistakes that could lead to penalties.

3. Employee Information Management

A free payroll check maker should allow you to easily manage employee information. This includes everything from basic contact details to pay rates, tax information, and benefits. The more streamlined and organized this process is, the faster you can generate paychecks.

Look for a tool that includes the following features:

- Employee Profiles: You should be able to store each employee’s basic information, such as their name, address, social security number, and employment type (full-time, part-time, contractor).

- Pay Rates and Hours Worked: You should have the option to enter hourly pay rates, salaried amounts, or commission-based pay. For hourly workers, you need the ability to log their hours worked for each pay period.

- Benefits and Deductions: The tool should allow you to store deductions for benefits, retirement contributions, insurance premiums, and other withholdings that might apply to your employees.

Efficient employee information management means you can easily generate accurate paychecks without manually re-entering employee data every time you need to process payroll.

4. Deductions and Benefits Tracking

Every business has different deductions, and a free payroll check maker should help you track them. This includes tax withholdings as well as other deductions for benefits, retirement contributions, insurance premiums, and more.

Key deductions to look for in the tool include:

- Federal and State Tax Withholdings: As mentioned earlier, the tool should calculate the right tax amounts automatically based on your employee’s location and pay type.

- Retirement Contributions: If you offer a 401(k) or other retirement plan, the tool should be able to calculate and deduct the appropriate contribution.

- Health Insurance and Other Benefits: If employees have benefits like health insurance, the tool should allow you to set up automatic deductions for premiums.

Having a tool that tracks deductions and benefits ensures that you are taking out the right amounts and helps you stay compliant with regulations, while also giving your employees clarity on what’s being deducted from their pay.

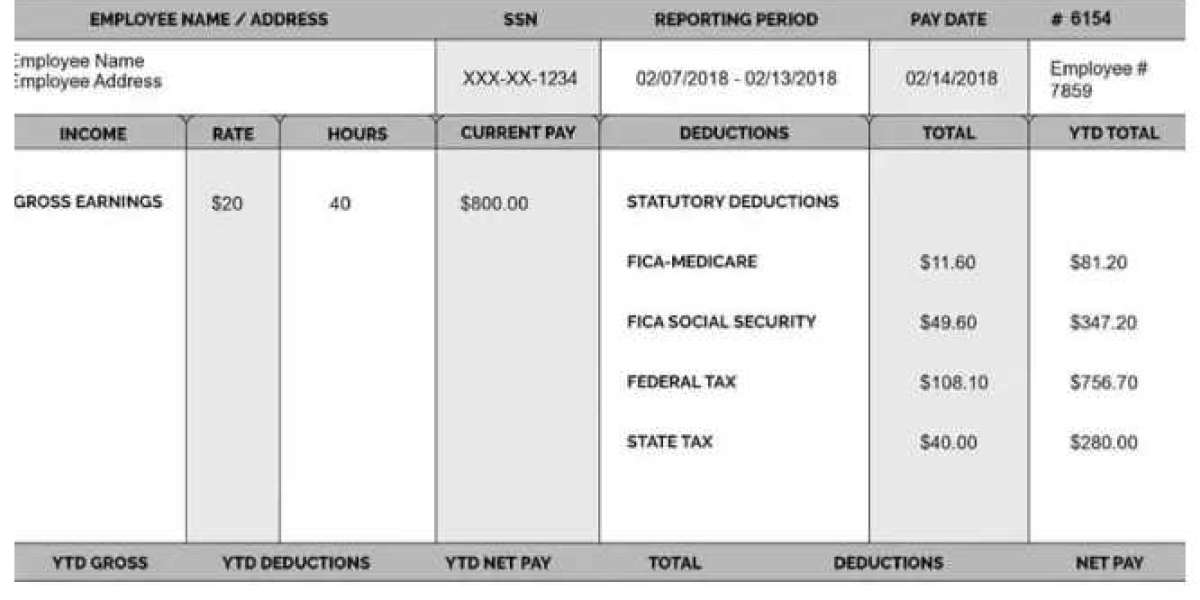

5. Paycheck Breakdown

A well-organized paycheck breakdown is essential for both employers and employees. A good free payroll check maker tool should allow you to display the breakdown of pay in a clear and easy-to-understand format.

Important information to include in the breakdown:

- Gross Pay: This is the total amount earned by the employee before any deductions are taken out.

- Deductions: List all deductions, such as taxes, insurance premiums, retirement contributions, and any other applicable withholdings.

- Net Pay: This is the amount the employee actually takes home after all deductions.

- Hours Worked (for Hourly Employees): For hourly employees, make sure the tool displays the total hours worked during the pay period.

A transparent paycheck breakdown not only ensures accuracy but also builds trust with your employees, as they can easily see how their pay is calculated.

6. Integration with Other Tools

As your business grows, you may want to integrate your free payroll check maker tool with other software programs you use. Look for a tool that offers integrations with accounting software (such as QuickBooks) or time tracking tools, as this will save you time and reduce the risk of errors.

Features to consider:

- Integration with Accounting Software: Ensure the paycheck creator tool can sync with your accounting software, so payroll data is automatically updated in your books.

- Sync with Time Tracking Tools: If you use a time tracking tool, look for a paycheck creator that integrates with it to pull in employees’ hours worked.

Having these integrations in place can make payroll management easier, especially if you’re using multiple tools to run your business.

7. Security Features

When handling payroll data, security is paramount. You want to ensure that sensitive employee information, such as Social Security numbers, banking details, and salary information, is protected.

Key security features to look for:

- Data Encryption: Make sure the tool encrypts your data to protect it from unauthorized access.

- User Access Control: If multiple people are involved in the payroll process, look for a tool that lets you control who can access the data and make changes.

- Backup Options: Ensure the tool offers cloud storage or backup features, so you won’t lose important payroll information if something happens to your system.

Data security features are crucial to protecting your business and your employees from potential data breaches.

Conclusion

Choosing the right free payroll check maker tool is a crucial decision for any business, especially if you’re looking to streamline payroll while keeping costs low. By looking for essential features like customization options, accurate tax calculations, employee information management, deductions and benefits tracking, and paycheck breakdowns, you can ensure that your payroll process is efficient, accurate, and secure.

With the right tool in place, you’ll save time, reduce errors, and ensure your employees receive their paychecks on time and with all the necessary details. As your business grows, these tools can also scale with you, offering more advanced features when needed. Whether you’re running a small business or nonprofit organization, investing in the right free payroll check maker can help you manage payroll with confidence and ease.