Market Overview 2025-2033

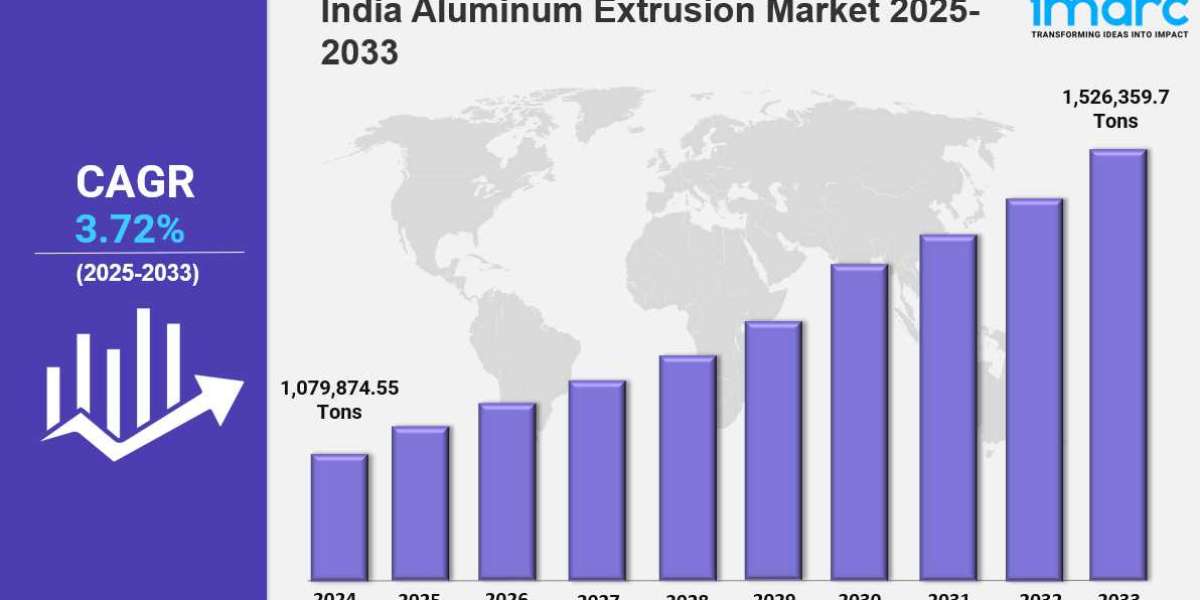

The India aluminum extrusion market size reached 1,079,874.55 Tons in 2024. Looking forward, IMARC Group expects the market to reach 1,526,359.7 Tons by 2033, exhibiting a growth rate (CAGR) of 3.72% during 2025-2033. The market is growing due to increasing demand in construction, automotive, and industrial sectors. Technological advancements, urbanization, and sustainability initiatives are driving expansion, making it a competitive and evolving industry.

Key Market Highlights:

✔️ Strong market growth driven by rising demand from construction, automotive, and industrial sectors

✔️ Increasing adoption of lightweight and energy-efficient aluminum solutions

✔️ Expanding government initiatives supporting domestic manufacturing and infrastructure development

Request for a sample copy of the report: https://www.imarcgroup.com/india-aluminum-extrusion-market/requestsample

India Aluminum Extrusion Market Trends and Driver:

The India aluminum extrusion market share is expanding rapidly, driven by urbanization and infrastructure development. As cities grow and new projects emerge, the demand for aluminum extrusions continues to rise. Known for its lightweight, strength, and corrosion resistance, aluminum is widely used in window frames, doors, and structural components.

Government initiatives like the Smart Cities Mission and Housing for All are accelerating this growth by promoting sustainable construction practices. With the construction industry expected to surge through 2024, the aluminum extrusion market is set to benefit significantly. The shift towards eco-friendly materials and energy-efficient designs further fuels demand, as aluminum plays a crucial role in reducing energy consumption in buildings.

The aluminum extrusion sector in India is being shaped by innovation. Automation and 3D printing are examples of advanced manufacturing technologies that are improving production accuracy and efficiency. These developments enable producers to design intricate profiles for a range of sectors, such as consumer goods, automotive, and aerospace. Improved alloys and surface treatments brought about by recent research and development expenditures have further increased the robustness and efficiency of aluminum extrusions. It is anticipated that these developments will simplify manufacturing and reduce expenses by 2024, increasing the accessibility of aluminum extrusions for a range of uses. Furthermore, the incorporation of Industry 4.0 technologies, such data analytics and the Internet of Things, would streamline processes and allow producers to react quickly to consumer needs.

Sustainability remains a key factor shaping the aluminum extrusion market in India. Stricter environmental regulations and increasing consumer demand for eco-friendly products are driving manufacturers toward greener practices. The government is implementing policies to reduce carbon emissions and encourage recycling, a major advantage for aluminum, which is highly recyclable. Using recycled aluminum significantly conserves energy compared to primary production, making it a preferred choice for manufacturers focused on sustainability. By 2024, circular economy principles will likely reshape the market, pushing companies to embrace recycled materials and minimize waste. Businesses that adopt sustainable strategies will gain a competitive edge, aligning with global environmental trends.

Market growth is also fueled by evolving consumer preferences and industrial needs. One major trend is the rising adoption of aluminum in the automotive sector. With manufacturers seeking lightweight materials to enhance fuel efficiency and meet emission regulations, aluminum extrusions are becoming essential. By 2024, the automotive industry is expected to drive a substantial portion of market demand. The expansion of the electric vehicle (EV) sector further boosts opportunities, particularly in battery enclosures and structural components.

Customization and design flexibility are also gaining traction, with manufacturers offering tailored solutions for architectural and interior design applications. Unique aluminum profiles are increasingly popular for their aesthetic appeal and functional benefits. As these trends continue to shape the industry, the Indian aluminum extrusion market is well-positioned for sustained growth in the coming years.

India Aluminum Extrusion Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Mill Finished

- Anodized

- Powder Coated

Breakup by Alloy Type:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

Breakup by End Use Industry:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800