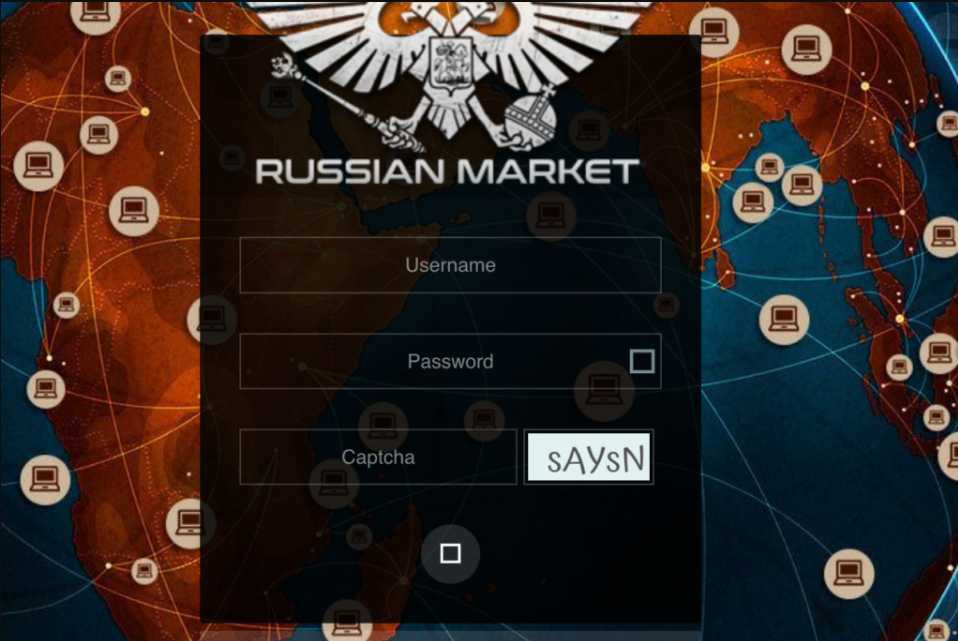

Introduction to Russianmarket

Navigating the world of credit scores can feel like wandering through a labyrinth. For vendors, understanding their creditworthiness is crucial for growth and success. Enter Russianmarket—a game-changer in making credit score solutions accessible and user-friendly for everyone involved. With tailored services that cater specifically to vendors, Russianmarket stands out as a beacon of hope in an often confusing landscape. Whether you're looking to enhance your business or simply gain insights into your financial health, this platform has got you covered. Let’s dive deeper into how Russianmarket is transforming the way vendors approach their credit scores.

The Importance of Russianmarket Credit Scores for Vendors

Credit scores are vital for vendors looking to establish trust and credibility in the marketplace. Russianmarket login provides a unique insight into financial health, enabling businesses to make informed decisions.

A solid credit score can open doors for better financing options. Vendors with high scores often attract more customers who feel secure in their transactions. This added layer of confidence fosters growth and encourages long-term partnerships.

Moreover, Russianmarket credit scores help vendors identify potential risks early on. Understanding these metrics allows them to navigate challenges proactively instead of reactively, ultimately leading to smarter business practices.

In an ever-competitive landscape, having access to accurate credit information is crucial. It empowers vendors not just to survive but thrive by making strategic choices based on solid data rather than assumptions or guesswork.

Challenges Faced by Vendors in Obtaining Russianmarket Credit Scores

Obtaining credit scores from Russianmarket To can be a daunting task for many vendors. One of the primary challenges is navigating the complex application process. Vendors often find themselves overwhelmed by paperwork and requirements that seem never-ending.

Additionally, there’s a lack of clarity regarding evaluation criteria. Many vendors struggle to understand what specific data points affect their scores, leaving them in the dark about how to improve their standing.

Time is another critical factor. The lengthy waiting periods for score assessments can hinder business operations and planning. Vendors may miss out on opportunities while they wait for approvals or feedback on their creditworthiness.

Not all vendors have access to resources that simplify this journey. Smaller businesses often feel disadvantaged due to limited support systems or guidance available within the market landscape.

How Russianmarket is Making a Difference

Russianmarket is revolutionizing the way vendors access credit scores. By simplifying the application process, they eliminate barriers that often hinder small businesses from acquiring financial insights.

Their platform offers seamless integration with existing systems, allowing vendors to obtain real-time credit assessments without extensive paperwork. This easy access empowers businesses to make informed decisions quickly.

Moreover, Russianmarket provides educational resources that help vendors understand their scores better. Knowledge is power; by demystifying credit scoring, they enable businesses to improve their financial health effectively.

In addition, Russianmarket actively collaborates with various stakeholders in the finance industry. These partnerships enhance data accuracy and ensure comprehensive coverage of vendor profiles across diverse sectors.

With a focus on accessibility and user experience, Russianmarket stands out as a beacon for vendors seeking reliable credit score solutions tailored to their needs.

Features and Benefits of Russianmarket Credit Score Solutions

Russianmarket offers a suite of innovative credit score solutions tailored for vendors. One standout feature is real-time access to credit scores, enabling vendors to make informed decisions instantly.

The platform employs advanced algorithms that analyze various data points, ensuring accuracy and reliability. This means no more guesswork when assessing potential clients or partners.

Another significant benefit is the user-friendly interface. Vendors can easily navigate through the system without any technical expertise. This accessibility empowers small businesses to leverage financial insights effectively.

Additionally, Russianmarket provides educational resources that help vendors understand credit scoring better. With these tools at their disposal, they can enhance their financial literacy and improve decision-making processes.

Moreover, integration with existing business systems streamlines operations further. By automating routine tasks related to credit evaluations, vendors save time while reducing manual errors in their processes.

Russianmarket Success Stories: Real Vendors, Real Results

Russianmarket has transformed the way vendors approach their credit scores. Many small business owners have shared inspiring success stories that highlight this change.

One vendor, Anna, struggled to secure financing for her bakery due to a low credit score. After utilizing Russianmarket’s tailored solutions, she improved her score significantly within months. This allowed her to expand her offerings and hire additional staff.

Similarly, Ivan, who owns an electronics shop, faced roadblocks when trying to partner with suppliers. With Russianmarket's expertise in analyzing his financial history and providing actionable insights, he was able to boost his credibility in no time.

These real-world examples demonstrate how Russianmarket doesn't just provide numbers; they offer pathways for growth. Vendors are not only gaining access but also experiencing tangible benefits that foster long-term success and sustainability in their businesses.

Conclusion: Why Russianmarket is the Best Choice for Credit Score Solutions

Choosing the right credit score solution can significantly impact a vendor's ability to thrive in today's competitive marketplace. Russianmarket stands out as a reliable partner, providing tailored services that cater specifically to the unique needs of vendors. With its user-friendly interface and robust data analytics, Russianmarket simplifies access to crucial credit information.

Vendors no longer need to navigate complex processes or face long wait times for credit assessments. Instead, they benefit from streamlined solutions designed with efficiency in mind. The commitment of Russianmarket to transparency ensures that vendors are equipped with the knowledge necessary for informed decision-making.

Success stories abound, demonstrating how Russianmarket has empowered businesses by enhancing their credit profiles and boosting financial confidence. Whether you're a small business owner or part of a larger enterprise, opting for Russianmarket means choosing accessibility, reliability, and support every step of the way.

For those seeking an edge in managing their finances and building strong relationships with partners while overcoming challenges associated with obtaining credit scores—Russianmarket is undoubtedly the optimal choice.