Creating accurate paystubs is essential for both employers and employees. Whether you’re a small business owner, a freelancer, or self-employed, having detailed and correct pay stubs helps with tax filing, record-keeping, and financial planning. Using a paystub generator free tool makes this process easy and convenient, but you need to follow best practices to ensure accuracy.

In this guide, we’ll cover:

✅ Why paystubs matter

✅ Common mistakes to avoid

✅ Best practices for creating accurate paystubs

✅ Top free paystub generators

Let’s dive in! ?

Why Paystubs Matter

A paystub is a document that records an employee’s earnings, deductions, and net pay. While traditional employees receive paystubs from their employers, freelancers, contractors, and self-employed workers often need to create their own.

Paystubs Are Important For:

✔ Proof of Income – Required for loans, rentals, and financial applications.

✔ Tax Filing – Helps ensure accurate reporting of income and tax deductions.

✔ Payroll Management – Keeps track of wages and withholdings for businesses.

✔ Compliance – Helps businesses meet labor laws and tax regulations.

Using a paystub generator free tool allows you to create paystubs quickly and affordably, but you need to ensure they are accurate and professional.

Common Mistakes to Avoid When Generating Paystubs

Before we discuss best practices, here are some common mistakes people make when using a free paystub generator:

❌ Incorrect Earnings Calculations – Entering wrong hourly wages or salaries can lead to inaccurate paystubs.

❌ Omitting Taxes and Deductions – Forgetting to include federal, state, and local taxes can cause tax compliance issues.

❌ Spelling Errors – Incorrect names, company details, or dates can make a paystub invalid.

❌ Using Unreliable Generators – Not all free paystub generators are accurate or professional.

❌ Forgetting to Save a Copy – Always keep a copy of your paystubs for tax and financial records.

Now that we’ve covered what not to do, let’s look at the best practices for creating accurate paystubs.

Best Practices for Creating Accurate Paystubs with a Free Generator

1. Choose a Reliable Free Paystub Generator

The first step to accurate paystubs is using a trustworthy and high-quality generator.

✅ Look for these features:

✔ Automatic tax calculations

✔ Customizable templates

✔ Multiple pay period options (weekly, biweekly, monthly)

✔ Ability to download and print paystubs

? Recommended Free Paystub Generators:

? Shopify Paystub Generator – Simple and professional.

? 123PayStubs – Includes tax calculations and multiple formats.

? Zintego Paystub Generator – Customizable and easy to use.

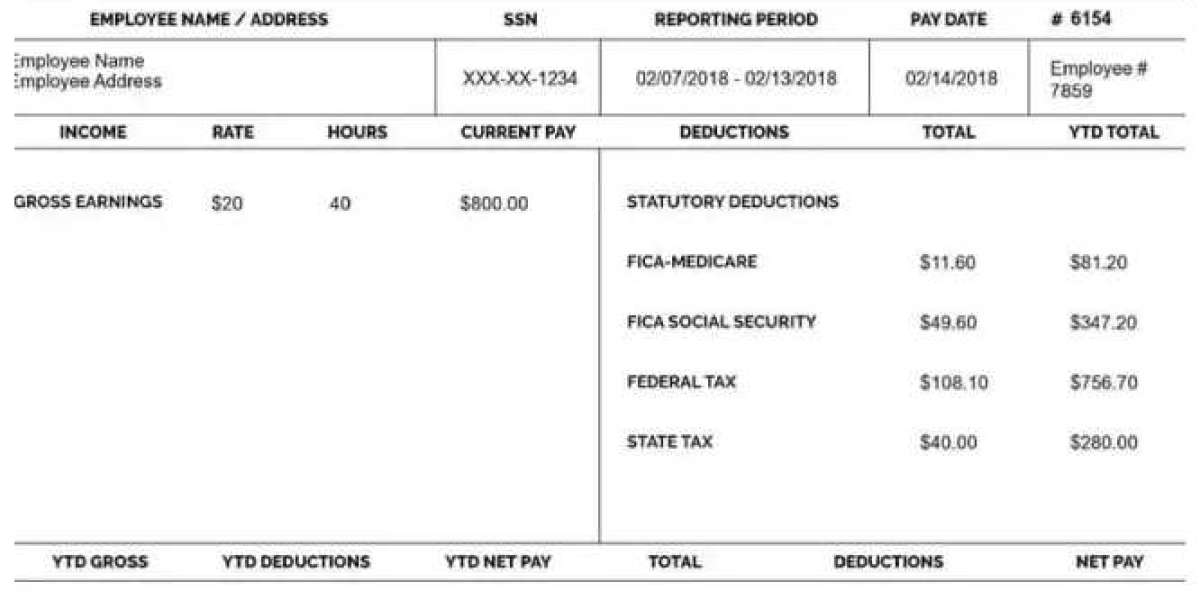

2. Double-Check All Personal and Company Information

Ensure all details on the paystub are correct, including:

✔ Employee Name Address – Full legal name and accurate contact details.

✔ Company Name Address – Ensure it matches business registration records.

✔ Pay Period Dates – Clearly state the start and end date of the pay period.

✔ Pay Date – The exact date when the payment was issued.

? Tip: Even a small spelling mistake can make a paystub invalid. Always review your information before finalizing.

3. Accurately Calculate Earnings

Your paystub must reflect the correct earnings, whether you are an hourly employee, salaried worker, or freelancer.

? For Hourly Employees Freelancers:

Gross Pay = Hours Worked × Hourly Rate

Example: If you worked 40 hours at $20/hour, your gross pay would be $800.

? For Salaried Employees:

Gross Pay = Annual Salary ÷ Number of Pay Periods

Example: If your salary is $60,000 and you’re paid biweekly (26 pay periods), your gross pay per period is:

$60,000 ÷ 26 = $2,307.69

? For Freelancers Self-Employed Workers:

List all income sources to create accurate paystubs for tax filing.

4. Include All Deductions and Taxes

An accurate paystub should include:

✔ Federal State Income Taxes – Based on tax brackets.

✔ Social Security Medicare (FICA Taxes) – 6.2% and 1.45% respectively.

✔ Health Insurance Retirement Contributions – If applicable.

✔ Other Deductions – Union fees, garnishments, or voluntary deductions.

? Example:

If you earn $2,000 and have the following deductions:

- Federal Tax: $200

- State Tax: $100

- FICA Taxes: $153

- Health Insurance: $50

Net Pay = Gross Pay – Total Deductions

$2,000 – ($200 + $100 + $153 + $50) = $1,497

Using a paystub generator free tool with auto-tax calculations helps prevent errors.

5. Format the Paystub Correctly

A professional paystub should have a clean and readable format.

✔ Use a clear, professional layout.

✔ Organize information into sections: earnings, taxes, deductions, and net pay.

✔ Avoid unnecessary details that clutter the paystub.

6. Always Save and Print Your Paystubs

Once you generate a paystub:

? Download and save it as a PDF for records.

? Print a physical copy if needed.

? Store all paystubs securely for at least three years (for tax compliance).

? Pro Tip: Keep a digital backup on a secure cloud storage service to prevent loss.

Top Free Paystub Generators You Can Use Today

Here are some reliable free paystub generators that help you create accurate and professional paystubs:

| Paystub Generator | Best For | Key Features |

|---|---|---|

| Shopify Paystub Generator | Freelancers Self-Employed | Free, simple, professional templates |

| 123PayStubs | Small Business Owners | Auto tax calculations, multiple pay periods |

| Zintego Paystub Generator | Contractors Remote Workers | Customizable design, detailed breakdown |

| PayStubCreator | Business Payroll Management | IRS-compliant, printable paystubs |

These tools provide easy, free solutions for payroll management and income tracking.

Final Thoughts: Why Accuracy Matters in Paystubs

Using a paystub generator free tool helps you save time and money, but accuracy is key. By following best practices, you can create error-free, professional paystubs that serve as valid income proof and tax records.

✅ Checklist for Accurate Paystubs:

✔ Choose a reliable paystub generator

✔ Double-check all personal and company details

✔ Calculate earnings correctly

✔ Include all deductions and taxes

✔ Format paystubs professionally

✔ Save and print copies for records