The rare earth metals market is rapidly growing, driven by its essential role in various cutting-edge technologies. Comprising 17 elements, rare earth metals such as neodymium, dysprosium, and praseodymium are critical in industries ranging from electronics and renewable energy to defense and aerospace. As demand for high-tech devices and sustainable solutions accelerates, the rare earth metals market is experiencing significant growth. This article delves into the growth dynamics of the rare earth metals market and the factors that are shaping its trajectory.

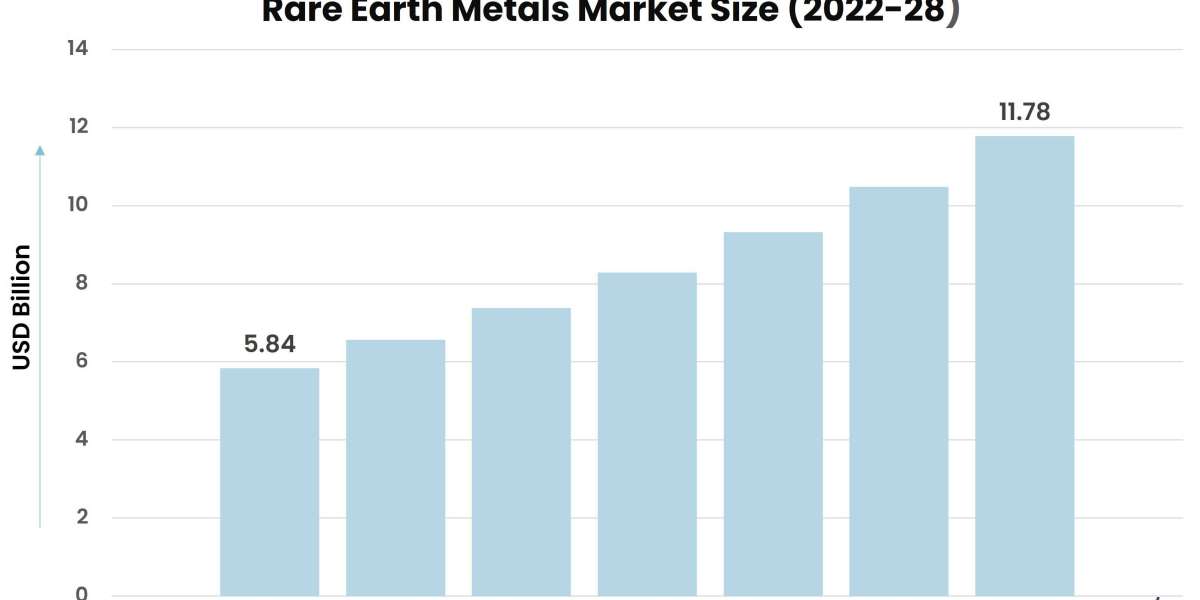

According to Stratview Research, the rare earth metals market was estimated at USD 5.84 billion in 2022 and is likely to grow at a CAGR of 12.42% during 2023-2028 to reach USD 11.78 billion in 2028.

Demand from Green Energy and Electric Vehicles

A major growth driver in the rare earth metals market is the global shift towards renewable energy and electric vehicles (EVs). Rare earth metals, particularly neodymium and dysprosium, are key components in the production of permanent magnets used in wind turbines and EV motors. As governments and corporations strive to reduce carbon emissions and achieve climate goals, the adoption of green technologies is increasing rapidly. For example, wind power generation and EV sales are expected to rise significantly over the coming decade, leading to a surge in demand for rare earth metals.

The demand for these metals is further amplified by the continued development of electric vehicle infrastructure and battery technologies. As the world moves towards electrification, rare earth metals will remain integral to advancing these green technologies.

Expansion of Consumer Electronics

Another vital factor contributing to the growth of the rare earth metals market is the booming consumer electronics industry. From smartphones and laptops to televisions and gaming consoles, rare earth metals are used in various components, including screens, speakers, and batteries. With the expansion of 5G networks, the Internet of Things (IoT), and the growing demand for smart home devices, the need for rare earth metals in electronics is surging. This trend is expected to continue as consumers increasingly rely on digital devices in everyday life.

Geopolitical Considerations and Supply Chain Shifts

Geopolitical factors are also shaping the growth dynamics of the rare earth metals market. China currently dominates global rare earth production, controlling about 60-70% of the world’s supply. However, concerns over supply chain vulnerabilities and geopolitical tensions have prompted efforts to diversify supply sources. Countries like the United States, Australia, and Canada are investing in new rare earth mining projects to reduce dependency on Chinese exports. This supply chain diversification is expected to influence the market’s growth trajectory, offering new opportunities for producers outside China.

Recycling and Sustainability Efforts

Sustainability is increasingly becoming a focal point in the rare earth metals market. Recycling rare earth metals from e-waste and discarded electronics presents a significant opportunity to address supply challenges and reduce environmental impacts. As technology improves, extracting and reusing rare earth elements from electronic waste is becoming more feasible, contributing to market growth. Companies that focus on developing efficient recycling methods are poised to benefit from this emerging trend.

Conclusion

The rare earth metals market is experiencing robust growth, driven by the expanding use of green technologies, the rapid rise of consumer electronics, and evolving geopolitical dynamics. As the world transitions to a more sustainable and technologically advanced future, the demand for rare earth metals is only expected to grow. With new supply sources and recycling initiatives on the horizon, the rare earth metals market will continue to be a critical player in the global economy for years to come.