Global Robo Advisor Market Analysis Expected to Reach USD 93.96 Billion by 2030, Driven by AI Integration and Digital Investment Trends

- Market Estimation Definition

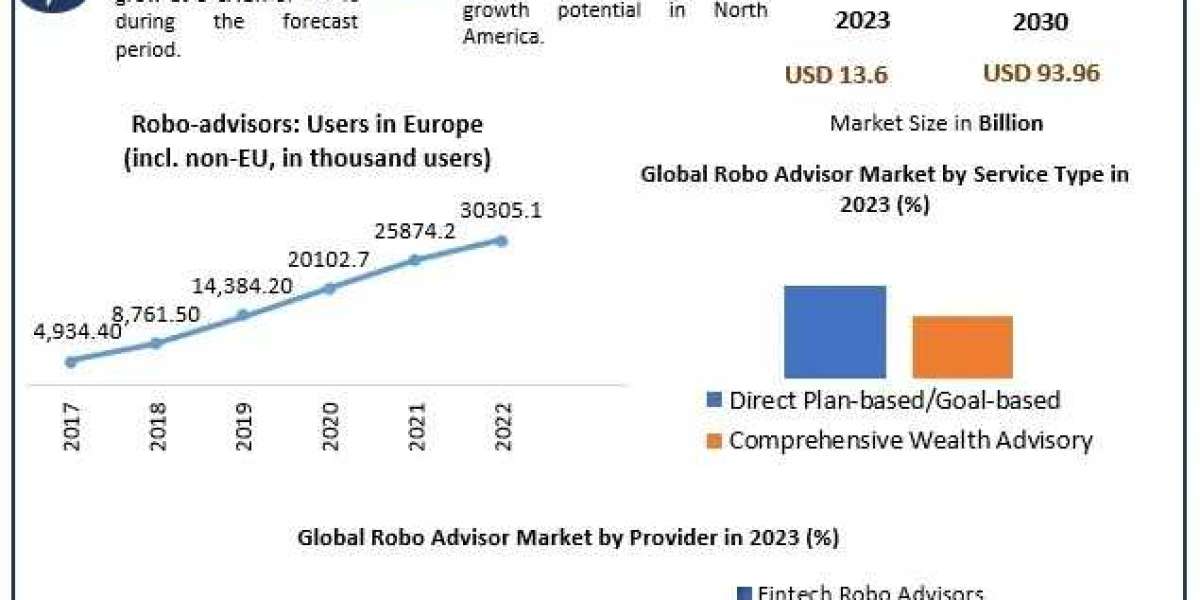

According to a recent report published by Maximize Market Research, the Global Robo Advisor Market size was valued at USD 13.6 billion in 2023 and is expected to grow at a remarkable CAGR of 31.8% from 2024 to 2030. This rapid growth is forecasted to take the market to nearly USD 93.96 billion by the end of 2030.

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning and investment management services with minimal human supervision. They leverage technology to analyze user data, provide customized investment advice, and automatically manage portfolios based on specific financial goals. By combining artificial intelligence (AI), machine learning (ML), and data analytics, these platforms offer efficient, cost-effective investment solutions for individual investors and financial institutions alike.

Claim your sample copy of this report instantly: https://www.maximizemarketresearch.com/request-sample/77484/

- Market Growth Drivers Opportunity

Key Drivers Fueling Market Growth:

- Increased Adoption of Digital Financial Platforms: As more individuals prefer managing their finances online, robo-advisors are gaining traction for their convenience, accessibility, and low-cost investment strategies.

- Integration of Artificial Intelligence and Machine Learning: AI-powered robo-advisors are improving portfolio management, risk assessment, and customer engagement, making automated investing more reliable and accurate.

- Growing Demand for Cost-Effective Investment Solutions: Robo-advisors offer lower fees compared to traditional financial advisors, making wealth management accessible to a broader audience.

- Millennial and Gen Z Preference for Digital Platforms: The younger generation's tech-savviness and inclination toward DIY financial planning have accelerated the adoption of robo-advisory services.

Market Opportunities:

- Expansion in Emerging Markets: There is significant potential in Asia-Pacific, Latin America, and the Middle East regions due to growing internet penetration, digital literacy, and rising disposable incomes.

- Technological Advancements: Incorporating blockchain, advanced analytics, and personalized financial planning tools will further enhance customer trust and expand market reach.

- Hybrid Models: The combination of robo-advisory services with human financial consultants is emerging as a key trend to attract high-net-worth individuals seeking personalized advice with the convenience of automation.

Download your complimentary sample copy of this report: https://www.maximizemarketresearch.com/request-sample/77484/

- Segmentation Analysis

The Robo Advisor Market is segmented based on Business Models, Services, End-Users, and Regions.

By Business Model:

- Pure Robo Advisors

- Hybrid Robo Advisors (Automation + Human Advisor)

Hybrid robo-advisors currently dominate the market due to their personalized approach, combining AI algorithms with expert human consultation.

By Service:

- Tax-loss Harvesting

- Retirement Planning

- Investment Advisory

- Portfolio Rebalancing

- Others

Investment advisory and portfolio rebalancing services are the most utilized, ensuring optimized asset allocation and automated adjustments based on market dynamics.

By End-User:

- Retail Investors

- High Net-Worth Individuals (HNIs)

- SMEs and Enterprises

- Banks and Financial Institutions

Retail investors remain the largest segment due to their growing interest in digital investment solutions, while SMEs and financial institutions are also increasing their adoption for internal wealth management.

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East Africa

North America leads the market due to its advanced financial infrastructure and early adoption of digital platforms. However, Asia-Pacific is anticipated to exhibit the highest CAGR during the forecast period, driven by financial technology developments in China, India, Japan, and Singapore.

- Country-Level Analysis (USA Germany)

USA Robo Advisor Market:

The United States holds the largest share in the global market, accounting for significant revenue due to the presence of key players like Betterment, Wealthfront, and Vanguard. The country's high digital literacy, established regulatory frameworks, and early adoption of fintech platforms have fueled market growth.

Moreover, U.S. investors appreciate robo-advisors for their transparency, low fees, and accessibility. The continuous integration of AI and ML into financial platforms further solidifies the U.S.'s position as a global leader in this space.

Germany Robo Advisor Market:

Germany is one of the fastest-growing markets in Europe, characterized by increasing demand for personalized financial services and rising awareness of automated investment platforms. German investors are gradually shifting from traditional wealth management methods to digital alternatives.

Local players like Scalable Capital and Quirion have strengthened Germany's robo-advisor ecosystem by offering user-friendly, AI-driven investment solutions tailored to local regulations and investor preferences.

Request your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/77484/

- Competitor Analysis

Key companies operating in the global Robo Advisor Market include:

Company | Notable Strategies |

Betterment | AI integration, goal-based investing, hybrid models |

Wealthfront | Tax optimization tools, financial planning apps |

Vanguard Personal Advisor Services | Low fees, diversified portfolios, strong brand trust |

Charles Schwab Intelligent Portfolios | Zero advisory fees, automated rebalancing |

Scalable Capital (Germany) | AI-powered risk management, European market focus |

Quirion (Germany) | Customizable portfolios, digital-first approach |

SigFig | Portfolio tracking, personalized investment advice |

Nutmeg (UK) | Transparent fee structures, socially responsible investing options |

Ellevest (USA) | Focus on women investors, financial education tools |

Wealthsimple (Canada) | Automated investing, socially responsible investing options |

These players are focusing on strategic collaborations, technological advancements, product diversification, and regional expansions to gain a competitive edge.

Want market insights? Read the summary of the research report for essential data:

https://www.maximizemarketresearch.com/market-report/global-robo-advisor-market/77484/

|

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656