Carbon Credit Market Overview :

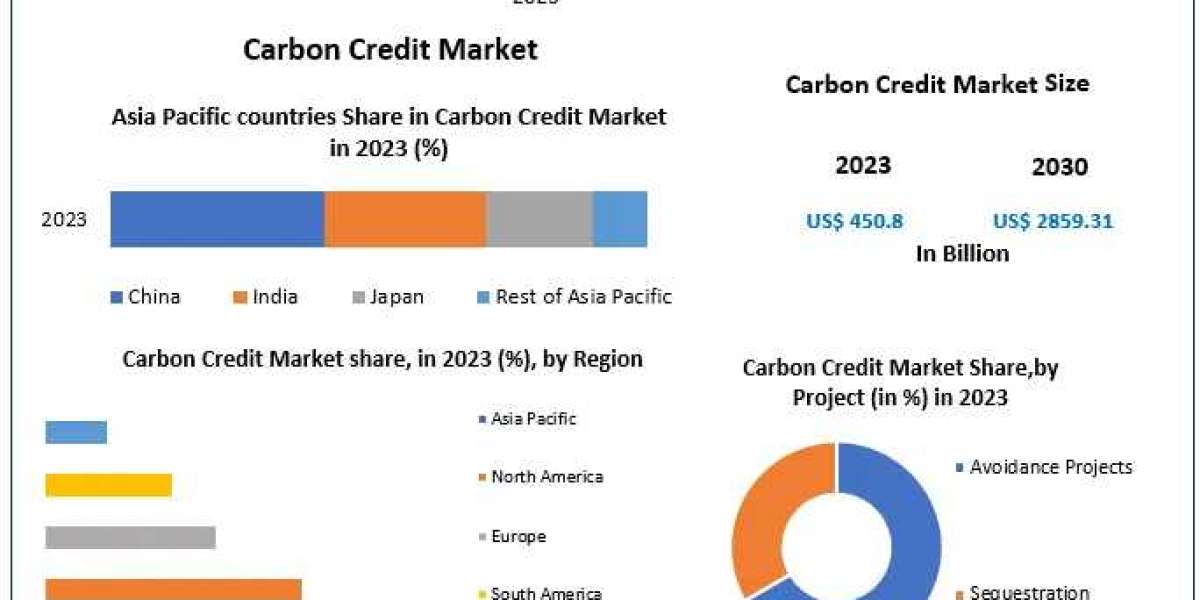

The total global market for the Carbon Credit Market was valued at USD in 2023 and is expected to grow at a CAGR of percent over the forecast period to reach USD by 2030. The report analyzed by Maximize Market Research, on the Carbon Credit market, covers an extensive regional analysis and competitive landscape.

Carbon Credit Market Report Scope and Research Methodology :

The portfolio, technology adoption, financial standing, merger and acquisition, joint ventures and strategic alliances are involved in the competitive environment for the Carbon Credit market. The report is an in-depth analysis of the Carbon Credit market provided with key findings including Pricing, investments, expansion plans, and physical presence in the Carbon Credit market. The bottom-up approach was used to understand the Carbon Credit market size estimation and growth rates in the report. The report provides information on the drivers, restraints, opportunities and challenges of the Carbon Credit market.

The research methodology involves gathering data from interviews, surveys, and secondary sources that can be trusted. The report looks into market tendencies, motivators, difficulties as well as chances while offering views on the competitive landscape. It covers various aspects of market dynamics such as drivers, restraints, challenges, opportunities, etc.

Discover detailed insights by accessing the sample through the provided link @https://www.maximizemarketresearch.com/request-sample/198127/

Carbon Credit Market Regional Insights :

Regional analysis is conducted to assess the status of the Carbon Credit market in countries belonging to North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. The report provides a comprehensive analysis of several factors such as market size, growth rate, and import-export activities, across different regions. The Carbon Credit market is segmented broadly into these regions, allowing for a detailed understanding of the market landscape and dynamics in each geographical area.

Carbon Credit Market Segmentation :

by Project

Avoidance Projects

Sequestration Projects

by Type

Compliance Market

VoluntaryMarket

by Application

Energy and Power

Aviation

Transportation

Industrial

Others

According to application, the carbon credit market's highest share is anticipated to belong to the energy electricity segment in 2023. The Paris Agreement's emphasis on lowering greenhouse gas emissions has spurred a rise in renewable energy projects worldwide. The industrial sector is shifting from high-emission fossil fuel-based technologies to low-emission technologies that integrate sustainable energy into their operational procedures as a result of the global shift towards sustainable energy sources like solar, wind, and hydropower. The primary source of greenhouse gas emissions is the production of energy and power. These elements are anticipated to fuel the growth of the carbon credit market's energy and power segment.

Click here to request access to a sample for detailed information : @https://www.maximizemarketresearch.com/request-sample/198127/

Carbon Credit Market Key Players :

1. BP Target Neutral

2. JPMorgan Chase Co.

3. Gold Standard

4. Carbon Clear

5. South Pole Group

6. 3Degrees

7. Shell

8. EcoAct

9. CBL Markets

10. Carbon Credit Capital

11. ClimateCare

12. VCS (Verified Carbon Standard)

13. Sindicatum Sustainable Resources

14. Mercury Capital Advisors

15. Nori

16. Carbon Trust

17. Veridium Labs

18. Natural Capital Partners

19. EDF Trading

Discover more by downloading the sample document through this link : @https://www.maximizemarketresearch.com/market-report/carbon-credit-market/198127/

Key questions answered in the Carbon Credit Market are:

- What is Carbon Credit ?

- What was the Carbon Credit Market size in 2023?

- What are the upcoming opportunities and trends for the Carbon Credit Market ?

- What are the different segments of the Carbon Credit Market ?

- Which are the factors expected to drive the Carbon Credit Market growth?

- What growth strategies are the players considering to increase their presence in Carbon Credit ?

- Who are the leading companies and what are their portfolios in Carbon Credit Market ?

- Who are the key players in the Carbon Credit Market?

- What is the CAGR at which the Carbon Credit Market will grow during the forecast period?

Browse our trending reports to explore related insights and analyses :

♦ IP Phone Market https://www.maximizemarketresearch.com/market-report/global-ip-phone-market/55506/

♦ Bentonite Market https://www.maximizemarketresearch.com/market-report/global-bentonite-market/25076/

Key Offerings :

- Past Size and Competitive Landscape

• Past Pricing and price curve by region

• Size, Share, Size Forecast by different segment

• Dynamics Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Segmentation A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape Profiles of selected key players by region from a strategic perspective

Contact Maximize Market Research: sales@maximizemarketresearch.com