3D Secure Payment Authentication Market: Overview Key Market Segments

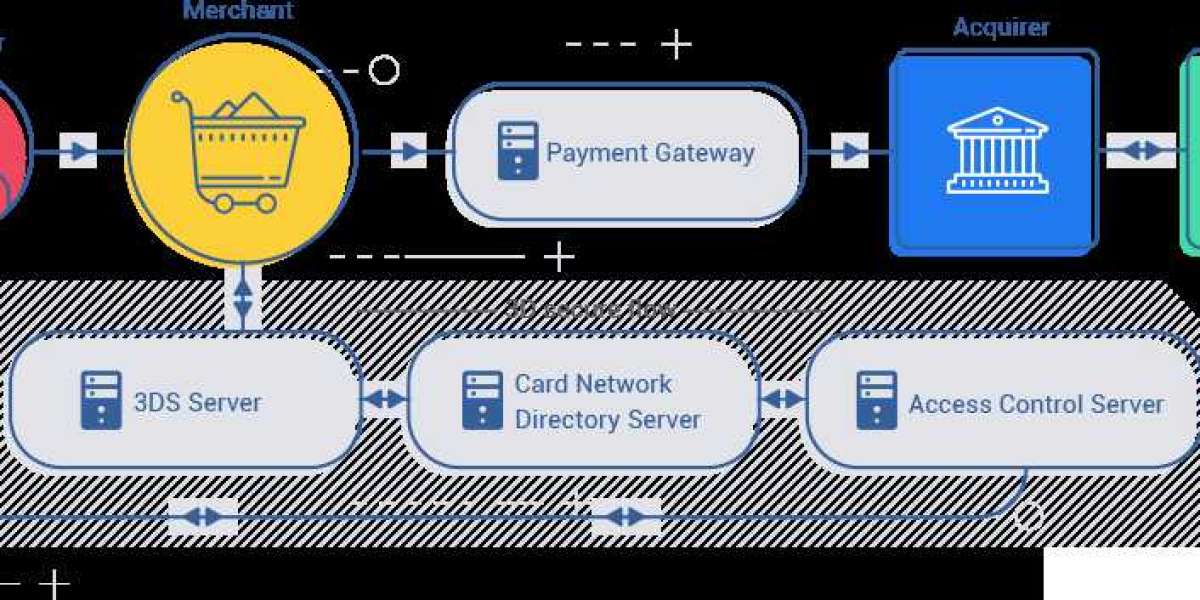

The 3D Secure Payment Authentication Market has witnessed significant growth in recent years due to the rising demand for secure online transactions. 3D Secure (3DS) is an online payment security protocol designed to provide an additional layer of protection for consumers and merchants during online credit and debit card transactions. The technology is essential in mitigating fraud, enhancing consumer confidence, and ensuring compliance with payment regulations such as PSD2 (Revised Payment Services Directive) in Europe. The protocol is primarily used in e-commerce transactions and is offered by major credit card schemes such as Visa (Verified by Visa), Mastercard (Mastercard SecureCode), and American Express (SafeKey).

With the rapid expansion of e-commerce, digital banking, and mobile payments, the need for enhanced security measures like 3D Secure has surged. The market is expected to grow significantly as more businesses and consumers shift to online and mobile payments, driven by global digitization trends. According to MRFR 3D Secure Payment Authentication Market Industry is expected to grow from 6.58 (USD Billion) in 2023 to 21.4 (USD Billion) by 2032.

This growth is being fueled by increasing cybersecurity threats, regulatory mandates, and the rising incidence of online fraud. As consumers demand more secure payment options, businesses are turning to 3D Secure technologies to protect both themselves and their customers. This article provides an in-depth analysis of the market, including key segments, industry news, leading companies, market drivers, and regional insights.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/24568

Key Market Segments

The 3D Secure Payment Authentication market can be segmented by component, application, deployment mode, and region.

1. By Component

Software Solutions: This segment includes the software platforms and solutions that enable 3D Secure authentication for payment service providers and merchants. These solutions integrate with existing payment gateways to verify cardholder identity during online transactions. The increasing use of cloud-based authentication platforms is driving the growth of this segment.

Services: The services segment includes professional services such as integration, maintenance, and support for 3D Secure solutions. As businesses seek to integrate secure payment options seamlessly, the demand for these services is rising.

2. By Application

E-commerce: E-commerce is the primary application of 3D Secure technology. Online retailers and payment gateways are using 3DS to verify customer identities and reduce the risk of fraudulent transactions. The growth of global e-commerce is a key driver for the adoption of 3D Secure in this segment.

Banking: Banks and financial institutions use 3D Secure to enhance the security of their online banking and card-not-present (CNP) transactions. With the growing shift to digital banking and online financial services, the demand for 3D Secure solutions in this sector is increasing.

Mobile Payments: Mobile payments are rapidly expanding, and 3D Secure is being adopted to ensure the security of in-app and mobile web transactions. As mobile commerce becomes more popular, this segment is expected to grow significantly.

Travel and Hospitality: The travel industry is increasingly adopting 3D Secure to prevent fraud in online bookings, especially for airline and hotel reservations. With the growing trend of digital bookings, this sector is seeing increased demand for secure payment authentication solutions.

3. By Deployment Mode

Cloud-Based: Cloud-based 3D Secure solutions are gaining popularity due to their scalability, cost-effectiveness, and ease of implementation. These solutions allow businesses to integrate secure payment authentication without the need for extensive on-premises infrastructure.

On-Premises: On-premises deployment remains relevant for organizations that prioritize data security and control. This deployment model is more common among large enterprises and financial institutions with stringent security and regulatory requirements.

Industry Latest News

1. 3D Secure 2.0 Adoption Accelerates

3D Secure 2.0 (3DS2) is the latest version of the protocol, designed to address the shortcomings of the original 3D Secure. Unlike the first version, which often resulted in poor user experiences due to additional verification steps, 3DS2 introduces a frictionless flow, allowing low-risk transactions to be completed without interrupting the customer journey. The adoption of 3DS2 has accelerated in recent years, driven by the growth of mobile commerce and the demand for seamless, secure payment experiences.

The European Union’s PSD2 regulation, which mandates the use of Strong Customer Authentication (SCA) for certain transactions, has further propelled the adoption of 3DS2 across Europe. This regulation requires multi-factor authentication for online payments, and 3DS2 is one of the most common methods used to comply with these requirements.

2. Major Card Networks Push for Global 3D Secure Standardization

Visa, Mastercard, and other major payment networks are pushing for the global standardization of 3D Secure protocols to ensure seamless cross-border transactions. This initiative aims to harmonize security practices across regions, reducing the risk of fraud in international e-commerce transactions and enabling smoother global payments. Standardization efforts are also focused on making 3DS more user-friendly by integrating biometrics and mobile authentication methods.

3. Emergence of AI and Machine Learning in Fraud Detection

Artificial intelligence (AI) and machine learning (ML) technologies are being integrated with 3D Secure authentication systems to enhance fraud detection and reduce false positives. These advanced technologies can analyze transaction patterns and detect anomalies in real-time, improving the accuracy and efficiency of fraud prevention measures. As a result, AI-powered 3D Secure solutions are becoming more popular in sectors like e-commerce and banking.

4. Growth of Tokenization and Biometrics in Payment Authentication

Tokenization and biometric authentication methods such as fingerprint and facial recognition are gaining traction in the 3D Secure space. These technologies enhance the security of online transactions while improving the user experience. As consumers become more accustomed to biometric authentication on smartphones and other devices, businesses are integrating these methods into their 3D Secure processes to simplify payment authentication and reduce abandonment rates.

Key Companies in the 3D Secure Payment Authentication Market

Several key players are leading the development and implementation of 3D Secure payment authentication technologies:

1. Visa Inc.

Visa offers its Verified by Visa service, a widely adopted 3D Secure solution that provides an additional layer of security for online card transactions. Visa has been instrumental in promoting the adoption of 3DS2 globally, especially in Europe, where it has played a significant role in helping businesses comply with PSD2 regulations.

2. Mastercard Inc.

Mastercard’s SecureCode is its version of 3D Secure, offering protection for both merchants and cardholders during online transactions. Mastercard has been proactive in pushing for the global adoption of 3DS2, working with banks, merchants, and payment gateways to improve security and reduce fraud.

3. American Express

American Express offers SafeKey, a 3D Secure solution that protects AmEx cardholders during online shopping. SafeKey uses dynamic authentication methods, including one-time passwords (OTPs) and biometrics, to verify cardholder identity during transactions.

4. Thales Group

Thales is a global leader in digital security, offering 3D Secure authentication solutions for banks, payment service providers, and merchants. Thales’ solutions integrate advanced fraud detection technologies, including AI and ML, to enhance transaction security while minimizing user friction.

5. Broadcom Inc. (CA Technologies)

Broadcom provides a range of security solutions, including 3D Secure payment authentication systems, for enterprises and financial institutions. The company focuses on delivering scalable and customizable authentication platforms that integrate with existing IT infrastructure.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/3d-secure-payment-authentication-market-24568

Market Drivers

Several factors are contributing to the growth of the 3D Secure Payment Authentication market:

1. Rising Online Fraud

As e-commerce and digital payments continue to grow, so does the risk of online fraud. The increasing sophistication of cybercriminals has led businesses to seek more robust security solutions like 3D Secure to protect online transactions. The adoption of 3DS helps reduce chargebacks and improve customer trust.

2. Regulatory Compliance

Regulations such as PSD2 in Europe and SCA mandates are driving the adoption of 3D Secure technologies. Businesses are required to implement multi-factor authentication for online transactions to comply with these regulations, making 3DS a critical tool for ensuring compliance and security.

3. Growth of E-commerce and Mobile Payments

The rapid expansion of e-commerce and mobile commerce is a major driver of the 3D Secure Payment Authentication market. As more consumers shop online and use mobile payment methods, businesses are adopting 3DS to protect against fraud and enhance the security of digital transactions.

Explore MRFR’s Related Ongoing Coverage In ICT Domain:

Next Generation Search Engine Market -

https://www.marketresearchfuture.com/reports/next-generation-search-engine-market-26666

Ott Business Messaging Market -

https://www.marketresearchfuture.com/reports/ott-business-messaging-market-26736

Pos Machine Market -

https://www.marketresearchfuture.com/reports/pos-machine-market-26775

Sales Platforms Software Market -

https://www.marketresearchfuture.com/reports/sales-platforms-software-market-26746

R And D Analytic Market -

https://www.marketresearchfuture.com/reports/r-d-analytic-market-26780