HR Payroll Software Market: A Comprehensive Overview

The HR payroll software market has seen significant growth over the past few years, driven by the increasing need for organizations to streamline and automate their payroll processes. HR payroll software is a critical component of any business as it helps in managing employee compensation, benefits, taxes, and compliance with government regulations. The demand for such solutions is increasing due to the complexities associated with payroll processing, tax calculation, and reporting, especially in companies with a large workforce.

HR payroll software market industry is projected to grow from USD 8.1 billion in 2024 to USD 18.9 billion by 2032. Factors such as the rise in cloud-based payroll solutions, the adoption of advanced technologies like Artificial Intelligence (AI) and machine learning, and the growing need for cost-effective HR management tools are boosting the market growth. Moreover, increasing regulatory compliance requirements in various industries are compelling businesses to adopt payroll software to ensure accuracy and transparency in financial processes.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/3076

Key Market Segments

The HR payroll software market can be broadly segmented based on component, deployment model, organization size, end-user industry, and region.

1. By Component

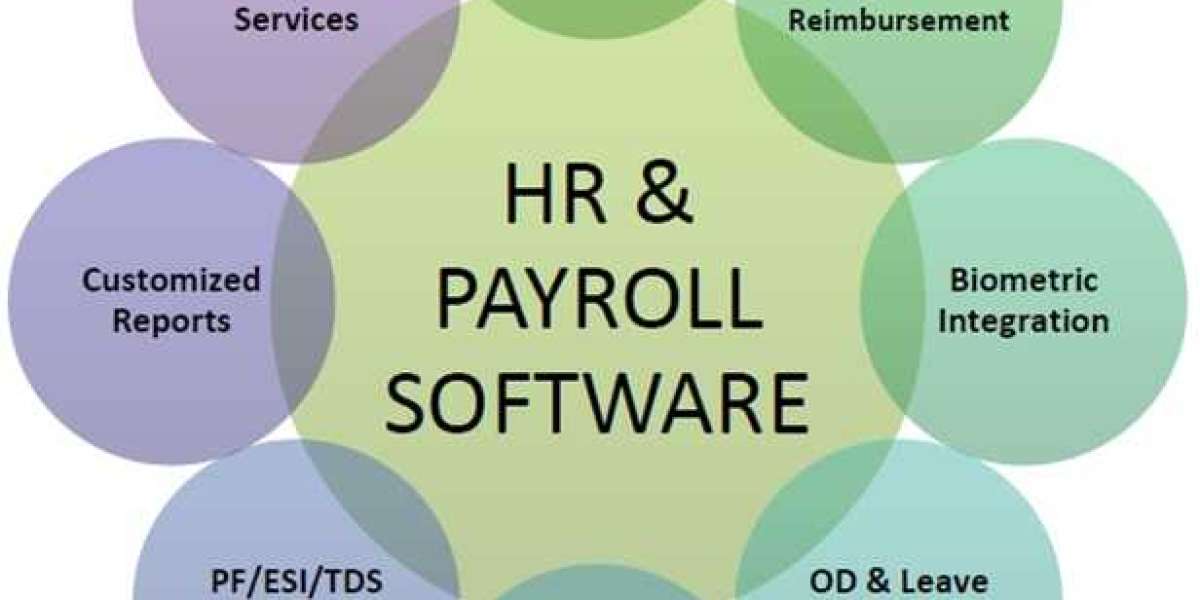

- Software: Payroll management software includes several features such as automated payroll processing, tax compliance, employee benefits management, and reporting tools.

- Services: These include managed payroll services, implementation, support, and maintenance. Managed payroll services are becoming increasingly popular, as organizations outsource their payroll functions to third-party providers.

2. By Deployment Model

- Cloud-Based Solutions: Cloud-based payroll software offers several advantages such as scalability, ease of access, regular updates, and cost-effectiveness. Small and medium-sized enterprises (SMEs) are rapidly adopting cloud-based solutions for their flexibility and affordability.

- On-Premise Solutions: On-premise solutions are typically used by large enterprises that require more control over their data and infrastructure. These solutions are deployed within an organization’s IT infrastructure and managed by in-house teams.

3. By Organization Size

- Small and Medium Enterprises (SMEs): SMEs are increasingly turning to HR payroll software to streamline their payroll processes and remain compliant with regulations without needing large in-house HR teams.

- Large Enterprises: Large enterprises, due to the scale and complexity of their workforce, require robust HR payroll solutions that offer advanced features like multi-country payroll management, benefits administration, and performance management integration.

4. By End-User Industry

- Banking, Financial Services, and Insurance (BFSI): The BFSI sector relies heavily on payroll software for managing compensation and benefits for its large workforce, while also adhering to strict regulatory requirements.

- IT and Telecommunications: As tech companies often have employees working across multiple geographies, managing multi-country payroll compliance is essential, making payroll software critical in this industry.

- Healthcare: The healthcare industry uses payroll software to manage compensation, compliance with labor laws, and employee benefits for medical professionals and staff.

- Retail and E-commerce: In this sector, where there is often a large, diverse, and dispersed workforce, HR payroll software plays an important role in streamlining payment processes, tax deductions, and benefits.

Industry Latest News

Integration of AI and Automation in Payroll Solutions: The introduction of AI and automation into payroll software is reshaping the industry. Companies like ADP and Ceridian are increasingly adopting AI-powered solutions that automate repetitive payroll tasks, ensuring better accuracy and saving time. Automated payroll systems also reduce errors in tax filing, minimize compliance risks, and increase overall efficiency.

Rise of Mobile-Enabled Payroll Software: The growing demand for mobile solutions has led to the development of mobile-enabled payroll software. Many software providers are now offering mobile applications that allow employees to access their pay stubs, manage leaves, and view tax documents directly from their smartphones. This trend is particularly popular in industries with a mobile workforce such as construction, retail, and logistics.

Cloud Adoption Surges: Cloud-based payroll software continues to dominate the market, with more organizations transitioning from legacy on-premise systems to cloud platforms. Solutions such as Workday and Oracle HCM Cloud provide cloud-based HR and payroll solutions that offer real-time access to data, simplify payroll management, and enhance collaboration among HR teams. Cloud adoption is growing due to its lower upfront costs, scalability, and real-time access to data.

Increase in Mergers and Acquisitions: The HR payroll software market has witnessed several mergers and acquisitions in recent years. For example, Paylocity acquired Samepage, an AI-powered collaboration tool, to enhance its payroll and HR suite with advanced collaboration features. These mergers are aimed at strengthening product offerings, expanding geographic reach, and improving customer satisfaction.

Focus on Compliance with Labor Laws: With ever-changing labor laws and tax regulations across different regions, compliance remains a major challenge for organizations. Payroll software vendors are focusing on offering more robust compliance features that automatically update in response to new legislation. Gusto, for instance, provides built-in compliance tools that help businesses adhere to federal and state payroll tax regulations.

Key Companies

Several companies are leading the HR payroll software market by offering innovative solutions that cater to different organization sizes and industries:

ADP: One of the largest providers of payroll solutions, ADP offers a range of cloud-based and on-premise payroll software options tailored for businesses of all sizes. Their solutions are known for their reliability, comprehensive reporting, and compliance features.

Workday: Workday is a leader in the cloud-based HR and payroll software space, offering advanced features like workforce analytics, talent management, and payroll processing. Its solutions are widely adopted by large enterprises.

Ceridian: Ceridian's Dayforce platform is an integrated cloud-based HR and payroll solution designed to handle complex payroll calculations, tax compliance, and real-time data updates.

Paycom: Paycom is known for its user-friendly payroll solutions that combine HR management, benefits administration, and payroll processing into a single platform. Paycom caters primarily to mid-sized businesses.

SAP SuccessFactors: SAP offers a comprehensive payroll solution that integrates seamlessly with its broader HR management system, making it ideal for global organizations.

Gusto: Gusto is popular among SMEs, offering an intuitive payroll platform that automates tax filing, benefits management, and compliance.

Market Drivers

1. Increasing Need for Payroll Process Automation

Manual payroll processes are prone to human error, consume time, and lead to inefficiencies. Organizations are adopting payroll software to automate payroll tasks, reduce errors, and improve operational efficiency. Automation also helps businesses ensure timely payroll processing, minimizing the risk of penalties due to non-compliance with tax laws.

2. Growing Adoption of Cloud-Based Solutions

Cloud-based payroll software is becoming the preferred choice for businesses due to its accessibility, scalability, and affordability. Cloud platforms offer real-time data access and integration with other HR systems, providing a seamless experience for both HR teams and employees. The cost benefits of cloud solutions, which reduce the need for expensive infrastructure, are driving adoption among SMEs and large enterprises alike.

3. Rising Complexity of Tax Regulations

Tax laws and payroll regulations are constantly evolving, making it challenging for organizations to stay compliant. Payroll software ensures that companies can automate tax calculations, update tax rates as they change, and generate compliance reports automatically. This is crucial for businesses operating in multiple regions with different tax laws.

4. Need for Real-Time Analytics and Reporting

Organizations are increasingly looking for payroll solutions that offer real-time analytics and reporting capabilities. Payroll software provides detailed reports on payroll expenses, employee compensation trends, and tax liabilities, enabling businesses to make data-driven decisions. These insights help organizations optimize their workforce management strategies and improve financial planning.

5. Demand for Employee Self-Service Features

Modern HR payroll software provides self-service portals where employees can access their payslips, update personal information, manage leaves, and view tax documents. This reduces the administrative burden on HR teams and improves employee engagement by providing greater transparency and convenience.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/hr-payroll-software-market-3076

Regional Insights

1. North America

North America holds the largest share of the HR payroll software market, driven by the high adoption of advanced technologies, cloud-based solutions, and stringent regulatory compliance requirements. The U.S. is the key contributor to market growth in the region, with major players like ADP, Paycom, and Gusto headquartered here.

2. Europe

Europe is another significant market for HR payroll software, with countries like the UK, Germany, and France leading in adoption. The GDPR and other data protection regulations have driven the need for secure payroll solutions that ensure compliance and data privacy.

3. Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the HR payroll software market, particularly in countries like China, India, and Japan. The rising adoption of cloud technologies, digital transformation initiatives, and increasing awareness of regulatory compliance are contributing to market expansion.

4. Latin America and Middle East Africa

These regions are also witnessing growing demand for HR payroll software as businesses in emerging economies seek to modernize their HR and payroll operations. Governments are introducing new labor regulations, which is pushing organizations to invest in payroll solutions to ensure compliance.

Conclusion

The HR payroll software market is poised for substantial growth as organizations continue to adopt digital solutions to streamline their payroll processes, reduce compliance risks, and improve overall efficiency. The integration of AI, cloud technology, and automation will continue to drive innovation in the market, with both SMEs and large enterprises seeking more sophisticated tools to manage their workforce. As the market evolves, businesses will increasingly rely on payroll software not only for processing employee payments.