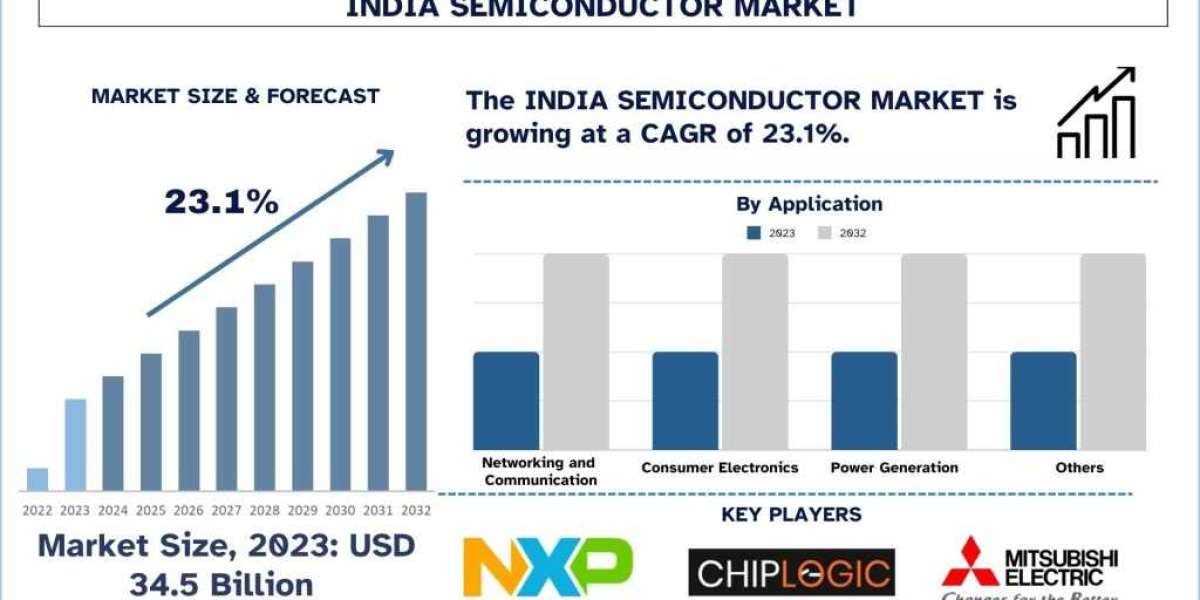

According to the Univdatos market insights analysis, rising demand for electronics, growing government initiatives, and rapid digital transformation across the globe will drive the scenario of the Indian semiconductor market. As per their “India Semiconductor Market” report, the global market was valued at ~USD 34.5 billion in 2023, growing at a CAGR of about 23.1% during the forecast period from 2024-2032.

The Indian semiconductor market has changed dramatically with a set of wheels from investments and government policies, technologies, and industry partnerships. Major changes influencing the Indian semiconductor market point to well-developed government support policies, increased venture capital, and new technologies. These steps have served as important in promoting innovation, improving the capability to manufacture complex semiconductor devices, and placing India on a sustainable growth path as it seeks to carve a niche for itself in this strategic industry. Here are some of the key developments influencing this market:

- Government Interventions and Measures

- Production-Linked Incentive (PLI) Scheme: These points were initiated to encourage semiconductor manufacturing in India, therefore, it is meant to attract both domestic and foreign investors. It offers sweeteners to firms for establishing production plants for making goods and encouraging manufacturing units.

- National Semiconductor Mission: This initiative, therefore, revolves around the development of a holistic semiconductor ecosystem in India. It covers the approach to chip designing, manufacturing, and even research for an industry that intends to be independent.

- Electronics Policy: In their attempt to stimulate electronics manufacturing, the government of the country has come up with several incentives such as tax holidays, subsidies, and favorable infrastructure. This policy framework fosters sustained development of the semiconductor industry through the provision of a propitious investment climate.

- Investment and Infrastructure Development

- Foreign Direct Investment (FDI): Global semiconductor companies have been investing in India to outsource several of their operations. Companies like Intel, Qualcomm, and Texas have invested in increasing their footprint, starting RD departments and generally improving their local production profiles.

- Establishment of Semiconductor Fabs: Current Indian semiconductor companies and several international semiconductor industries such as Vedanta and Tata Group plan to invest heavily in building semiconductor fabs in India. They are important for enhancing the manufacturing capability, and supply of semiconductors.

- Chip Design and Testing Facilities: New specializations are coming into play to cater to the personalized chips and high-end technology sectors including automobiles, medical, and consumer markets to meet these needs, design and testing cash is being spent.

- Technological Advancements

- Focus on Advanced Technologies: There is a concerted effort to acquire and innovate on next-generation semiconductor technologies like 5nm and 7nm processes to continue to compete in the international market. To sustain the competition and explore new opportunities, simultaneously, Indian firms are focusing on unconventional sectors such as Artificial intelligence, the Internet of things, and automotive electronics through RD investment.

- Emerging Applications: Stimulated by the demand for EVs, renewable energy and smart devices bring significant demands for dedicated semiconductor solutions. There are new opportunities for power electronics and sensors for these new applications of interest.

- Partnership with Schools and Skills Training

- Partnerships with Educational Institutions: Ventureships between various semiconductor corporations and premier academic facilities like IITs and IISc are setting up research and development. All of these asserted partnerships are vital for the creation of new technologies and talented human capital.

- Skill Development Programs: In response to the talent deficit in this semiconductor industry, measures that relate to skill development are being deployed. These programs work towards the goal of imparting the right levels of knowledge and skills in semiconductor design, manufacturing, and allied fields.

- Overview of Startup Ecosystem and Innovation

- Emerging Startups: There is an increasing trend of new ventures venturing into the semiconductor industry solutions where to find solutions ranging from power chip design to artificial intelligence, and the Internet of Things. The current world is being led by innovational giants such as Agnikul and Novi Labs which are massively exploring the future.

- Incubation and Innovation Centers: Several government, and private organizations are participating in funding and developing incubation centers that play a key role in new technologies in the semiconductor industry. These centers offer support besides offering a place to work to new companies, thus boosting their growth.

- Global Supply Chain Management

- Diversification of Supply Chains: The COVID-19 pandemic, new wave of protectionism, and tensions in Asia-Pacific make India an attractive destination for the diversification of supply chains for global semiconductor companies.

- International Collaborations: More Indian companies are partnering with the global players to get the best knowledge and technologies in sharing which added more strengths to the country’s semiconductor industry.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=66556

Recent developments in the market:

- In 2022, the India Semiconductor Mission (ISM) was launched to build a vibrant semiconductor and display ecosystem to enable India's emergence as a global hub for electronics manufacturing and design.

- In September 2024, the US Department of State revealed its collaboration with India’s Semiconductor Mission (ISM) under the Union Electronics and IT Ministry to explore opportunities for expanding the global semiconductor ecosystem.

Conclusion

The market for semiconductors in India is expected to exhibit strong growth with the drive to industrialization. Players are being as technologically innovative, therefore investing in new product developments and strategic collaborations along with capacity enhancements for emerging events. The market will however remain a dynamic one for companies that focus on innovation and more specifically on sustainability and delivery of customer-oriented technologies. This means that the new developments that the key players bring about not only advance their position in this market but also serve the vision of improving the industrialization and sustainability of India.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com