Market Overview

The Corporate Flows B2B Payment Market is undergoing significant transformation as digital solutions reshape the way businesses manage and process transactions. B2B payments, or business-to-business payments, involve the transfer of funds between companies to settle accounts, purchase goods, or acquire services. Traditionally reliant on checks and bank transfers, the B2B payment landscape is shifting towards digital solutions, offering faster, more secure, and more efficient alternatives.

This market encompasses a range of payment methods, including wire transfers, electronic funds transfers (EFT), automated clearing house (ACH) payments, virtual cards, and digital wallets. With the increasing adoption of cloud-based platforms, AI-driven payment processing, and the rise of fintech solutions, businesses are moving away from manual processes and embracing automated systems that offer real-time tracking, lower transaction costs, and enhanced security. Corporate Flows B2B Payment Market Industry is expected to grow from 214.69(USD Billion) in 2023 to 442.9 (USD Billion) by 2032.

The Corporate Flows B2B Payment Market has gained traction in recent years due to factors such as the globalization of supply chains, the need for efficient cash flow management, and the demand for greater transparency and traceability in financial transactions. As companies aim to improve their payment processes and integrate with global trade networks, B2B payment solutions are becoming a cornerstone of modern business operations.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/28352

Key Market Segments

The Corporate Flows B2B Payment Market is segmented based on payment method, enterprise size, industry vertical, deployment mode, and region. Understanding these segments is crucial for companies looking to tailor their payment strategies effectively.

1. By Payment Method:

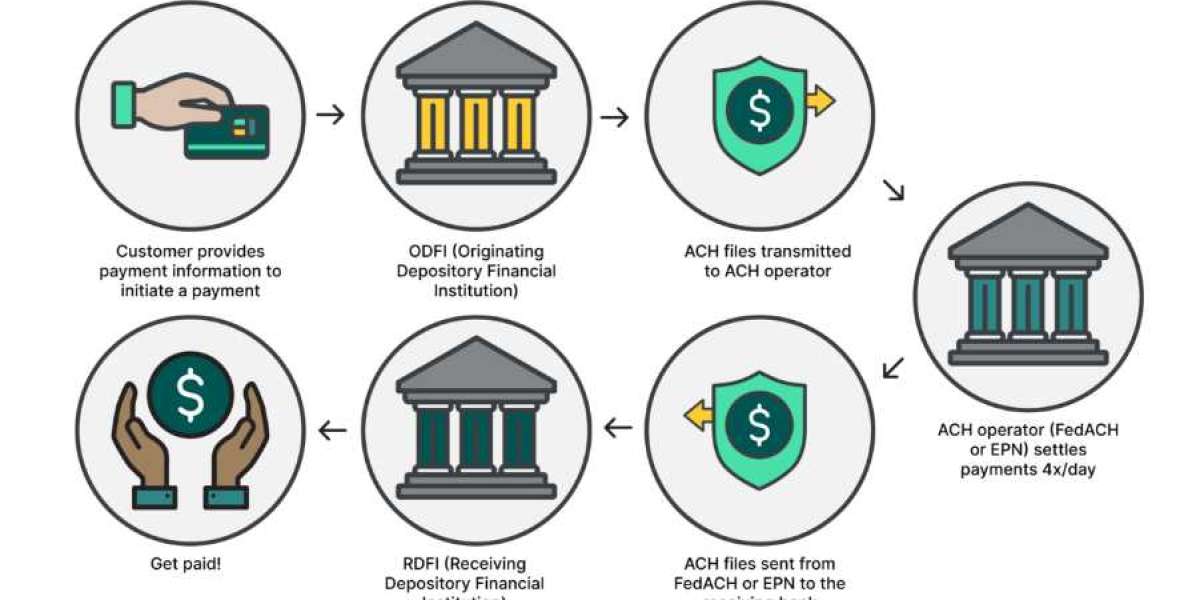

Bank Transfers (Wire Transfers and ACH): Traditional bank transfers remain a popular choice for large payments, offering security and reliability. ACH payments have gained popularity due to their lower transaction costs and suitability for recurring transactions.

Digital Payment Solutions: This includes payment gateways, digital wallets, and virtual cards, which offer enhanced convenience and faster processing times. These solutions are becoming increasingly preferred, especially among businesses seeking to digitize their operations.

Credit and Debit Cards: While typically used for smaller payments, credit and debit cards are also used in certain B2B transactions, particularly for quick settlements and purchases.

Blockchain and Cryptocurrencies: A growing trend in the market is the use of blockchain technology for cross-border payments, offering greater transparency, lower fees, and faster settlement times. Some businesses are also exploring cryptocurrencies as an alternative payment method.

2. By Enterprise Size:

Small and Medium Enterprises (SMEs): SMEs often face challenges such as limited access to credit and higher transaction fees. They are increasingly adopting digital payment solutions to streamline their cash flow and reduce costs associated with manual processes.

Large Enterprises: Large corporations have more complex payment needs, often dealing with high transaction volumes and international payments. These enterprises benefit from custom payment solutions, automated processing, and integrated treasury management systems.

3. By Industry Vertical:

Manufacturing: Manufacturing companies rely heavily on B2B payments for purchasing raw materials and managing supplier relationships. Efficient payment solutions are crucial for maintaining supply chain continuity.

Retail and E-commerce: B2B payments in retail involve transactions between wholesalers, distributors, and suppliers. The adoption of digital payment platforms helps these businesses manage inventory and vendor payments more effectively.

Healthcare: The healthcare industry deals with a complex network of suppliers, insurance companies, and service providers. B2B payment solutions in this sector are essential for streamlining transactions and ensuring timely payments to vendors.

IT and Telecommunications: Technology companies often have international clients and suppliers, requiring payment solutions that support cross-border transactions and multiple currencies.

4. By Deployment Mode:

On-Premises: Some companies prefer on-premises payment solutions for greater control over their data and security. This mode is more common among large enterprises with the resources to manage their own infrastructure.

Cloud-Based: Cloud-based solutions are becoming the preferred choice for their scalability, ease of integration, and lower upfront costs. They enable businesses to access their payment systems from anywhere and benefit from regular software updates.

5. By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa (MEA)

Regional variations play a significant role in shaping the adoption and evolution of B2B payment solutions, influenced by factors such as regulatory frameworks, digital infrastructure, and business practices.

Industry Latest News

The Corporate Flows B2B Payment Market has been characterized by numerous innovations, partnerships, and regulatory developments that are shaping its future. Key industry news and trends include:

1. Rise of Real-Time Payments (RTP): Real-time payments are becoming a critical component of B2B payment strategies. They enable businesses to settle transactions instantly, reducing cash flow gaps and improving liquidity management. Many countries, including the United States and parts of Europe, have introduced RTP networks to support faster transactions.

2. Increased Focus on Security and Compliance: With rising incidents of cyber fraud, companies are prioritizing secure payment methods and compliance with regulations like the General Data Protection Regulation (GDPR) and Payment Services Directive 2 (PSD2) in Europe. This focus on security has led to investments in fraud detection technologies, encryption, and multi-factor authentication.

3. Strategic Acquisitions and Partnerships: Major financial institutions and fintech companies are acquiring smaller players to expand their B2B payment capabilities. Partnerships between banks and technology providers are helping to integrate traditional banking services with digital payment platforms, offering more holistic solutions.

4. Expansion of Cross-Border Payment Solutions: Globalization has led to an increased need for efficient cross-border payment systems. Companies are leveraging blockchain technology and AI-driven platforms to optimize currency conversion, reduce transaction times, and ensure compliance with international regulations.

Key Companies

The Corporate Flows B2B Payment Market is highly competitive, with several leading companies driving innovation and offering comprehensive payment solutions. Some of the key players include:

1. PayPal Holdings Inc.: PayPal offers a range of B2B payment solutions, including PayPal Business and Xoom for international payments. Its focus on providing fast and secure digital transactions has made it a preferred choice for SMEs and freelancers.

2. Stripe Inc.: Known for its developer-friendly API, Stripe offers powerful tools for B2B payments, including invoicing, fraud prevention, and support for multiple currencies. Stripe’s solutions are especially popular among tech companies and startups.

3. Mastercard Incorporated: Mastercard provides a range of B2B payment solutions, including virtual cards and payment gateways. Its network is widely used for cross-border transactions, providing businesses with enhanced security and speed.

4. Visa Inc.: Visa's B2B Connect and other digital payment solutions support secure and efficient corporate transactions. Its global reach makes it a major player in cross-border payments, helping businesses access new markets.

5. American Express: American Express offers corporate card solutions and accounts payable automation services, catering to large enterprises that require robust payment capabilities and detailed transaction insights.

6. Fiserv, Inc.: Fiserv provides technology solutions for electronic payments, focusing on ACH, wire transfers, and integrated treasury management. It partners with financial institutions to deliver tailored B2B payment solutions.

Market Drivers

Several factors are driving the growth of the Corporate Flows B2B Payment Market:

1. Demand for Digital Transformation: The shift towards digital payment solutions is driven by the need for more efficient and streamlined payment processes. Businesses are increasingly moving away from paper-based systems to digital platforms that reduce manual errors and improve transaction speed.

2. Growth of E-commerce and Online Marketplaces: As businesses embrace e-commerce and online sales channels, there is a growing need for digital payment solutions that can handle large transaction volumes and integrate seamlessly with various platforms.

3. Need for Cash Flow Management: Managing cash flow is a critical challenge for businesses, especially SMEs. B2B payment solutions offer real-time transaction tracking, automated invoicing, and better control over receivables, helping businesses optimize their cash flow.

4. Rising Adoption of Blockchain: Blockchain technology is gaining traction in the B2B payment market due to its ability to provide transparency, reduce transaction costs, and enhance the security of cross-border payments. It allows for faster settlement times and minimizes the risk of fraud.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/corporate-flows-b2b-payment-market-28352

Regional Insights

1. North America: North America leads the market due to the widespread adoption of digital payment solutions and a well-established financial infrastructure. The region is home to major players and has a high level of investment in fintech innovations.

2. Europe: Europe is seeing a surge in digital B2B payment adoption, driven by regulatory initiatives like PSD2 that encourage open banking and innovation. Countries like the UK, Germany, and France are key markets, focusing on secure and compliant payment solutions.

3. Asia-Pacific: The Asia-Pacific region is expected to witness rapid growth due to the increasing adoption of digital platforms, the rise of e-commerce, and a large base of SMEs. China and India, in particular, are experiencing a shift towards digital B2B payments as businesses modernize their financial operations.

4. Latin America: Latin America is gradually embracing digital B2B payments as companies seek to overcome challenges related to traditional banking and cash-based transactions. Brazil and Mexico are leading the way in adopting digital wallets and mobile banking for business payments.

5. Middle East and Africa (MEA): MEA is experiencing growth in the B2B payment market due to the expansion of cross-border trade and the adoption of fintech solutions. However, limited digital infrastructure in some countries poses challenges to widespread adoption.

Bug Tracking Software Market -

https://www.marketresearchfuture.com/reports/bug-tracking-software-market-27470

Cloud Cost Management Software Market -

https://www.marketresearchfuture.com/reports/cloud-cost-management-software-market-27411

Cemetery Management Software Market -

https://www.marketresearchfuture.com/reports/cemetery-management-software-market-27376

Next Generation Search Engine Market -

https://www.marketresearchfuture.com/reports/next-generation-search-engine-market-26666

Online Psychic Reading Service Market -

https://www.marketresearchfuture.com/reports/online-psychic-reading-service-market-24253

Recruitment Software Market -

https://www.marketresearchfuture.com/reports/recruitment-software-market-24264

Church Management Software Market -

https://www.marketresearchfuture.com/reports/church-management-software-market-23745