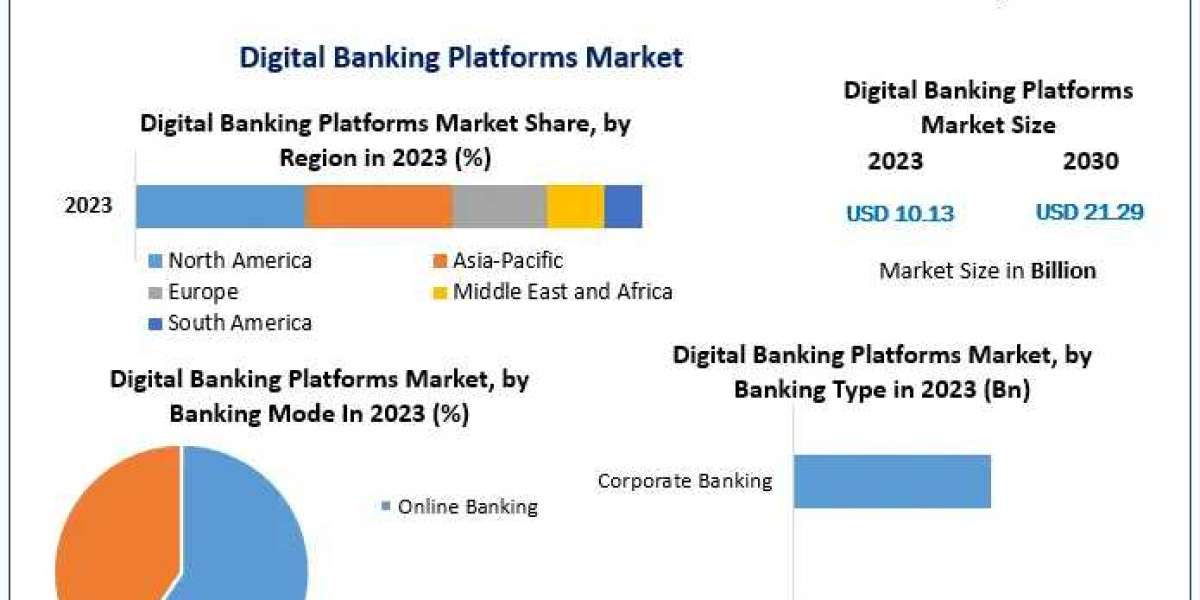

At a compound annual growth rate (CAGR) of 11.2%, the global digital banking platforms market, which was valued at US$ 10.13 billion in 2023, is projected to reach US$ 21.29 billion by 2030.

Digital Banking Platforms Market Report Overview:

Digital Banking Platforms Market Research Report analyzed the current state in the definitions, classifications, applications, and industry chain structure. The Digital Banking Platforms market analysis provides unbiased professional commentary on the present market scenario, prior market performance, production and consumption rates, demand and supply ratios, and income generation forecasts for the projected period. The Digital Banking Platforms market study also gives information on the leading businesses functioning in the industry's strategic ambitions and company growth strategies. To summarise what has been said thus far, the report provides a comprehensive picture of the Digital Banking Platforms market in both global and regional markets.

Unlock Insights: https://www.maximizemarketresearch.com/request-sample/29247/

Global Digital Banking Platforms Market report Scope and Research Methodology:

The Digital Banking Platforms market research contains a wealth of information, including market dynamics, scenarios, and prospects for the projection period. Quantitative, qualitative, value (USD Million), and volume (Units Million) statistics are included in segments and sub-segments. Data at the regional, sub-regional, and country levels contain demand and supply dynamics, as well as their impact on the Digital Banking Platforms market. Competitive landscape has been included with a share of significant companies, new advances, and tactics. Important financial information, latest advancements, SWOT analysis, and strategies of the Digital Banking Platforms market players.

Digital Banking Platforms Market Regional Analysis:

The region section in the Digital Banking Platforms market report includes specific market-affecting elements and changes in market regulation that affect the market's present and future developments. Some of the primary indicators used to estimate the Digital Banking Platforms market scenario for different regions include new sales, replacement sales, national demographics, regulatory acts, and import-export tariffs. In addition, the Digital Banking Platforms market report provides the existence and availability of global brands, as well as the obstacles they face owing to big or scarce competition from local and domestic brands, as well as the influence of sales channels, are taken into account when offering forecast analysis of national data.

Request For Free Sample : https://www.maximizemarketresearch.com/request-sample/29247/

Digital Banking Platforms Market Segmentation

Retail banking has become a key facilitator in the market for transferring banking models globally, according to the banking mode sector. Along with evolving rivals, cutting-edge technologies, and shifting consumer behavior and expectations, the digital revolution has disrupted the market. Due to the requirement to satisfy the higher expectations of customisation held by retail customers and to connect these expectations with the increasing proliferation of channels, the sector is anticipated to lead the market throughout the forecast period.

by Banking Mode

Online Banking

Mobile Banking

by Deployment Type

On-Premises

Cloud

by Banking Type

Retail Banking

Corporate Banking

Inquire For More Details: https://www.maximizemarketresearch.com/inquiry-before-buying/29247

Digital Banking Platforms Market Key players:

1.Backbase

2. EdgeVerve Systems

3. Temenos

4. Finastra

5. TCS

6. Appway

7. NETinfo

8. Worldline

9. SAP

10. BNY Mellon

11. Oracle

12. Sopra

13. CREALOGIX

14. Fiserv

15. Intellect Design Arena

16. NF Innova

17. Halcom D.D

18. TagitPte Ltd

19. ETRONIKA

20. Fidor

Key Questions answered in the Digital Banking Platforms Market Report are:

- Which region holds the largest share of the Digital Banking Platforms market?

- What is the expected CAGR of the Digital Banking Platforms market during the forecast period?

- Which regional Digital Banking Platforms market is expected to grow at a high CAGR during the forecast period?

- Which segment emerged as the leading segment in the Digital Banking Platforms market?

- What key trends are expected to emerge in the Digital Banking Platforms market in the coming years?

- What is the expected Digital Banking Platforms market size by 2030?

- What was the global Digital Banking Platforms market size in 2023?

- Which company held the largest share in the Digital Banking Platforms market?

Key Offerings:

- Market Share, Size Forecast by Revenue | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Key Trends

- Market Segmentation – A detailed analysis of segments with their sub-segments and region

- Competitive Landscape – Top Key Players and Other Prominent Players

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656